Utilities and regulators are not typically known for innovation. Instead, they tend to focus their efforts and attention on reliability and cost effectiveness. So, when Rob Powelson, new president of the National Association of Regulatory Utility Commissioners (NARUC) kicked off his first national meeting under the theme “Infrastructure, Innovation and Investment,” I was intrigued.

The opening general session focused on how to upgrade aging utility infrastructure in ways that optimize new technology, and introduced a new Presidential Task Force on Innovation to promote modernization. This task force will discover how NARUC members can embrace emerging innovation – like integrated energy networks and battery storage.

This utility-industry focus on innovation marks a new direction. To prepare for the venture, we can learn from the most recent rapid disruption in a related industry, telecommunications: a mere 20-year transition from POTS (plain old telephone service) to PANS (pretty amazing new stuff). This cautionary tale reveals that the winners are grid operators who welcome new ideas and offer customers new services.

A cautionary tale

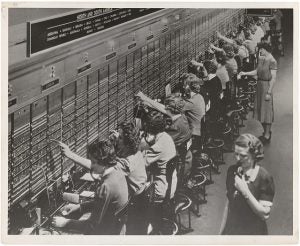

In 1996, Congress opened up the local telecommunications market to competition, to spur lower prices and innovation. At the time, the market was dominated by the monopoly Bell System, affectionately known as Ma Bell, and its regional operating companies (also known as “the Bells”). There had been little innovation in local service offerings beyond the color and shape of the princess phone and some services, like call forwarding and call waiting. In fact, the Bells had argued to regulators for a long time that it would compromise the reliability of the system to allow others to connect.

[Tweet “What the US Electricity Sector Can Learn from the Telecom Revolution”]

The opening of the market coincided with dramatic technological advancementss in communications, wireless, and internet. The Bell companies were extremely resistant to new market entrants and played regulatory games with everything from interconnection to customer service. State commissions were flooded with complaints of anti-competitive behavior, and the Bells used the regulatory process to block competition and customer access. While those wars waged, customers migrated from the telephone company to mobile wireless and the internet.

The once dominant Bell System is gone, and the existing wireline network struggles as it continues to lose market share. In contrast, the new networks, mobile and broadband, have thrived as they offer customers choice and evolving new services. We know that wireline phones were simply supplanted by seemingly superior, more desirable technologies. What we don’t know is how much the Bells’ emphasis on fighting change in regulatory battles, rather than putting resources into innovating within their networks and working with new entrants, contributed to their demise.

A new era

The American telecommunications story of grid defection and bypass can enlighten today’s utilities.

The accelerating transition of the electricity system has been compared to the journey taken in the telecommunications industry. While the experience is not completely analogous, there are lessons to be learned. For example, customers flocked to wireless cell phones that offered them new services and mobility. The internet, designed to allow innovation at the edges, made it easy for innovators to interconnect their applications to the internet and reach customers. The more people that connect and use the networks, the more valuable the service. These technologies converged, giving customers the ubiquitous communications and internet devices we carry today, and increasingly more people have cut the cord to the telephone company.

Broadband internet, along with wireless technology, have transformed how we think about communications. The tale of the powerful Bell operating companies, in light of these new alternative networks, deserves study. Some thought alternative platforms couldn’t be developed to compete with the telephone company, and were proven wrong.

The American telecommunications story of grid defection and bypass can enlighten today’s utility system operators and regulators as they stand at the crossroads of choosing between using regulatory processes to cling to the past, or innovating in tandem with new technologies and new companies to deliver value to customers. In addition to delivering new value and markets, the new ways are cheaper and cleaner, too.

4 Comments

Cellular technology lower to barrier to entry, and dependency on the wired infrastructure. In electricity the fact that 3rd parties coming in providing access to distributed energy resources (DER) still does not free them from being dependent on the poll and wires infrastructure. The electricity sector need technology like cellular – ability to transfer electricity wireless with out losses. That will be a breakthrough.

Thanks for your comment. The point of the blog was the peril in assuming the existing network is essential. I agree we are not seeing wireless electricity yet, but we do have distributed networks, microgrids, and storage developments that could alter how dependent customers are on a centralized grid run by a utility. I hope utilities will embrace these new technologies and demonstrate the value in networked services rather than adopting policies that deny access and encourage bypass.

Nicely said Diane! Do you think that, differently than telecom, the electric sector transformation will start with regulators?

Hi Edison, thanks for your question. I think it has started and will be driven by customers and technology. My hope is that regulators will enable the change so all can benefit.