Resilience proceeding gives FERC a chance to advance gas-electric coordination

Last September, the U.S. Department of Energy (DOE) started a conversation on resilience, asking the Federal Energy Regulatory Commission (FERC) to provide new revenues and guaranteed profits to the owners of old, inefficient coal and nuclear power plants to compensate these resources for certain reliability and (undefined) resilience attributes.

Last September, the U.S. Department of Energy (DOE) started a conversation on resilience, asking the Federal Energy Regulatory Commission (FERC) to provide new revenues and guaranteed profits to the owners of old, inefficient coal and nuclear power plants to compensate these resources for certain reliability and (undefined) resilience attributes.

FERC swiftly disposed of that proposal in a January 8 order, finding that it was not warranted and would run counter to its pro-market regulatory model. FERC then asked all of the Regional Transmission Operators (RTOs) and Independent System Operators (ISOs) to explain how they are evaluating and addressing resilience within their respective markets.

The Gas – Electric Disconnect

While the RTO/ISO filings did not identify any immediate resilience threats, they did describe the growing disconnect between natural gas pipelines and the electric generators that have become the new largest users of the pipeline system:

- PJM detailed the current misalignment between the gas and electric markets, explaining that electric generators use the system in more variable ways than the traditional “steady” pipeline customers like local natural gas distribution companies. PJM asked FERC to encourage pipelines to develop additional services to meet the needs of electric generators.

- ISO-NE highlighted the findings of its January 2018 Operational Fuel Security Analysis, suggesting that it may face fuel security issues due to challenges in obtaining natural gas during constrained cold weather periods.

- CAISO acknowledged the gas-electric coordination challenges posed by the limited operability of the Aliso Canyon storage facility after a major 2015 leak.

Generators need significant flexibility from pipelines, but today’s pipeline rules typically assume that users will take gas in even amounts over throughout the day. The current rate design for new capacity requires customers to sign up for service for every day for the next 10 to 20 years, regardless of whether that service is needed or used.

That’s simply not compatible with the needs of competitive generators, who can’t recover these types of costs in their electric energy offers. Because generators do not have a business case for transacting directly with pipelines, they rely on the opaque secondary market to meet their needs.

One Size Doesn’t Fit All

All three RTO/ISO filings underscore the growing difficulty of ensuring fuel security, reliability, and resilience when the new largest users of the pipeline system (electric generators) do not directly contract with the pipelines they rely on to transport fuel.

The key attribute of our future energy system is flexibility. And flexibility is at the heart of resilience (it’s no coincidence that the dictionary includes “flexible” as a synonym for “resilient”).

FERC – which oversees both the gas and electric markets – has already recognized the importance of flexibility on the electric side, incorporating updates to its fast-start pricing rules, ramping products to compensate generators for their variability, and other more flexible service offerings. But the natural gas market rules have not been meaningfully updated since before natural gas surpassed coal as the chief electricity supplier.

EDF’s Solution Set

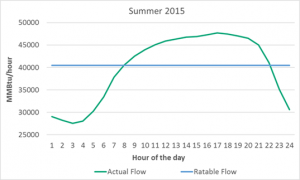

Today, EDF provided FERC with a set of recommended solutions to resolve this incompatibility, by proposing a new transactional structures between pipelines and generators. It starts with changing the way generators communicate their gas usage needs to pipelines (as shown below, these needs vary throughout the day):

At the North American Energy Standards Board’s Gas Electric Harmonization forum last year, we proposed a definition for a Shaped Nomination that allows customers to tell pipelines the specific quantities of gas they will use in each hour of a day, and suggested a standard for how a customer should communicate this information to the pipeline.

These new standards would lay the groundwork for valuing this service in pipeline tariffs. Incorporating a more granular, hourly structure would facilitate price transparency in the gas markets and lead to more informed investment signals. Meanwhile, electric generators could transact for and get next day, hourly flows that can be incorporated into their electricity offers.

Growing Momentum

DOE, the North American Electric Reliability Corporation, the National Academy of Science, the Electric Power Research Institute, and others all agree that enhanced gas-electric coordination would improve reliability and resiliency. Several pipelines have already incorporated these concepts into their tariffs and have detailed the operational and reliability benefits of offering more shaped flow services.

Taking action in this area is a logical extension of FERC’s past efforts to bring increased competition and transparency to the gas market. A recent analysis by Alison Silverstein, Rob Gramlich, and Michael Goggin suggests that enhanced gas-electric coordination would be highly valuable to customers.

To enhance grid resilience, FERC should encourage pipelines and generators to develop transactional structures to ensure gas market rules reflect contemporaneous market conditions. Progress towards a more reliable, customer responsive, and affordable energy system depends on it.