- Japan’s government and Canada’s government are both backing an effort to build stronger emissions monitoring for the natural gas that Japan buys internationally.

- Canada’s leaders can seize this opportunity for international climate leadership by finalizing federal methane regulations for Canadian production.

Energy Exchange

Asian economies want low-emission natural gas – here’s how Canada can deliver

Ensuring New York’s All-Electric Buildings Act delivers on climate goals

By Casey Horan & Magdalen Sullivan

- The All-Electric Buildings Act can accelerate the energy transition and help decarbonize New York’s building sector, which is the largest source of climate pollution in the state.

- Potential exemptions, particularly the broad framework proposed by the New York Department of Public Service, threaten to undermine the Act’s effectiveness and the state’s climate progress, necessitating a more precise and data-driven standard for granting exemptions.

Bipartisan support, market signals show path forward for zero-emission trucks in Texas

- The Texas Legislature closed their latest session demonstrating bipartisan support for several priority zero-emission truck policies.

- Though deadlines and politics in the compact legislative series prevented final passage of the measures, there is now a strong foundation for future policy opportunities to complement the growing zero-emission transportation market in Texas.

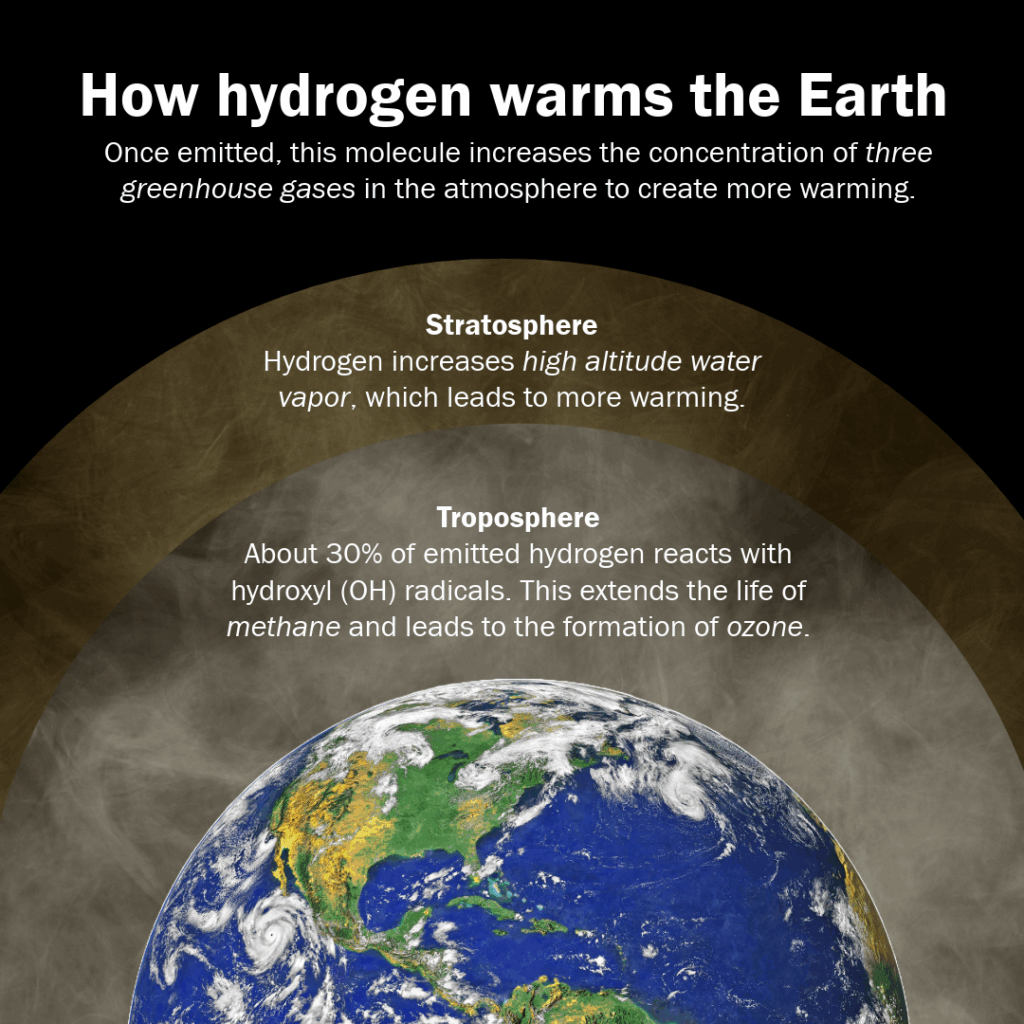

Why wait to account for hydrogen’s warming impact in standards & policies when it will cost more later?

As the world works towards deploying a cleaner energy future, governments and industry are investing in building a hydrogen economy to replace high greenhouse gas emitting energy sources in critical hard to decarbonize sectors. But as we prepare to deploy hydrogen at scale, we must ensure that our standards and policies are rooted in the latest science. Otherwise, we risk undermining the very climate benefits we seek.

May 2025: Electric trucks, buses round-up

Retrofitted CircularEV with a fast-charging infrastructure. Photo courtesy of American Textile Maintenance.

- In May, we saw a wide range of electric truck orders announced. Truck types include electric step vans, box trucks and transit buses, proving that electric can work for any type of fleet.

- Several fleets placed orders for or received their first electric trucks last month, demonstrating that new fleets are still excited about their electrification options and continue to embrace zero-emission trucks.

Don’t mess with Texas: bill begins to tackle the clean up challenge of inactive oil and gas wells

By Colin Leyden and Adam Peltz

- A bill aimed at Texas’ 115,000 inactive oil and gas wells has passed both legislative chambers and will help address one of the state’s most critical, yet hidden, challenges.

- A bill heading to Gov. Abbott’s desk challenges the status quo in Texas, making sure the oil and gas industry starts cleaning up its old, leaky, non-producing wells.

Texas’ oil and gas industry has long been among the national leaders in production, but with that leadership comes the responsibility to safely and responsibly plug unproductive legacy assets. This is particularly true when it comes to the over 100,000 inactive oil and gas wells scattered across the Lone Star State. The recent passage by both legislative chambers of Senate Bill 1150 represents a modest but meaningful step toward making sure the oil and gas industry cleans up its mess and addresses one of our state’s most pressing environmental and fiscal challenges. The bill is now headed to Gov. Abbott for signature.