This commentary was originally posted on our EDF Voices blog.

Source: SolarPowerForYou/Flickr

So far, my experience is that environmentalists and business executives often speak different languages. Take the basic idea of sustainability. To an environmentalist, sustainability, as applied to a business, refers to the amount of environmental damage it will cause over time. To a business person, the term refers to the ability of the business to generate profits and so sustain itself.

In other words, there is a profound difference between the “green” that environmentalists are focused on and the “green” that businesses must generate to survive.

At EDF, I am trying to bring those two camps together. Broadly defined, my work involves creating opportunities for companies to make profits by selling products that benefit the environment, usually by reducing carbon emissions. My belief is that, with the right incentives and market structures, the profit motive can be a powerful force for change. Green companies that hire workers also create new advocates for environmental policy.

A study by McKinsey, the big consulting outfit, has shown that there are potentially hundreds of billions of dollars in energy efficiency investments that could yield annual returns of 7% to 20%. At a time of historically low yields on fixed income investments, like bonds, those are pretty good numbers.

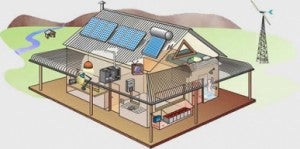

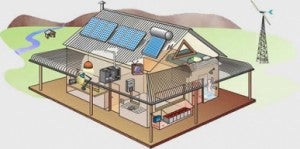

Mostly, I focus on increasing investment in energy efficiency and renewable generation projects for homes, offices and other commercial properties. In many cases we can lower a building’s utility bills, including financing costs, while also reducing carbon emissions.

Take investments in solar technologies. I am lucky enough to have pretty good credit and was able to get a solar installer to finance a rooftop installation that provided my wife and I with immediate savings. Unfortunately, many homeowners do not currently qualify for financing. So EDF is working to decrease financing costs and increase availability of capital for such projects through a program called On-Bill Repayment (“OBR”).

OBR can help a building owner finance, say, a rooftop solar array, with money put up by an third part investor, and then repay that loan through his or her monthly utility bill. The costs of the loan are reduced because the loan is part of the legally binding rate tariff for the property, and will remain in place even after a foreclosure.

Once we have OBR in place, far more homeowners should be able to finance the upfront cost of installing energy efficiency or solar projects that lower their bills. This creates jobs, saves money and is good for the planet. What’s not to like?

Take California. The state is expected to initiate an OBR program for commercial properties in about 4-6 months. EDF’s economists estimate that this program over the next 12 years will lead to about $7 billion in third-party clean energy investment, create 50,000 job-years that cannot be exported. Over the same period, OBR will the cut carbon emissions by 10.3 million tons, the equivalent to replacing 180,000 gasoline cars for 12 years with solar-powered electric vehicles. And the environmental benefit will continue to grow as we add residential customers and expand to other states.

OBR is just one way in which business and the environment can coexist. In future blog posts, I will look at other ways to achieve the same end.

By: Victoria Mills and Cheryl Roberto

By: Victoria Mills and Cheryl Roberto