Greater Flexibility, Efficiency in Gas Markets Requires New Standards

Markets for electricity and natural gas in the U.S. grew up independently of one another. The rules in one do not always align with the rules in the other, creating challenges for both operators and regulators. Cumbersome inefficiencies are becoming more evident with the rapid evolution of the electric system. With more gas-fired power plants coming online, and the growing requirement to balance intermittent renewable sources on the electric grid, there is now a pressing need to synchronize these two markets. Fixing the disconnects means the two systems need a better framework for doing business with one another. The place where the markets meet is gas generators’ use of the nation’s pipeline system.

Markets for electricity and natural gas in the U.S. grew up independently of one another. The rules in one do not always align with the rules in the other, creating challenges for both operators and regulators. Cumbersome inefficiencies are becoming more evident with the rapid evolution of the electric system. With more gas-fired power plants coming online, and the growing requirement to balance intermittent renewable sources on the electric grid, there is now a pressing need to synchronize these two markets. Fixing the disconnects means the two systems need a better framework for doing business with one another. The place where the markets meet is gas generators’ use of the nation’s pipeline system.

Flexibility is Key

Pipelines primarily make money by selling firm (i.e., premium) transportation service. This type of service places value on one thing: moving gas from point A to point B. This market design means that pipelines have no commercial incentive to provide services that are actually needed by gas generators (they get paid regardless of how the capacity is used). The fuel supply needs of gas generators vary over the course of the day and therefore require pipelines to deliver gas on a more variable basis—a “smart” service far more valuable to power generators because they are paying for what they use, rather than for pipeline capacity. Furthermore, signing up for firm service is often too expensive for gas generators who don’t need the service on every day of the year and are not guaranteed recovery of these costs in the electric markets.

We’ve already seen this conflict come to a head with several pipeline projects. For example, the North American Electric Reliability Corporation’s 2016 Long-Term Reliability Assessment points out that the recent suspension of two major pipeline projects – Kinder Morgan’s Northeast Energy Direct and Algonquin’s (now Enbridge) Access Northeast – “demonstrates the need for regulatory solutions to facilitate electric generator commitments. This is particularly true for generation operating in wholesale electric markets.”

Synchronizing Two Independent Markets

The solution to these problems lies in developing a pipeline service that will be useful and economically beneficial to generators. Real world demand on the electric system requires generators to be nimble, and the gas flows they receive from pipelines should in turn be provided on a flexible basis.

But some outdated market rules are standing in the way. Take for example the pipeline tariff rule, which requires customers to take their natural gas evenly over the course of the day, in equal amounts each hour over a twenty four hour period. But this isn’t how generators burn gas to serve variable electric load. In addition to normal ups and downs throughout the day, these generators are often providers of grid reliability services and help smooth the intermittency of wind and solar resources.

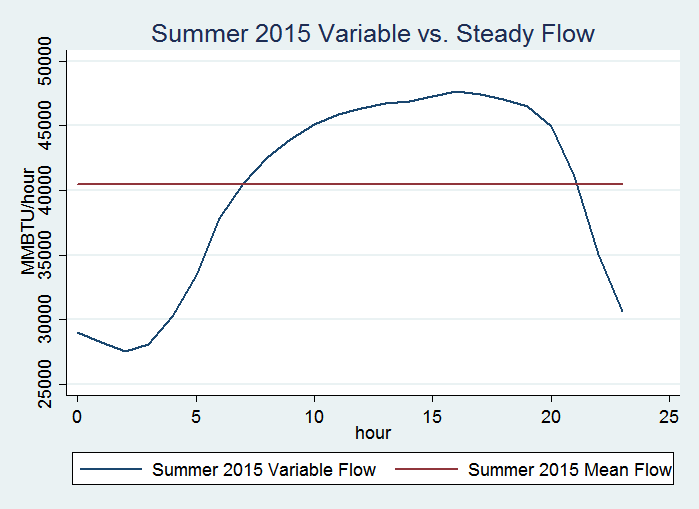

The graph below shows a visual representation of this conflict: the red line is the uniform, flat requirement that gas be delivered in even amounts, whereas the blue line shows how generators actually behave over the course of the day.

Defining the Curve

Pipelines sometimes try to meet the needs of their customers and provide gas on a more flexible basis. But there are no formal rules or language governing this, rendering transactions uneven and opaque. That’s why EDF has been participating in the Gas Electric Harmonization forum at the North American Energy Standards Board (NAESB), a non-profit organization that develops standards for the gas and electric industries.

EDF proposed a definition for a “Shaped Nomination,” which allows a customer to provide to a pipeline the specific quantities of gas it will use in each hour over the course of a day, and suggested a standard for how a customer should communicate this information to the pipeline. Earlier this year, four out of five of NAESB’s segments (i.e., 80% of industry), voted in favor of the proposal. Because local distribution companies voted against it, however, they were able to block the proposal.

Ultimate authority over market design, however, rests with the Federal Energy Regulatory Commission (FERC), which can choose whether or not to follow NAESB recommendations. So now it’s up to FERC to address the definition and standard. NAESB told FERC it “looks forward to responding to any guidance provided by the Commission.” The industry as a whole would benefit from this guidance, particularly because all segments of NAESB except for one voted to move forward with the proposal.

Next Steps

If FERC decides to move forward, the definition and standard will bring much-needed clarity and transparency to the natural gas and electricity markets. The definition and standard will enhance efficiency by providing a transactional structure and means of communicating a Shaped Nomination. This would be an important first step in developing a more robust market for flexible pipeline services, which is critical for a more reliable, efficient, and cost-effective operation of the grid.

Image source: Wikimedia Commons