New data finds alarming levels of methane emissions in the Permian, posing long-term risk for oil and gas portfolios

Investors managing oil and gas portfolios are contending with major disruption as two interrelated crises play out: the global COVID-19 pandemic and extreme volatility in the price of oil. Yet even before these events, cracks were showing in the sector’s financial footing. Pressure has been rising on industry to improve returns, while demand to deliver on Environmental Societal Governance initiatives has never been higher.

Into this mix comes new data from scientists working with EDF’s PermianMAP initiative showing that methane emissions in the Permian Basin, the world’s largest oil field, is nearly three times the rate reported in Environmental Protection Agency’s nationwide statistics.

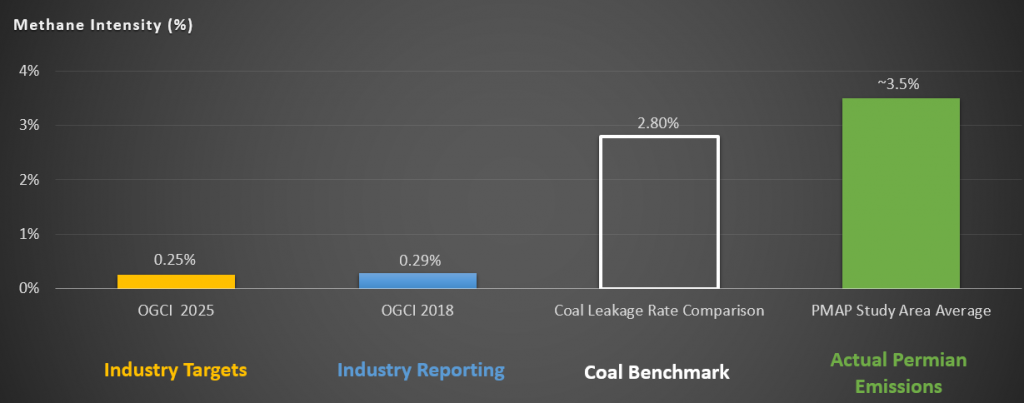

The 3.5% loss rate estimated in the data area is roughly 15 times higher than reduction targets set by leading producers, and significantly higher than many companies have reported. It translates to 1.4 million tons of wasted gas each year, enough to meet the annual natural gas needs of every home in Dallas and Houston combined.

The findings surface a material risk to oil and gas investors and to the future of natural gas from the Permian Basin. At current emissions rates from the basin, burning Permian natural gas for electricity does more near-term climate damage than coal.

A year from now, the U.S. oil and gas sector may look very different for many of the independent operators who make up a large portion of Permian producers. Withstanding this period of economic turbulence will require companies to make tough decisions. Yet even in this time of crisis, operators must keep an eye on future market demands, operational excellence and climate performance.

Permian study findings

The Permian sprawls across West Texas and New Mexico and has more than 100,000 operating well sites. Between October 2019 and March 2020, EDF scientists collaborated with academic institutions to collect data using tower-based monitors, ground-based mobile sensors, helicopters and fixed wing aircraft across a 10,000-square-kilometer study area responsible for 40% of Permian production.

The estimated 3.5% leak rate reflected in the new data stands in stark contrast to the .20% leakage rate agreed to by the 13 of the world’s largest operators in the Oil and Gas Climate Initiative, representing 30% of global oil and gas production. Furthermore, the emissions rate seen in the Permian is more than 10 times the methane intensity of 0.29% that OGCI has been reporting for 2018.

Investors driving change

This is not the first time oil and gas methane emissions have been found to be higher than reported. Numerous studies published in recent years have uncovered similar results. The status quo is emissions are far too high, while data quality from industry self-reported figures is far too low.

New data finds alarming levels of methane emissions in the Permian, posing long-term risk for oil and gas portfolios Share on XBut it is possible to change this pattern and investors have a key interest, because good investment decisions are made based on good information. Conscious ESG investors play a critical role in galvanizing greater disclosure from industry, while themselves benefitting from improvements in more empirical data which better reflect facts on the ground and emissions into the atmosphere.

As outlined in EDF’s recent whitepaper Hitting the Mark, methane emissions are consistently underestimated by oil and gas companies because their current methodologies for doing so provide limited data integrity. Industry standard practices use outdated desktop calculations based on equipment counts to determine methane emissions, rather than incorporating real-world direct measurements. Industry estimates also typically undercount emissions by omitting super-emitting events, a small number of undetected leaks that occur unpredictably in operations, but that drive a large share of emissions.

Investors have the opportunity to drive change by urging companies to step up their efforts, thereby holding them accountable in three key areas:

- Leverage methane best management practices. The first priority for portfolio companies must be to address the largest sources of emissions through high frequency leak detection and repair and improved flare maintenance and monitoring. For further information, the Methane Guiding Principles — a partnership between industry and civil society — offers a comprehensive set of methane classes, tools and resources for operators to achieve methane excellence.

- Improve reporting of emissions. As demonstrated by the findings, merely setting targets is not enough. Due to the lack of credible data, investors must press companies to improve their methane reporting through direct measurement. EDF’s Investor Guide to Hitting the Mark offers a way forward.

- Support policy in Texas and New Mexico. Even as federal regulations are rolled back, investors and their portfolio companies in the Permian can support state policy efforts. In November, New Mexico committed to enact nationally leading methane rules, with public comments on a proposed rule expected to begin in the fall. While in Texas, there is an opportunity for regulators to implement strengthened flaring rules as part of any proposed production cuts.

The energy industry is moving towards a low-carbon economy, but it won’t happen overnight. Even in a time of significant uncertainty for industry, action on methane allows companies to make real progress on ESG and climate goals now, while taking steps to prepare for a low-carbon future.

For ongoing comparable public data on operator performance associated with methane emissions in the Permian Basin, please visit PermianMAP.