Yesterday, the Southern California Gas Company filed for permission to resume operations through approved wells at its Aliso Canyon gas storage facility, saying it has completed key safety tests. The facility has been offline over the last year, after it sprung one of the largest gas leaks ever recorded.

Yesterday, the Southern California Gas Company filed for permission to resume operations through approved wells at its Aliso Canyon gas storage facility, saying it has completed key safety tests. The facility has been offline over the last year, after it sprung one of the largest gas leaks ever recorded.

Efforts to bring the facility online – and the challenges for the region’s electricity system if Aliso stays offline – underscore the need to address these issues from a broader, longer term perspective.

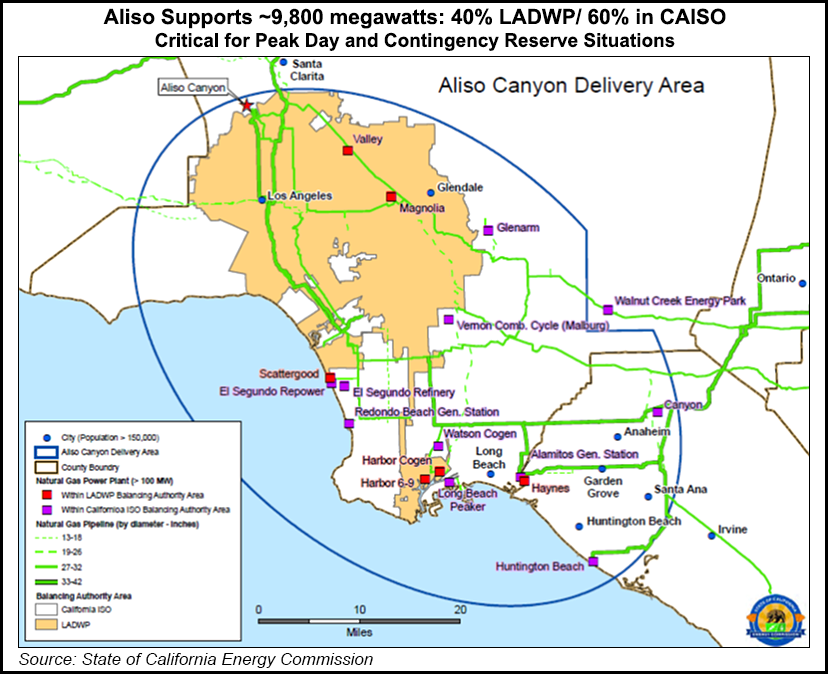

In addition to supplying gas to homes and businesses, the giant storage field served 17 major gas fired electric generating plants in the region. When a link as important as Aliso Canyon fails, the reliability implications for the electric grid are serious.

Despite official warnings of blackouts, California did not experience any serious electric reliability threats over the summer, thanks to the California Independent System Operator (CAISO) – the entity responsible for keeping the lights on in California – and other agencies, as well as relatively favorable weather and system conditions. But winter could bring new spikes in demand, which means we’re not out of the woods yet.

Electric Generation Plants Served by Aliso Canyon

Short Term Fixes vs. Long Term Solutions

CAISO’s main focus in the immediate aftermath of the Aliso Canyon leak was on short-term reliability, which is understandable. But now that a year has passed, the focus must shift to the long term. CAISO is seeking approval from the Federal Energy Regulatory Commission (FERC) to extend most of its short term measures to address summer 2016 reliability concerns through November 2017.

This means that, subject to FERC approval, short term responses developed through an expedited stakeholder process and intended as temporary measures, are taking on the character of California’s longer term response to the Aliso Canyon incident. The good news is that CAISO has recently announced plans to evaluate certain market design features and consider long term responses to the Aliso Canyon leak through stakeholder processes.

But more needs to be done. And it’s important to start addressing these market gaps now.

Integrating Complex, Shifting Needs

For starters, there is no quick resolution in the cards. Although SoCalGas is asking for permission to restart some operations, Aliso Canyon is unlikely to be returned to historic levels of functionality in the near future. In fact, it may be permanently limited because of regulatory changes.

In addition, California’s gas storage regulatory landscape is poised to change dramatically. The state’s Division of Oil and Gas and Geothermal Resources is formulating new rules for gas storage facilities. Recent legislation, like SB 887, will also increase regulatory oversight of these facilities. CAISO must consider and respond to these developments, so that electric reliability continues to be maintained.

Other agencies have already started considering broader questions. The California Council on Science and Technology is developing a study on the long term viability of gas storage. A federal interagency task force has just issued critical recommendations to reduce the risk of incidents like the Aliso Canyon leak. This broader discussion is incomplete without considering underlying CAISO market design gaps.

The Need for Better Gas Electric Coordination

A key lesson from the Aliso Canyon incident is the risks of overreliance on gas storage. These risks are exacerbated by the misalignment between the timing of the electric and gas markets.

The basic challenge is that gas fired generators are required to determine how much gas they need before receiving electric dispatch orders from CAISO. California generators schedule their gas for the following day before they bid into CAISO’s day ahead electricity market. Because generators must schedule gas supply before they receive electricity dispatch awards from CAISO, they’re effectively forced to guess their gas needs, increasing the likelihood of imbalance.

Imbalance refers to the difference between how much gas a shipper causes to be delivered into the pipeline relative to how much gas is actually burned by that shipper. Shippers are required to maintain imbalances within a certain band called a tolerance band. When trading imbalances with other shippers isn’t feasible, shippers often depend on storage withdrawals or injections to adhere to the tolerance band, increasing reliance on gas storage facilities like Aliso Canyon.

Getting the Markets Right

The federal interagency report recommends that the timing of information relating to energy bidding and/or gas nomination processes be improved to enhance coordination between the gas and electric systems. CAISO’s position is that the costs of implementing changes needed to better align gas and electric market schedules outweigh the benefits.

But this remains a subjective, qualitative assessment that is not backed by hard numbers. A quantitative analysis would allow CAISO to verify if its assessment is supported by data.

CAISO must also address market gaps relating to price formation. When generating resources aren’t properly compensated to reflect the value of their services to the grid, price signals will be distorted, preventing the right levels of investment in resources needed by the electric grid.

CAISO’s current market design doesn’t allow generators to reflect sub-day variations in fuel costs in their market bids, muting price signals reflecting the true costs of gas fired generation. It also doesn’t allow generators’ actual costs of gas procurement to be reflected in their market bids (a gas price index is used to calculate fuel costs), thereby obscuring price signals in the wholesale electric market.

The Road Ahead

Fixing these and other gaps in CAISO markets would go a long way to addressing the reliability issues raised by the Aliso Canyon incident, and help reduce overreliance on gas storage. If there’s a good time to consider the longer term implications of Aliso Canyon’s limited operability and the underlying market design gaps, it is now. Focusing on these issues is critically important given California’s vision of a cleaner, more renewable electric grid.