It’s been a consequential month for research on solar radiation modification (SRM). And while there has been a lot of news lately that’s concerning to those of us working in climate, it’s important to celebrate progress in fundamental areas: advancing public research and creating more global connections across the SRM research community.

It’s been a consequential month for research on solar radiation modification (SRM). And while there has been a lot of news lately that’s concerning to those of us working in climate, it’s important to celebrate progress in fundamental areas: advancing public research and creating more global connections across the SRM research community.

Climate 411

Three signs solar radiation modification research is moving in the right direction

As California moves closer to authorizing a West-wide electricity market, new analysis shows how the market will benefit other Western states

This is the second in a blog series on the opportunities presented by the Pathways Initiative. Check back for additional publications in the series coming soon.

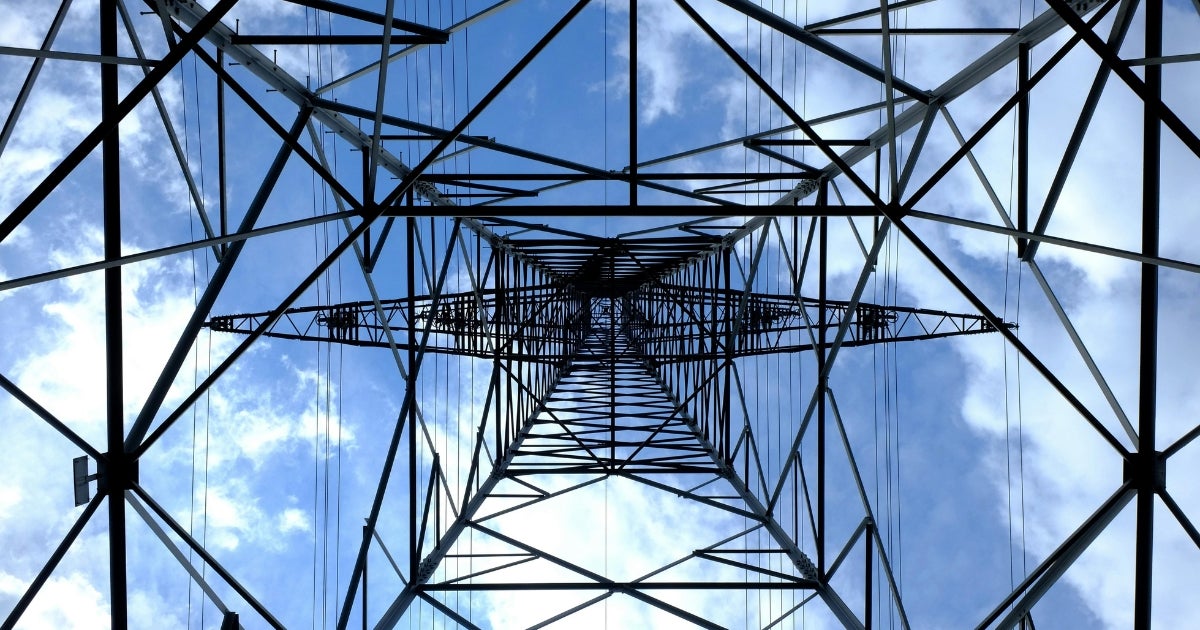

An expanded regional electricity market is coming into focus in the West. A bill is currently moving through the California legislature that will enable the state to join a West-wide electricity market operated by a regional organization and overseen by an independent governing board — a move that will unleash California’s clean electricity potential and benefit the entire West. New analysis underscores how this market will deliver cleaner, cheaper and more reliable electricity to its participants.

A budget bill with sweeping attacks on safeguards that protect Americans

The budget reconciliation bill is now working its way through Congress, and what President Trump calls the “big, beautiful bill” has a lot of ugly provisions in it.

Among those ugly provisions are sweeping attacks on federal agencies and their ability to carry out their responsibilities under the law to protect the health and safety of the American public.

These provisions borrow from previous legislation that never made it into law, and so far they have received relatively little public attention compared to other parts of the budget reconciliation bill.

If signed into law, they would erect nearly insurmountable procedural hurdles to maintaining our existing health and environmental protections, and to establishing new ones. Safeguards that Americans rely on every day – from air quality standards to food and product safety regulations – are all at risk.

In addition to being harmful and misguided public policy, these provisions have no place in a budget reconciliation bill – which is supposed to include only provisions that are primarily intended to affect spending or revenues. Because the harmful policy impacts of the provisions are the intent and the budgetary impact is incidental – and far outweighed by the damage that would result –the House’s attempt to shoehorn these provisions into the budget reconciliation bill is an end-run around Congress’s own rules.

Here are some of those provisions:

Despite $1 billion budgeted for clean energy, New York’s delayed cap-and-invest rollout is costing residents billions more in savings

Last week, New York approved its 2025 budget, which includes $1 billion to invest in clean energy, energy efficiency and other programs that will reduce pollution and save New Yorkers money. Unfortunately, the benefits of these investments are overshadowed by the delayed launch of New York’s cap-and-invest program, which would provide billions more in savings to New Yorkers every year.

New tax bill repealing clean energy incentives will raise costs, surrender jobs and increase pollution

Professional worker installing solar panels. Shutterstock.

(This post was written by EDF Vice President for Political and Government Affairs Joanna Slaney)

Two key U.S. House committees this week advanced a tax plan that effectively ends incentives for clean energy and electric vehicles, undermining an American-made energy boom while raising costs for businesses and families and threatening people’s health with more pollution.

The draft legislation also includes repeals of the U.S. Environmental Protection Agency’s tailpipe pollution standards and the U.S. Department of Transportation’s more protective fuel economy standards for the nation’s new cars and passenger trucks – rules aimed at reducing expensive fuel use and harmful pollution while providing cleaner air.

The move is a clear abuse of the reconciliation process, which allows Congress to advance certain spending and tax bills on a simple majority vote, freeing lawmakers from the 60-vote threshold in the Senate most legislation must meet to be considered.

Local leadership on climate takes center stage at the African American Mayors Association Conference

A conversation between Memphis, TN Mayor Paul Young, Baltimore, MD Mayor Brandon Scott and Cleveland, OH Mayor Justin Bibb.

Federal policies on climate and energy are changing, but the need to build resilient communities remains as urgent as ever. That was a key message that the Environmental Defense Fund brought to the 2025 African American Mayors Association (AAMA) Conference in Washington D.C., where hundreds of mayors and civic leaders from across the country shared strategies and ideas on a range of issues, with EDF lending its voice to discussions around building healthy communities and stabilizing climate.

Guided by the conference theme, “The Power of Now”, mayors sought solutions for navigating rapidly changing federal priorities and identified partnerships that can empower cities to take on their biggest challenges—like climate change.

As cuts to the federal workforce, climate databases and funding for infrastructure projects take their toll, AAMA has built partnerships with businesses and non-profits like EDF to fill some of the gaps. EDF is a strategic partner to AAMA, serving as a member of the association’s Business Council and aligning on stabilizing climate and building healthy communities. During the conference, mayors discussed how EDF resources were enabling them to tackle localized environmental challenges and connect with opportunities for funding infrastructure and resilience projects affected by federal cuts. “Addressing climate and addressing environmental justice is all a part of what we need to be focused on as mayors. It affects educational outcomes, it affects public safety, it affects economic opportunity,” said Justin Bibb, mayor of Cleveland, OH.

Our conversations at the conference highlighted many resources and opportunities—here are the key ones that mayors should know about. Read More