Need Help Funding a Retrofit? Use an Efficiency Services Agreement

By Scott Henderson, Advisor to Metrus Energy

While many in the clean energy industry are familiar with the use of power purchase agreements (PPA) to finance solar energy systems at commercial and industrial facilities, many may be surprised to know that there is a similar contract for funding energy efficiency retrofit projects. Called an efficiency services agreement (ESA), this contract was designed to address the challenges, or “pain points,” that building owners commonly face when contemplating such projects.

While many in the clean energy industry are familiar with the use of power purchase agreements (PPA) to finance solar energy systems at commercial and industrial facilities, many may be surprised to know that there is a similar contract for funding energy efficiency retrofit projects. Called an efficiency services agreement (ESA), this contract was designed to address the challenges, or “pain points,” that building owners commonly face when contemplating such projects.

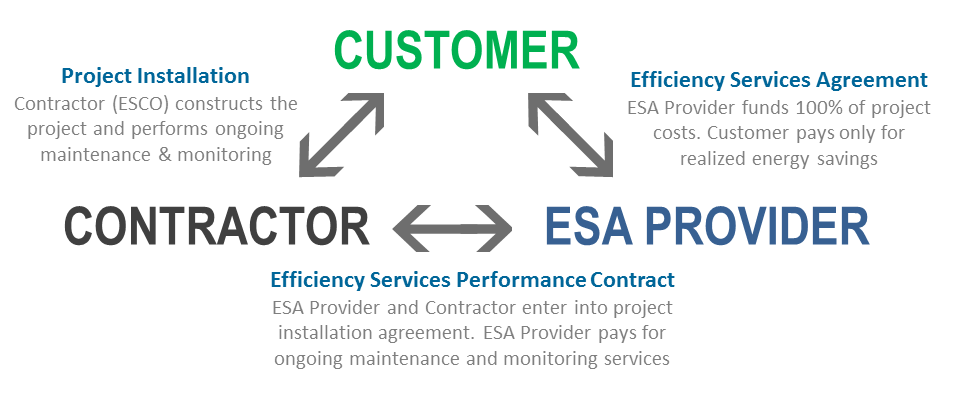

Like a PPA, an efficiency services agreement enables third-party ownership of a project, in which a developer designs, finances, implements, and owns a package of energy and water efficiency measures at a customer facility. In return for implementing the project, the ESA provider charges the customer for any realized savings, at a rate that is less than their current cost of electricity, gas, or water. This continues until the end of the contract period, typically 10 years, upon which time the customer can renew the contract or purchase the equipment at fair market value.

Pay-for-performance financing

The ESA is a pay-for-performance contract. If the efficiency project does not produce measurable and verifiable savings, the customer owes nothing. More fundamentally, ESAs allow energy and water efficiency to be valued and sold as a resource, much like wind or solar power.

Although building owners recognize the benefits of implementing multi-measure energy and water efficiency retrofits, their implementation in the commercial and industrial (C&I) market has been historically low. Most C&I building owners grapple with a common set of “pain points” as they attempt to plan, fund, and execute capital improvement projects. However, these pain points are often most acute when it comes to energy and water efficiency retrofits, conspiring to scuttle even the most well-designed project.

Challenges cited by customers

The list below includes eight pain points that C&I owners frequently cite when evaluating energy and water efficiency retrofit projects, as well as the specific ways in which ESAs address these challenges:

- The customer’s capital budget for facility improvements is constrained, due to competing needs for cash within the organization.

ESAs involve zero up-front capital from the customer. ESA providers fully finance the project using their own sources of capital and cover all ongoing operations and maintenance (O&M) costs.

- The customer is unable to assume the performance and/or financial risk associated with a large, integrated energy project.

ESA providers mitigate these risks for the customer by taking ownership of the assets and charging the customer only for realized energy savings.

- The customer must establish that energy savings have truly been realized.

ESA providers, with their contractor partners, use only the most sophisticated, transparent, and widely-accepted protocols for measurement and verification of energy savings.

- The customer lacks the time and resources necessary to undertake an integrated energy efficiency project.

ESA providers typically handle all project development activities including overseeing engineering and construction, project financing, and providing O&M services during the contract period.

- The building energy efficiency market is heavily fragmented with a wide array of technologies and service models to choose from, often leading to confusion and/or inaction on the customer side.

ESA providers manage project development, giving customers more time to focus on their core business. They also partner with leading contractors to ensure reliable and efficient engineering and construction of projects, including equipment selection.

- The customer is worried about the impact of financing an energy efficiency project on their balance sheet.

ESA payments often qualify as an operating expense for accounting purposes, avoiding any negative impact on the customer’s balance sheet. Since ESA providers fund projects using their own capital, the customer can reserve their credit capacity for core business needs.

- The customer is sensitive to rising energy prices.

ESAs provide customers with a partial hedge against rising energy prices by allowing them to lock in a known rate for a significant portion of their baseline energy consumption. Further, the rate is lower than the rate they currently pay.

- Customers who manage multiple facilities are hesitant to invest the time and energy to undertake a “one-off” project that can’t be easily scaled or replicated.

ESAs are structured to accommodate funding of multiple projects with different scopes across a portfolio of buildings.

To date, most of the initial customers utilizing ESAs have been large industrial or institutional customers. Organizations such as these tend to own and occupy a large campus or portfolio of facilities, allowing them to replicate their first ESA project across other buildings.

By directly addressing the most commonly cited “pain points” of customers, ESA providers turn energy and water efficiency into a resource that can be produced, measured, and sold in much the same way that PPA providers generate and sell solar or wind power.

Moreover, ESAs have the added benefit of helping customers upgrade their facilities from the inside out with new equipment and other improvements that are critical to their daily operations.

Image source: Dave Sanderling 2012-13