The Regional Greenhouse Gas Initiative is at a critical juncture. Here are 3 ways it can put states on the path to meet our climate goals

Since the Regional Greenhouse Gas Initiative (RGGI) began well over a decade ago, this group of Eastern states has successfully slashed climate pollution from power plants in half, generated substantial health benefits and raised $3 billion in proceeds that have been invested back into states.

Now this program, which puts a declining cap on power sector pollution, is at a crucial juncture that will determine its impact this decade.

Since February of 2021, RGGI Inc, the organization that oversees RGGI has been conducting its third program review — a process meant to assess RGGI’s successes, impacts and potential design changes. Given the opportunities offered by major investments in the Inflation Reduction Act (IRA) and the Bipartisan Infrastructure Law (BIL), along with the fast-approaching 2030 deadline for the U.S. to reduce emissions by at least 50%, the stakes for the current program review are high.

EDF submitted public comment on the review, urging RGGI Inc to take several key steps as it plans the trajectory of RGGI through 2030 and beyond. First, RGGI Inc should align the program’s emissions cap with national and state climate commitments. Second, RGGI should include an interim target of at least 80% emissions reductions by 2030 to ensure that states take near-term action that lines up with where the power sector needs to be to achieve climate targets. Third, RGGI Inc should create a pathway to cover imported electricity as a means to mitigate emissions leakage (a situation where emissions from non-RGGI states may increase).

1. The RGGI cap should align with national and state climate commitments

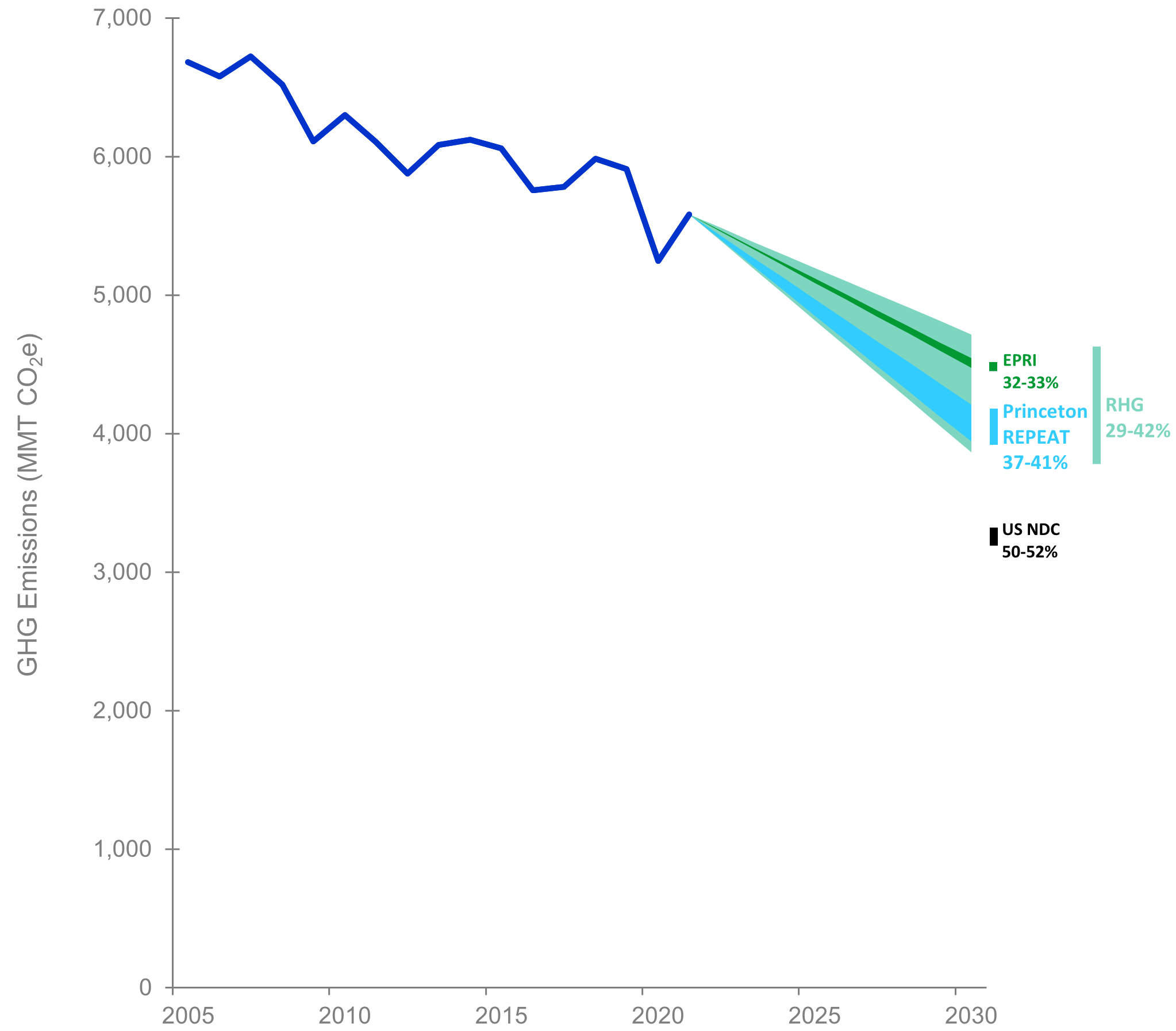

The passage of IRA and BIL underscore the need for an ambitious and enforceable cap on greenhouse gas emissions, as the supply side approach of federal investments and demand side approach of a cap complement each other. That is, the IRA and the BIL are pushing down the cost of clean energy, allowing the RGGI states to meet a more ambitious cap more easily. At the same time, the cap will apply certainty of emissions cuts to the IRA and BIL. As the chart below shows, while emissions are projected to lower thanks to IRA and BIL, the extent to which they go down varies substantially based on assumptions about fuel costs and other economic factors. Adding an enforceable cap like RGGI could ensure that the covered states take the lower-carbon path, providing a critical backstop to meeting our power sector decarbonization goals. In addition to the target of 50% emissions reductions by 2030 in the US Nationally Determined Contribution, the U.S. has pledged to fully decarbonize its electricity by 2035, which will require states to make major strides by at least 2030 to keep pace with the intended emissions path.

Range of Post-IRA Economy-Wide Projected Emissions Reductions

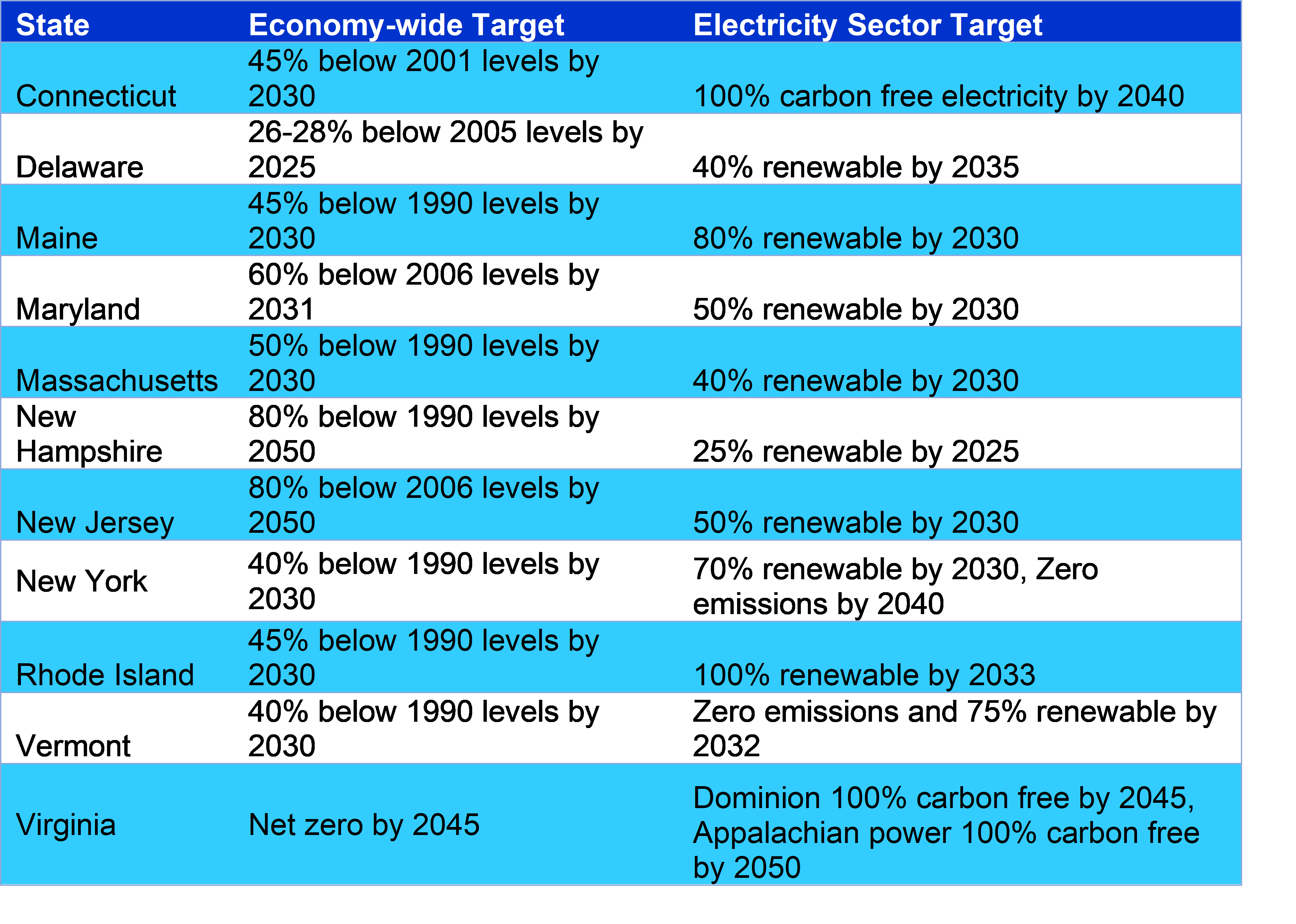

RGGI states have made climate commitments of their own, both for economy-wide emissions and for the electricity sector specifically. While these targets vary in stringency, several are as ambitious or more ambitious than the 80% by 2030 target proposed in EDF’s comments. To keep the program working effectively across the whole region, RGGI will need to incorporate the high level of ambition taken in its leadership states.

Further, the models projecting emissions cuts from the IRA and BIL are cost minimizing, which likely does not perfectly reflect the reality of these economic sectors. In practice, polluting industries – the power sector in particular — face market frictions that may prevent them from making economically optimal decisions in all cases. For example, the high upfront costs of building renewables can make them look riskier than fossil fuels even if lower operating costs make the renewable resource more economical on balance. The historical dominance of fossil fuels in the energy system can also create an artificial barrier to building renewable resources. Companies that operate coal, oil, and gas generation often have power in and knowledge of energy markets, which can let them outcompete younger companies even when the economic fundamentals favor renewables. The added push of an enforceable cap could help bridge the divide between what actions make sense on paper and what companies end up doing in the real world.

2. RGGI should set a near-term, ambitious target to catalyze pollution reductions across the economy

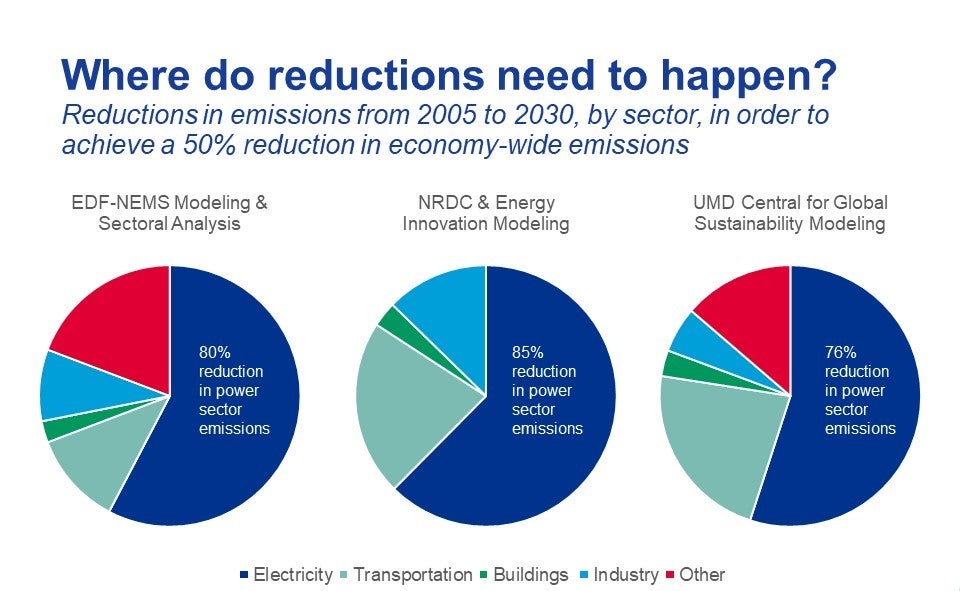

Meeting the Biden administration’s pledge to cut emissions 50-52% below 2005 levels by 2030 will require rapid action in the power sector. Multiple models, with multiple different sets of assumptions, have all found that reducing power sector emissions 80% or more by 2030 will be a critical step to decreasing economy-wide emissions in line with the administration’s goal (see figure below).

The electricity sector must decarbonize faster than other sectors for several reasons. Especially relative to transportation and industry, electricity tends to be cheaper to decarbonize, so states can get much of their near-term emissions reductions from the power sector while waiting for technology in other areas to mature. Further, decarbonizing electricity is, in many cases, a necessary precondition to decarbonizing other sectors. In many areas like transportation, manufacturing, and home heating, electrification is the key step to reducing emissions – but it only works if the electricity grid is relatively clean.

As part of the program review, ICF, acting on behalf of RGGI, modeled a cap trajectory of zero electricity sector emissions by 2035. While this scenario is a helpful addition to the review, RGGI Inc should also adopt a target of at least 80% emissions reductions by 2030. The interim 80 by 30 target would complement a zero by 2035 target insofar as it would require near-term action by the RGGI states, leading to lower cumulative emissions this decade. Although the RGGI cap technically applies only to annual emissions, it is cumulative emissions, the stock of greenhouse gasses that have built up in the atmosphere, that actually drive climate change. To minimize harm to the climate, a steady, declining emissions path is much better than a level path that leads to more pollution in the near-term and declines sharply as 2035 approaches.

Both ICF and EDF’s modeling further show that adopting an ambitious cap would not generate a spike in cost. In ICF’s zero by 2035 scenario, allowance prices remain well below the current trigger level of RGGI’s cost containment reserve (CCR). EDF’s analysis using the FACETS model similarly finds that allowance prices remain relatively low even with a cap set to 80% reductions by 2030, including under scenarios where high allowance prices would be expected. For instance, low gas prices tend to drive allowance prices up, as lower gas prices generate higher emissions and, as a result, tighter allowance markets. Even in the low gas price scenario however, allowance prices remain below the CCR trigger level between 2025 and 2035 under EDF’s model of an 80% by 2030 cap.

3. RGGI should adopt measures to mitigate emissions leakage

While RGGI continues to deliver substantial, net climate benefits even when you consider the emissions leakage that occurs, taking steps to address emissions from imported power should be an important part of the third program review. A 2023 analysis from Resources for the Future found a leakage rate of 12-22%, indicating that although most program benefits are retained within the RGGI states, leakage is still an issue. As the stringency of the cap increases, this issue may become bigger. That is, with a tighter cap, utilities may face greater pressure to buy electricity from states it does not cover, especially states like Ohio and West Virginia, which are part of PJM but not part of RGGI. In RFF’s analysis for example, leakage is driven in part by an increase in coal-fired generation in the PJM region as the cap declines.

Fortunately, other systems, such as the California Air Resources Board’s (CARB) cap-and-trade program, provide a precedent for pricing emissions from imported electricity. EDF’s comments provide draft language that RGGI Inc could adopt into its model rule as a framework to cover imported electricity, which can reduce the emissions leakage undermining the program and benefit electric generations within the RGGI states.

The third program review comes at a critical time for RGGI. New federal climate investments stand to transform the cost and availability of clean energy technologies, like wind, solar and battery storage. At the same time, key deadlines for climate action are just around the corner, raising the stakes for immediate action. RGGI Inc must consider these challenges and opportunities as it assesses the program’s progress and develops a new model rule that will influence state and national climate progress for years to come.