This summer, many of the world’s largest asset managers publicly disclosed their voting records from this spring on climate shareholder resolutions, and the results indicate a worrisome trend. Many failed to support ambitious climate proposals — and some stumbled even on the simple ones, like calling for better methane emission data. Read More

Energy Exchange

A tale of two resolutions: Exxon vs. Coterra, what investors got wrong

Round one of EPA methane comment period draws record engagement; Here’s how companies and investors can step up in round two

The public comment period for the Environmental Protection Agency’s proposed oil and gas methane rules generated more than 400,000 individual submissions, including many from energy and financial companies that support Biden administration efforts to reduce emissions of this powerful greenhouse gas.

The public comment period for the Environmental Protection Agency’s proposed oil and gas methane rules generated more than 400,000 individual submissions, including many from energy and financial companies that support Biden administration efforts to reduce emissions of this powerful greenhouse gas.

However, our analysis of comments from energy and investment companies shows a troubling divide between those that support strong rules and others trying actively to weaken them before they even take effect. When EPA’s next comment period opens this spring, it will be critical for supporters to weigh in on the overall goal, as well as on specific provisions — including elimination of routine flaring, transitioning away from polluting pneumatic equipment, and ensuring comprehensive leak detection, including at smaller wells.

A broad collection of investors representing trillions of dollars in capital has urged oil and gas companies to demonstrate genuine effort to reduce their emissions. Yet despite increasing numbers of targets from industry in recent years, U.S. methane emissions remain sky high — suggesting voluntary efforts will not be enough to meet this challenge.

If responsible operators already taking action do not take advantage of this unique policy opportunity, the worst actors will continue to bring down the reputation of the industry as a whole for years to come.

Methane policy is a test of investors’ post-COP climate commitment. Will they pass?

Climate pledges and statements of support from the financial industry ring hollow unless and until firms support public policies that will deliver required emission cuts. That’s at risk of happening now as major asset managers have remained silent on a proposed new Environmental Protection Agency rule requiring oil and gas producers to cut their methane emissions.

Climate pledges and statements of support from the financial industry ring hollow unless and until firms support public policies that will deliver required emission cuts. That’s at risk of happening now as major asset managers have remained silent on a proposed new Environmental Protection Agency rule requiring oil and gas producers to cut their methane emissions.

Now is the time for investors to speak up. By backing the regulation, the financial sector has a crucial, cost-effective opportunity to support the mitigation of short-term climate risk from a dangerous climate pollutant. The EPA comment period for the proposed methane regulations lasts until Jan. 31, 2022, and is the perfect venue for investors to voice their support.

5 questions on flaring for investors to ask oil and gas companies

For investors concerned with environmental, social and governance issues, flaring poses one of the most immediate and material risks to shareholder value in the oil and gas industry. For an industry that prides itself on operational excellence, flaring is a waste of potentially saleable product and an unsustainable industry practice with detrimental climate and public health effects.

For investors concerned with environmental, social and governance issues, flaring poses one of the most immediate and material risks to shareholder value in the oil and gas industry. For an industry that prides itself on operational excellence, flaring is a waste of potentially saleable product and an unsustainable industry practice with detrimental climate and public health effects.

But the practice of routine flaring, which burns off natural gas at oil and gas sites when producers are unprepared to transport or store the fuel, is also a challenge with clear opportunity for solutions. As J.P. Morgan Asset Management recently observed, “flaring is a problem with multiple solutions and a compelling long-term economic proposition.”

As industry, investors and Texas regulators begin to acknowledge the problem, how can shareholders support management teams’ continuous improvement and understand which operators are getting it right and which are not keeping pace?

Asking the right questions through shareholder engagement is a good place to start.

New data finds alarming levels of methane emissions in the Permian, posing long-term risk for oil and gas portfolios

Investors managing oil and gas portfolios are contending with major disruption as two interrelated crises play out: the global COVID-19 pandemic and extreme volatility in the price of oil. Yet even before these events, cracks were showing in the sector’s financial footing. Pressure has been rising on industry to improve returns, while demand to deliver on Environmental Societal Governance initiatives has never been higher.

Into this mix comes new data from scientists working with EDF’s PermianMAP initiative showing that methane emissions in the Permian Basin, the world’s largest oil field, is nearly three times the rate reported in Environmental Protection Agency’s nationwide statistics.

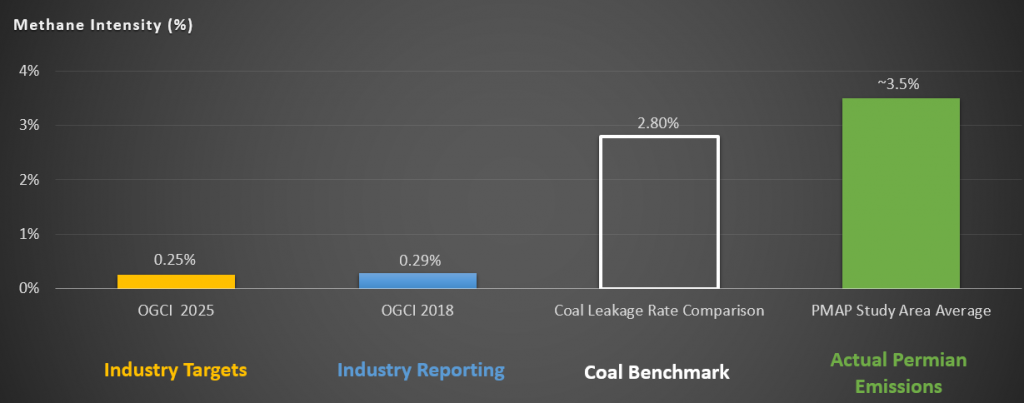

The 3.5% loss rate estimated in the data area is roughly 15 times higher than reduction targets set by leading producers, and significantly higher than many companies have reported. It translates to 1.4 million tons of wasted gas each year, enough to meet the annual natural gas needs of every home in Dallas and Houston combined.

The findings surface a material risk to oil and gas investors and to the future of natural gas from the Permian Basin. At current emissions rates from the basin, burning Permian natural gas for electricity does more near-term climate damage than coal.

A year from now, the U.S. oil and gas sector may look very different for many of the independent operators who make up a large portion of Permian producers. Withstanding this period of economic turbulence will require companies to make tough decisions. Yet even in this time of crisis, operators must keep an eye on future market demands, operational excellence and climate performance.

Permian study findings

The Permian sprawls across West Texas and New Mexico and has more than 100,000 operating well sites. Between October 2019 and March 2020, EDF scientists collaborated with academic institutions to collect data using tower-based monitors, ground-based mobile sensors, helicopters and fixed wing aircraft across a 10,000-square-kilometer study area responsible for 40% of Permian production.

The estimated 3.5% leak rate reflected in the new data stands in stark contrast to the .20% leakage rate agreed to by the 13 of the world’s largest operators in the Oil and Gas Climate Initiative, representing 30% of global oil and gas production. Furthermore, the emissions rate seen in the Permian is more than 10 times the methane intensity of 0.29% that OGCI has been reporting for 2018.

Federal methane rollbacks spark new opposition from 12 major utilities

Backlash continues to grow against the Trump administration’s efforts to deregulate methane emissions from the oil and gas industry. The coalition opposing the Environmental Protection Agency’s rollbacks now includes major oil and gas companies¹, a midstream gas transmission operator, investors representing over $5.5 trillion in assets under management and 12 of the nation’s largest utilities.²

These utilities, who use natural gas produced by oil and gas companies for electricity generation and delivery to commercial and residential consumers, have expressed strong opposition to the proposed regulations, recognizing national standards as the “foundation” of industry efforts to reduce methane emissions.

The public comment period, which began on Sept. 24, offers downstream energy providers a key opportunity to publicly add their voice to the broad set of stakeholders supporting federal regulation of methane in the oil and gas sector.