Energy Efficiency Financing Blog Series

By: Brad Copithorne, EDF’s Energy & Financial Policy Specialist

In Part 1 of this blog series, we examined how several innovative companies have developed a structure to finance energy efficiency projects in commercial buildings. This structure, an Energy Services Agreement (ESA), provides building owners access to capital, solves the split incentive issue and eliminates exposure to performance risk on the project. In Part 2, we examine another innovative financing solution that will provide capital to residential projects.

In Part 1 of this blog series, we examined how several innovative companies have developed a structure to finance energy efficiency projects in commercial buildings. This structure, an Energy Services Agreement (ESA), provides building owners access to capital, solves the split incentive issue and eliminates exposure to performance risk on the project. In Part 2, we examine another innovative financing solution that will provide capital to residential projects.

McKinsey recently estimated that there is over $225 billion of available cost effective energy efficiency investment opportunities available in the residential sector. If these investments are made, energy consumption in the residential sector will decline by 28% by the end of this decade. Unfortunately, most homeowners do not have access to low-cost sources of capital to pay for the upfront costs of the retrofits.

On-Bill Repayment

On-bill repayment (OBR) programs allow customers to repay third-party loans for energy efficiency and renewable energy investments through their utility bills. Utility bills generally have very low default rates because nobody wants their power turned off. Loans tied to the utility bills should also have low default rates which will allow lowered costs for borrowers and increased availability of credit.

During the past decade, various utilities have successfully piloted more than a dozen on-bill finance programs. These programs have used utility, ratepayer, public or mission-driven capital which has greatly limited scalability. An OBR program, on the other hand, uses entirely third party capital from profit motivated investors such as banks. Since this is a much larger pool of capital, the supply of funds will increase to meet demand.

Based on extensive consultation with key stakeholders, including banks, the three California investor-owned utilities, project developers and others, EDF believes that an OBR program can be successfully launched statewide in California using entirely private capital, and provide building owners with low-cost funding for energy efficiency and renewable projects. EDF is currently in discussions with California utilities and regulators on creating an OBR program for the state.

EDF estimates that a statewide OBR program that would generate $2.7 billion of annual investment in energy efficiency and renewable projects. Over 20,000 installation jobs would be created and after 5 years, annual CO2 emissions would decline by 7 million tons.

On-Bill Repayment: Step By Step

- Approved contractors and utilities identify projects, and then help building owners apply for a loan to pay for upgrades.

- The contractor provides the homeowner with an estimate of the expected monthly energy savings and up-front upgrade costs.

- If the loan is approved by a 3rd-party lender, the contractor will execute the project.

- Expert, objective inspectors (managed by either the utility or a government entity) validate the estimate of projected savings and that the upgrades are properly installed.

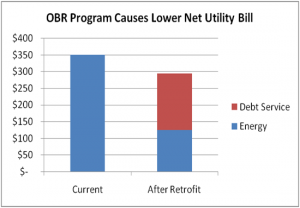

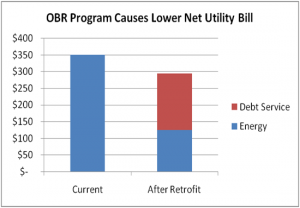

- Homeowners pay a combined monthly bill for both energy and loan repayment. The program would require that savings exceed debt service, so the customer would see a reduction in their monthly utility bill.

Example: Homeowner

Current utility bill: $350 per month

Investments: Solar panels, duct sealing, controls and new refrigerator

Expected utility bill savings: $225 per month

Investment loan: $20,000

Loan terms:

– Interest rate on loan: 6.25%

– 15 years repayment schedule

– Monthly payment: $170

Utility bill after retrofit: $125

Utility bill + loan payment: $295

Savings: $55 per month (savings will grow as utility energy rates increase)

Program Terms

- Any building with a meter would be eligible including commercial, industrial, public, multifamily and single family residential buildings.

- Eligible measures would include approved list of renewable and energy efficiency projects.

- Contractors and lenders would be subject to pre-approval.

- Projected first year savings would need to exceed debt service by a comfortable margin.

- Lender would have no ability to request a customer disconnection but partial bill payments would be allocated proportionally between lender and utility. The utility would follow all standard disconnect procedures.

Innovations In Energy Efficiency Finance

Next week EDF and Citi are co-hosting a conference for institutional investors, real estate owners and project developers on energy efficiency finance. Both ESAs and on-bill repayment will be discussed extensively. Our next blog post will report on the outcomes of the conference.

Technology giant Verizon is making significant strides toward increasing the use of on-site green energy throughout its national portfolio with plans to finish more than $100 million in clean and renewable energy projects across facilities in seven states by the end of this year. The investment is estimated to reduce carbon emissions by over 15,000 metric tons each year, which is comparable to over 2,000 homes’ annual electricity use. Verizon’s video showcasing its plans includes an introduction by Environmental Defense Fund (EDF)’s very own Victoria Mills, managing director of Corporate Partnerships.

Technology giant Verizon is making significant strides toward increasing the use of on-site green energy throughout its national portfolio with plans to finish more than $100 million in clean and renewable energy projects across facilities in seven states by the end of this year. The investment is estimated to reduce carbon emissions by over 15,000 metric tons each year, which is comparable to over 2,000 homes’ annual electricity use. Verizon’s video showcasing its plans includes an introduction by Environmental Defense Fund (EDF)’s very own Victoria Mills, managing director of Corporate Partnerships.