The use of rechargeable batteries – in everything from iPhones, TV remotes, and even cars – has become pervasive over the past few years, especially as they have become more affordable. So why can’t we use them to help power our homes and businesses, too? The idea isn’t that complicated. But the cost of large-scale energy storage is still prohibitively high.

However, in select markets, like Hawaii’s commercial building market, privately connected battery storage is already cheap enough, compared to utility rates, to warrant installation. Furthermore, other energy storage markets, like California and New York, could reach the point of commercial viability in the next ten years – and not just for commercial buildings, but the residential market, too.

These insights are fleshed out in the Rocky Mountain Institute’s ground breaking study, The Economics of Grid Defection. Essentially, this report says that once solar power and energy storage are at the right price, customers could leave the central electricity grid and their utility entirely – a process sometimes referred to as ‘grid defection.’ That gives utilities in select states about ten years to come up with new business models as they potentially start to lose customers.

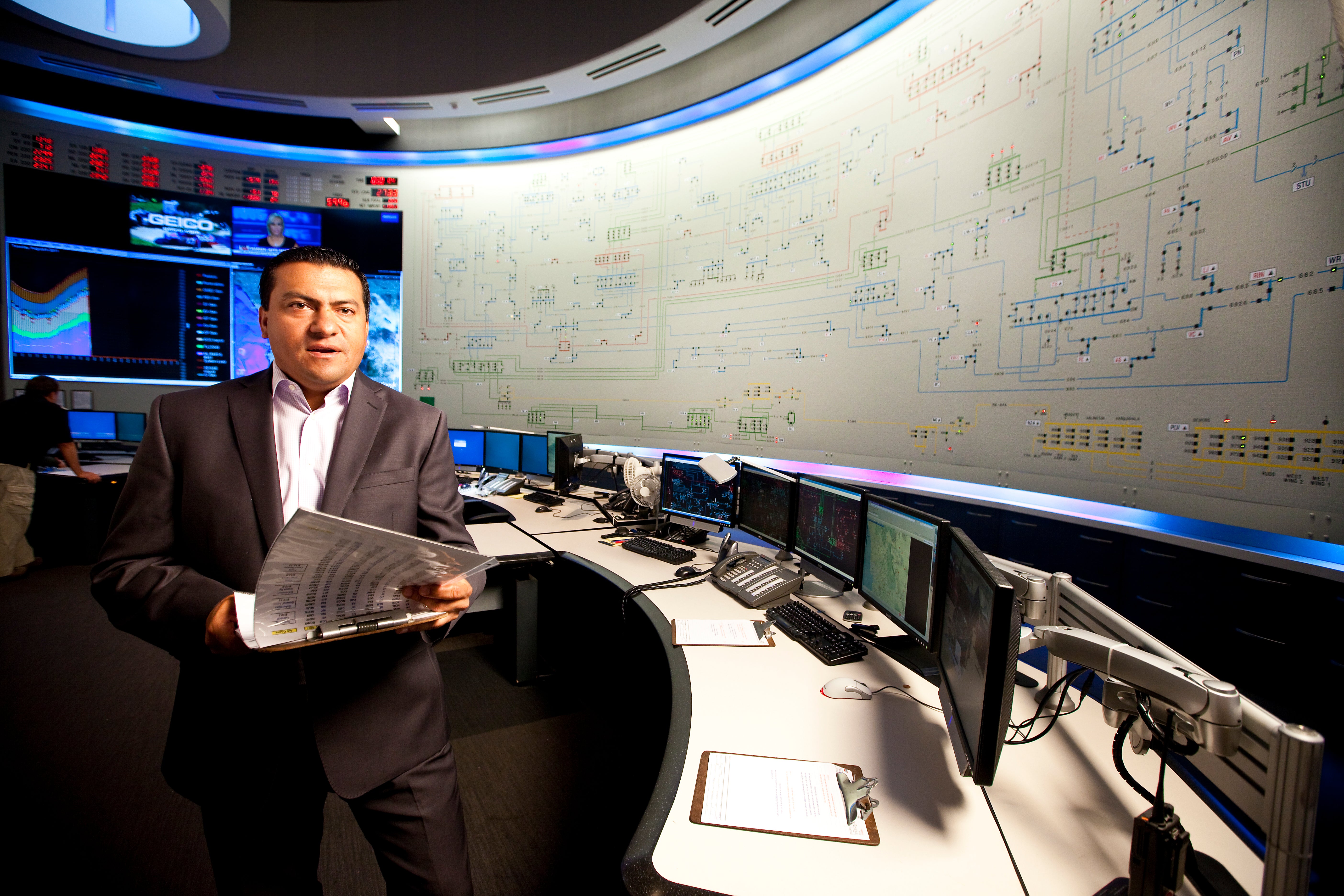

Perhaps more importantly though, grid defection also presents a potential solution to the grid security issues found by the latest Federal Energy Regulatory Commission (FERC) study and published by the Wall Street Journal in March, which suggests that the grid could be brought down if only 9 substations were targeted in a coordinated attack. In addition, Climate Central has noted a doubling in weather related outages since 2003. For “grid defected” customers, relying on their own generator and storage units, such events would not affect them.

However, the prospect of grid defection is not a certainty. Firstly, customers may choose to stay with their utility so as to maintain a link to the grid for selling excess electricity. Secondly, utilities could choose to get in on the “solar plus storage” market, leasing both to customers in return for a form of electricity generation that the utility can control to help manage the overall electricity system. Indeed, CEO of Sunverge, Ken Munson, sees this as an increasingly attractive business model.

Falling solar prices and huge market growth in battery technology are also key drivers of the potential for grid defection, as well as the research funding that sparked much of these advancements.

Among the more interesting potential developments in the energy storage world is the impact that Tesla’s proposed Gigafactory could have on markets other than Tesla’s electric vehicle market. Set to open in about three years, the new GigaFactory will be large enough to manufacture more lithium-ion batteries than the entire industry produces now. Navigant analyst, Sam Jaffe estimates that this could bring the cost of lithium ion batteries down around $180 per kWh, a price that Bloomberg New Energy Finance didn’t see coming until well into the next decade. For comparison, Tesla’s current costs for lithium ion batteries (supplied by Panasonic) are around $200 – $300 per kWh. A drop in price this significant could be what renewable energy needs to reach even higher levels of penetration. Energy storage, among other technologies, will be instrumental in realizing the full potential of renewable energy because it guarantees that the energy produced by renewables is available at all times, even when the sun isn’t shining or the wind isn’t blowing.

The choice to produce your own energy and leave the utility behind completely will be coming for a vast number of customers in the next ten years and plenty more beyond that. Fortunately, this presents a once-in-a-generation opportunity for utilities to reinvent their role in how electricity is generated, moved, managed, and consumed.

As the U.S. prepares to spend around $2 trillion over the next two decades replacing our aging, inefficient, and polluting energy infrastructure, the time for new utility business models is now.

One Comment

I completely agree with this article. With distributed generation gaining momentum for all the reasons cited here, the time for utilities to rethink their centralized generation-based business models is now (or yesterday). Yet the industry is populated with old-school utility CEOs like First Energy’s, who recently said that renewables are bad for his business (and thus bad for the country) and we need to continue relying on carbon-based power generation. Energy storage at for residential and commercial use makes sense and is becoming economically viable. At the grid-scale level it’s also making inroads thanks to recent FERC rulings, technology advances, some timely government funding, and a few forward-thinking utilities in places like Hawaii and California. Tesla’s gigafactory could be a game changer, driving down costs, increasing energy density and improving performance. Thanks for your insights.