5 Reasons the Future of Clean Energy Investing Looks Stronger than Ever

People don’t invest in an industry to save the world or promote a cause; they invest because they believe the amount they put in will ultimately be returned to them as a much greater sum.

You’ve got to spend money to make money and, when it comes to clean energy, there is a lot of money to be made. Here are five reasons clean energy investment will continue its positive performance in 2015 and beyond.

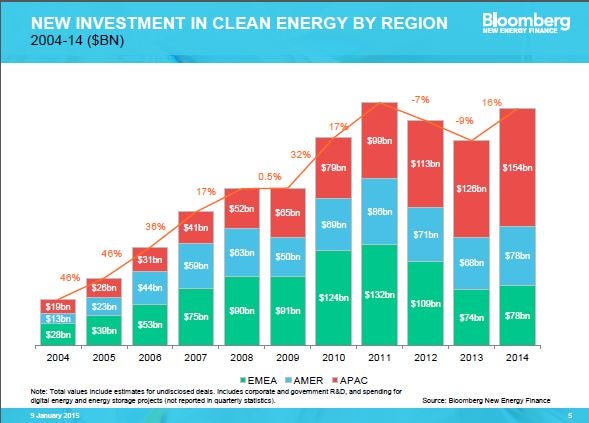

1. Clean energy investment has been – and continues to be – on the rise

Recent buzz around clean energy investment has centered on a new Bloomberg New Energy Finance (BNEF) report detailing the global clean energy industry’s strong 2014 investment results, results that even “beat expectations”. While 2004-2014 saw an extended recession and high unemployment for the global economy, clean energy investment grew five-fold during those 10 years, up from $60.2 billion in 2004 to an impressive $310 billion this past year, according to BNEF.

A proxy for this positive trend has also been the steady growth of U.S. venture capital investment in cleantech, up from $893 million (3.8 percent of total U.S. venture investment) in 2004 to $4.367 billion (14.9 percent of total U.S. venture investment) in 2013, according to Clean Edge Inc.

A proxy for this positive trend has also been the steady growth of U.S. venture capital investment in cleantech, up from $893 million (3.8 percent of total U.S. venture investment) in 2004 to $4.367 billion (14.9 percent of total U.S. venture investment) in 2013, according to Clean Edge Inc.

A strong start to 2015 indicates these trends will continue for the foreseeable future. Just take a look at some of the transactions that have already taken place in the first weeks of this year:

- $250 million investment in U.S. residential solar by Morgan Stanley

- $350 million agreement between JP Morgan and SolarCity

- $195 million arrangement between Investec and SunRun

- Over $1.5 billion in investments by Google in various renewable energy projects

For further support of this trend, Deutsche Bank, among others, is bullish on solar investment’s 2015 prospects.

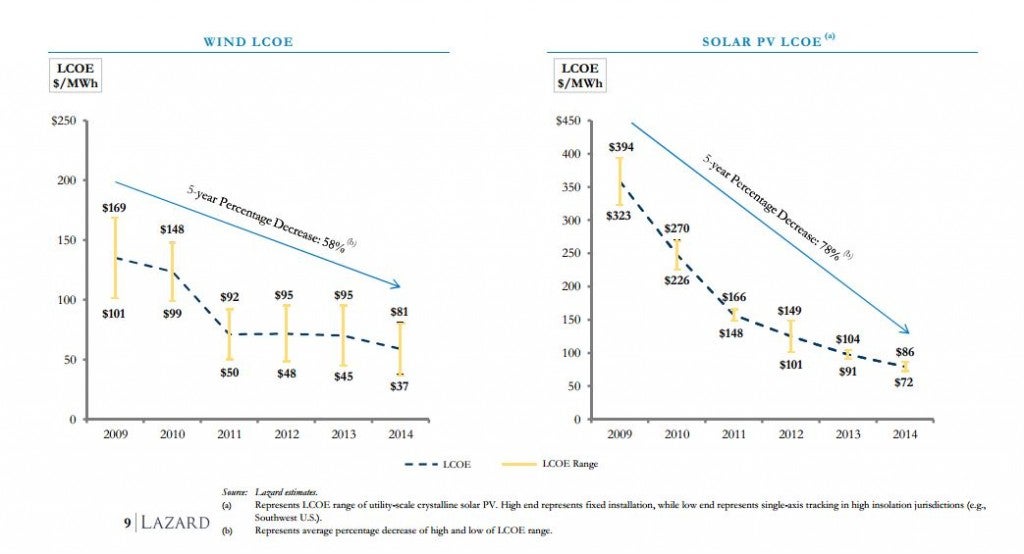

2. Wind and solar energy costs continue to drop precipitously

According to Lazard, the levelized cost of energy (LCOE) for solar and wind energy have decreased 78 percent and 58 percent, respectively, since 2009. It goes without saying that is huge. Also, according to BNEF, costs of solar PV modules have fallen in line with an ‘experience curve’ since 1976 – i.e. prices have declined by 24.2% with every doubling of cumulative capacity, and there are no signs of this trend losing steam.

As costs of wind, solar, and other forms of clean energy decline, improved economic viability will likely lead to growth in clean energy investment.

3. Clean energy investment in the developing world is growing explosively – and just getting started

As costs drop, renewables promise to catch and become even more desirable in the developing world. In 2014, growth in clean energy investment was most notable in a small sample of developing countries that hold some of the world’s largest populations, namely Brazil, China, and India, where growth was 88 percent, 32 percent, and 14 percent respectively. India got a vote of support from President Obama last week when he committed to help finance India’s ambitious goal to increase solar capacity by 33 times – a goal which will require $100 billion in global investments over the next seven years.

Among the many reasons clean energy resources are ideal for developing nations are:

- Many of these countries lack infrastructure for large, traditional power plants; and, distributed generation (like rooftop solar) requires far less infrastructure;

- Many developing countries are at sunny, equatorial latitudes, which are ideal for solar power; and

- In regions characterized by energy poverty, upscaling usage of renewables is far less politically sensitive because there are not established fossil-fuel lobbies fighting to preserve the status quo.

As renewable energy becomes increasingly popular in the developing world, global clean energy investment should benefit.

[Tweet “5 signs clean energy has been – and will continue to be – trending upward at an impressive rate www.edf.org/cQD “]

4. Promising policy advances for clean energy integration

U.S. and global policy momentum is trending toward the creation of a global economy that is increasingly favorable toward renewable energy integration. This also bodes well for growth in clean energy investment. For example, in 2014, the United States and China – the world’s two largest economies – signed an accord in which each country agreed to accelerate the adoption of renewable energy.

The Environmental Protection Agency’s proposed Clean Power Plan – which could limit carbon emissions from existing power plants for the first time ever – is another promising policy advancement for clean energy. To meet these new requirements, utilities will need to increasingly turn to clean energy tools like renewables and energy efficiency, further driving demand and growth in these sectors. Furthermore, President Obama’s recent State of the Union address identified climate change as the single greatest threat to future generations, signaling an emphasis on climate policy in his final years in office.

5. Countries around the world are already seeing the benefits of clean energy adoption

Positive experiences from countries pursuing clean energy integration prove the viability of upscaling renewables, as well as provide motivation and blueprints for others to follow. For example, Germany is undergoing a major energy transition away from centralized, fossil-fueled electricity, and demonstrates a country that is proactively pursuing renewables integration can experience economic benefits. On top of improved grid reliability, Germany has also seen improved employment and macroeconomic conditions. Denmark – which Forbes recently ranked as the number one country for business – is also proactively transitioning to a power sector dominated by clean energy; wind generation now provides around 30 percent of the nation’s electricity. As more countries ramp up clean energy while maintaining strong economies, clean energy investment should grow.

While 2014 was an especially strong year for clean energy investment, it was not an outlier so much as an indication of what is to come. Investors, take note: clean energy has clearly been trending upward at an impressive rate. Money has and will continue to be made through the industry in 2015 and onward.

Image sources: LendingMemo.com; Bloomberg New Energy Finance; Lazard