Methane policy is a test of investors’ post-COP climate commitment. Will they pass?

Climate pledges and statements of support from the financial industry ring hollow unless and until firms support public policies that will deliver required emission cuts. That’s at risk of happening now as major asset managers have remained silent on a proposed new Environmental Protection Agency rule requiring oil and gas producers to cut their methane emissions.

Climate pledges and statements of support from the financial industry ring hollow unless and until firms support public policies that will deliver required emission cuts. That’s at risk of happening now as major asset managers have remained silent on a proposed new Environmental Protection Agency rule requiring oil and gas producers to cut their methane emissions.

Now is the time for investors to speak up. By backing the regulation, the financial sector has a crucial, cost-effective opportunity to support the mitigation of short-term climate risk from a dangerous climate pollutant. The EPA comment period for the proposed methane regulations lasts until Jan. 31, 2022, and is the perfect venue for investors to voice their support.

Methane regulation: Low-hanging fruit on the path to net-zero

Methane is a powerful climate warmer — 80 times more potent than carbon dioxide for the first two decades after it’s emitted. Methane from oil and gas operations, agriculture and other industries is responsible for at least 25% of the global warming we experience today.

Methane policy is a test of investors' post-COP climate commitment. Will they pass? Share on XIt’s no surprise then that cutting these emissions presents one of the quickest, simplest and most affordable ways to reduce warming, even as we continue the clean energy transition.

The EPA proposal would regulate methane from the nearly 1 million active onshore oil and gas wells in the United States. The rules are broadly supported, will have minimal compliance costs or financial impact for the oil and gas industry and will play a key role in reducing a powerful climate pollutant.

Yet, while leading oil and gas companies have been supportive of EPA, there has still been a push by parts of industry to weaken or slow the implementation of the rules. Positive statements from the financial community can counteract these voices and demonstrate private sector backing for climate policy.

Investors can help raise ambition

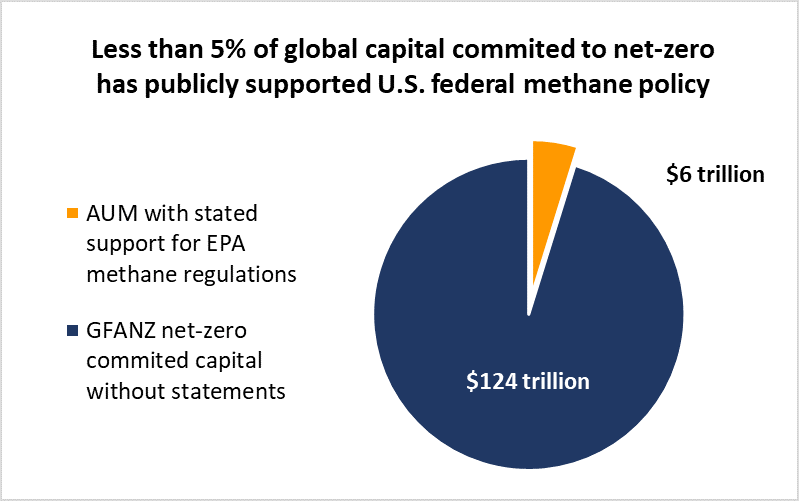

Some in the investment industry are speaking loudly in support of the policy. A group of 168 investors with $6.23 trillion under management issued a statement urging the Biden administration to implement ambitious methane regulation in the oil and gas industry.

In a column in Barron’s, for example, John Hoeppner of LGIM America encouraged his colleagues to support the EPA’s proposed regulation. Other investors supporting the EPA rules range from large global insurance companies like Allianz Global Investors to Quantum Energy Partners, a U.S. energy focused private equity firm.

As big as that is, these voices are still the minority.

In fact, the supporters represent a small fraction of the $130 trillion in capital committed to net-zero through the Glasgow Financial Alliance for Net Zero.

In particular, the U.S.’s largest money managers, as named by Bloomberg, have so far been completely silent.

How investors can lead

Asset managers have long taken a hands-off approach to public policy advocacy. But now investors face even greater risk from staying silent on emission policies. As LGIM’s Hoeppner wrote, it is time for investors to “speak up in favor of policies that will drive emissions reductions.”

EPA methane regulation represents one of the first post-COP26 tests of investors’ climate commitments. Whether finance firms support federal rulemaking will set the tone for the year ahead in net-zero planning. To scale climate action, policy needs to be implemented fast. The bigger the gap between government action and corporate commitments, the more challenging and expensive it will be for large financial actors to meet their climate goals.

The financial industry’s methane moment is now. It’s time for the global investment community to answer the call and speak loudly in support of EPA’s proposed methane regulations. Strong public statements, press releases and public letters to the Biden administration will help drive climate action, mitigate portfolio risk and provide tailwinds for investors net-zero journey.

For investors interested in getting involved EPA’s overview of how to comment on the rule can be found here. The regulatory docket, including submitted public comments can be found here.