On Tuesday, the Business and Commerce Committee in the Texas Senate held an interim charge hearing on the Electric Reliability Council of Texas (ERCOT) protocols, including a look at the impact on system reliability, a topic that EDF is following closely. The charge as given directs the Texas Senate Business and Commerce Committee to:

Review current and pending ERCOT protocols as they apply to all generation technology, and identify those protocols that may provide operational, administrative, or competitive advantages to any specific generation by fuel type. Consider the impact any revisions to the protocols may have on grid reliability and electricity rates. Make recommendations for revisions or statutory changes to limit distortions in the Texas electrical market.”

Leaders from all parts of the Texas electric system discussed the process of creating protocols and concerns about the impact of protocols on system reliability: Public Utility Commission (PUC) Commissioner Ken Anderson gave an update on activities at PUC and ERCOT this year, many of which we’ve discussed previously. Anderson was followed by a panel including ERCOT CEO Trip Doggett.

Mr. Doggett told lawmakers that the “electric supply will be tight this summer and warned that the agency will likely declare Energy Emergency Alerts asking consumers to cut back on use. ERCOT may also implement emergency procedures, including taking industrial users offline. But blackouts would happen only if there was an extraordinary drop in generation or the state experienced record high temperatures.” Senator Leticia Van de Putte asked about the Brattle report’s suggestion of a capacity market that would allow demand response (DR) and whether the 13 percent reserve margin should be treated as a target or a minimum requirement. This was not fully addressed beyond saying the Brattle report will be discussed at a Commission workshop on July 27.

The Director of ERCOT’s Independent Market Monitor, Dan Jones, keeps an eye on the system to make sure the market is functioning efficiently and no one is exerting undue influence over the Texas market. Concerns of market manipulation have been raised by outside observers and committee members were clearly concerned about those allegations, which Mr. Jones is in the process of studying. Jones also discussed the Brattle report recommendations, including one to further increase price caps in ERCOT. Senator Kirk Watson asked how the recent cap increase, approved by the PUC to encourage more generation, could affect volatility, another issue that will be addressed along at the upcoming PUC workshop.

John Fainter, representing the Association of Electric companies of Texas (AECT), an electric industry group, stated that the industry “supports the flexibility in the process with the current protocols” and that “we will continue to have emerging technologies and that demand management should be part of the solution.”

We agree that it is important for the protocol development process to remain flexible and stakeholder driven, but the problem lies in the inertia with which these new emerging technologies and demand resources are brought into the market. The current stakeholder process tends to favor the status quo and, if that process is not successful in implementing the desired solution, consider further action through other means.

According to Brattle, “competitive DR resources can reduce our peak demand needs by 15 percent, greatly improving system reliability and playing a critical role in addressing future resource adequacy concerns.” Large commercial and industrial customers, who are already “quite engaged” in various DR programs, only represent 14 percent of the total DR potential in ERCOT. In contrast, during the summer of 2011 residential and small commercial customers accounted for 72 percent of peak load and “currently provide little DR.”

According to Brattle, “competitive DR resources can reduce our peak demand needs by 15 percent, greatly improving system reliability and playing a critical role in addressing future resource adequacy concerns.” Large commercial and industrial customers, who are already “quite engaged” in various DR programs, only represent 14 percent of the total DR potential in ERCOT. In contrast, during the summer of 2011 residential and small commercial customers accounted for 72 percent of peak load and “currently provide little DR.”

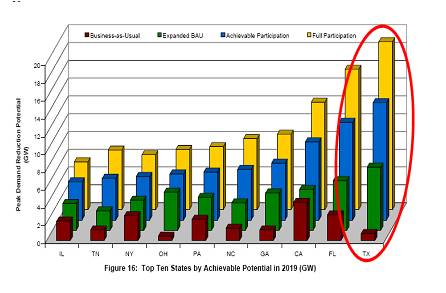

While EDF did not testify at the hearing, we submitted written testimony. Despite the current flexibility, the mechanisms by which new demand side resources expand do not necessarily allow for all stakeholders to be evenly weighed and can stymie the flexibility needed. Texas is currently among the lowest states in terms of load management, despite having the highest potential according to FERC and the Brattle Group. As ERCOT works to address resource adequacy issues, and this committee considers whether some protocols provide operational or competitive advantages to any specific generation, we believe it is important to note that ERCOT protocols generally provide operational and competitive advantages to generation resources over most demand side resources.

Therefore, we advocate the following changes to ERCOT’s market structure, including protocol revisions as proposed by Brattle:

- Enabling DR to directly participate in energy markets so it can set prices directly;

- Enabling all emergency DR to set prices at their individual strike prices during reserve shortage conditions, as in PJM;

- The adoptions of provisions by ERCOT that allow demand resources to submit other operational data in lieu of telemetered data in order to substantially expand participation; and

- If supply offers clear, they should be paid a market price, such as the economically efficient price as determined by ERCOT’s Demand Side Working Group.

As this committee, ERCOT, and the PUC consider resource adequacy and inequities within current protocols, EDF recommends paying special attention to expanding DR options for residential customers and small business. The four-market structure changes recommended above are critical to those efforts, but more work is needed to ensure that as other changes begin to impact retail rates, customers have recourse through DR programs that compensate them based on a fair market price.