- In June, Rivian doubled Amazon EV van deliveries to over 30,000, and Rizon electric box trucks expanded across Los Angeles fleets.

- Over 6,000 new zero-emission trucks were deployed in the first half of 2025, solidifying 2025 as the 3rd best year on record for zero-emission truck deployments.

Energy Exchange

June 2025: Electric trucks, buses round-up

Posted in General Leave a comment

Stars, stripes, and fixin’ pipes: this Independence Day let’s celebrate Wyoming’s methane opportunity

By John Rutecki & Sean Hackett

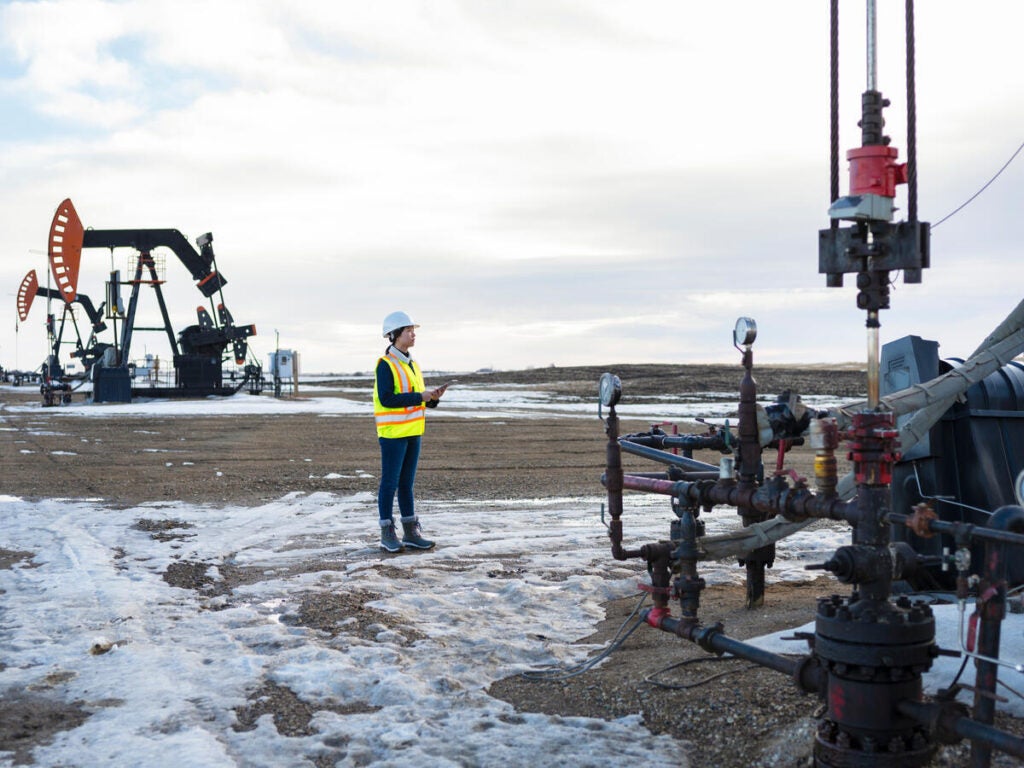

- Wyoming has historically embraced responsible stewardship of the land and resources, and should now apply that principle to methane emissions from oil and gas.

- This will keep their energy exports competitive globally, encourage job growth in the methane mitigation industry and lead to cleaner air. Several operators in the state are already showing that lower-emissions production is possible and affordable.

Posted in General Comments are closed

Asian economies want low-emission natural gas – here’s how Canada can deliver

- Japan’s government and Canada’s government are both backing an effort to build stronger emissions monitoring for the natural gas that Japan buys internationally.

- Canada’s leaders can seize this opportunity for international climate leadership by finalizing federal methane regulations for Canadian production.

Posted in General Comments are closed

Ensuring New York’s All-Electric Buildings Act delivers on climate goals

By Casey Horan & Magdalen Sullivan

- The All-Electric Buildings Act can accelerate the energy transition and help decarbonize New York’s building sector, which is the largest source of climate pollution in the state.

- Potential exemptions, particularly the broad framework proposed by the New York Department of Public Service, threaten to undermine the Act’s effectiveness and the state’s climate progress, necessitating a more precise and data-driven standard for granting exemptions.

Posted in General Comments are closed

Bipartisan support, market signals show path forward for zero-emission trucks in Texas

- The Texas Legislature closed their latest session demonstrating bipartisan support for several priority zero-emission truck policies.

- Though deadlines and politics in the compact legislative series prevented final passage of the measures, there is now a strong foundation for future policy opportunities to complement the growing zero-emission transportation market in Texas.

Posted in General Comments are closed

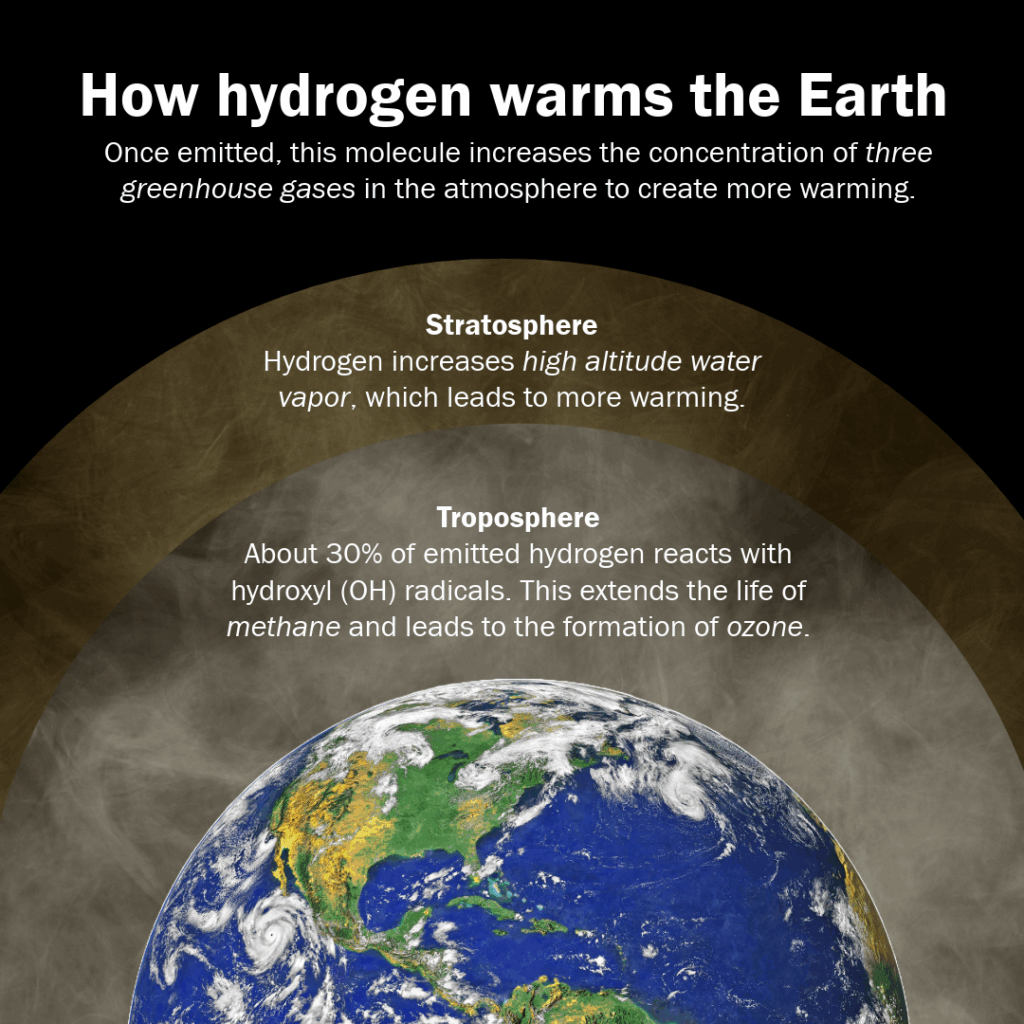

Why wait to account for hydrogen’s warming impact in standards & policies when it will cost more later?

As the world works towards deploying a cleaner energy future, governments and industry are investing in building a hydrogen economy to replace high greenhouse gas emitting energy sources in critical hard to decarbonize sectors. But as we prepare to deploy hydrogen at scale, we must ensure that our standards and policies are rooted in the latest science. Otherwise, we risk undermining the very climate benefits we seek.

Posted in General Comments are closed