Tax credits for carbon capture? Not without these 3 important rules.

By Adam Peltz and Scott Anderson

Removing carbon emissions from the air — a process known as carbon capture, utilization and sequestration — is one of the most important things we can do to battle climate change, and the Internal Revenue Service is currently developing regulations around tax incentives that could make or break the success of U.S. efforts to do this effectively.

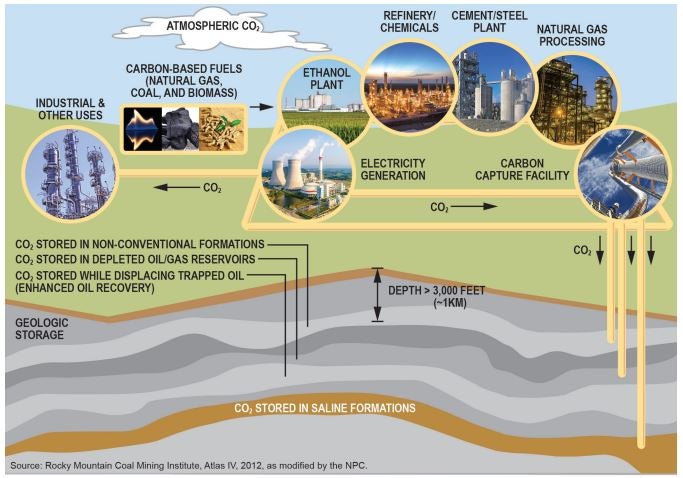

CCUS is a suite of technologies that can capture carbon dioxide from the air and industrial sources. Companies can either reuse carbon dioxide or permanently store it in deep underground rock formations. The International Energy Agency estimates that by 2050, 9% of all necessary climate mitigation will come from CCUS activities. In other words, most versions of a carbon neutral economy will include a healthy amount of capturing carbon dioxide and putting it underground.

But CCUS can be a climate solution only if the carbon is securely stored once removed from the atmosphere. Any regulation or tax incentive offered to companies who practice CCUS must assure that.

Earlier this month, a coalition of major industry participants and leading environmental groups filed comments with the IRS outlining three crucial recommendations to ensure the agency gets it right for the climate.

Tax credits for carbon capture? Not without these 3 important rules. Share on XThe core issue relates to how IRS polices the climate integrity of tax credits for a process known as enhanced oil recovery, which involves storing carbon dioxide in underground oil formations.

The IRS is focused on closing regulatory gaps for EOR projects that use the voluntary protocol of the International Standards Organization to claim credits. Improperly operated EOR projects can leak carbon dioxide to the atmosphere, and the Environmental Protection Agency regulations underlying EOR projects do not address climate issues unless operators “opt in.” The ISO standard addresses climate, but it is voluntary. IRS must give it some teeth in order to ensure public trust in the climate integrity of tax credits claimed in this way.

EDF has been working for over a year with a broad stakeholder coalition, including Clean Air Task Force, The Nature Conservancy, Occidental Low Carbon Ventures, Shell, the Carbon Utilization Research Council and ClearPath to ensure the IRS rules do just that.

More oversight, fewer leaks

In the proposed regulation, the IRS requires companies who practice CCUS to assess projects for leakage, but that requirement ends after 17 years. However, injection associated with these projects can go on for decades — in fact, carbon dioxide leakage could occur for centuries — negating the benefits of particular CCUS projects altogether. The EPA has leak reporting rules for some CCUS projects, but EOR projects that use the ISO standard are not subject to those regulations. So no authority would ensure such projects are not leaking carbon dioxide to the atmosphere in the following years.

That scenario was so worrisome that the National Petroleum Council called on the government to require companies to comply with an environmentally protective CCUS protocol even after the tax credit period ceases (in the case of the ISO standard, all the way to project completion). EDF and our partners agree, and it was a cornerstone of our submission to IRS. In fact, EDF would not support the use of the ISO alternative standard in the absence of such a backstop.

Increased transparency

The second recommendation concerns transparency. Currently, the IRS does not make certain taxpayer information public. This is a valuable privacy protection, but public trust in the integrity of CCUS projects requires more transparency. For EOR projects following the voluntary ISO standard, there is no requirement to report leakage information. EPA should develop reporting rules to cover operations pursuant to ISO. In the meantime, the IRS should require companies to publicly post this information online.

Third-party audits

Lastly, because there is no climate oversight for EOR projects following the voluntary ISO guidelines, most stakeholders agree that each project’s status should be annually evaluated by a competent third-party auditor. Absent this, EOR operators would not be subject to meaningful oversight on carbon dioxide leakage. Our comments to the IRS include recommendations to ensure the people performing this oversight are qualified, independent and have no conflict of interest.

Heading in the right direction

Overall, EDF believes that IRS is taking both the threat of leakage and the importance of public trust seriously, and its proposed rules go a long way toward bolstering the climate integrity of tax credits claimed under this program. However, the issue of ensuring integrity and compliance for EOR projects using the ISO standard remains unresolved, and EDF’s support for that option hinges on the IRS getting this right.