Chasing Red Herring On The Wind

The saying goes that hunters used smoked red herrings to train their dogs, trying to throw them off the scent of the hunt with something that has a much stronger and tempting smell but ultimately wasn’t the real target. This is quite similar to recent discussions about resource adequacy – now that it’s become clear that the EPA isn’t the reason for power plants shutting down, some seem more focused on finding another scapegoat rather than addressing the real problems in the market.

The saying goes that hunters used smoked red herrings to train their dogs, trying to throw them off the scent of the hunt with something that has a much stronger and tempting smell but ultimately wasn’t the real target. This is quite similar to recent discussions about resource adequacy – now that it’s become clear that the EPA isn’t the reason for power plants shutting down, some seem more focused on finding another scapegoat rather than addressing the real problems in the market.

There was a time, not too long ago, when the low marginal costs of technologies like wind and solar power were seen as a good thing. In 2009 the Public Utility Commission (PUC) said “renewable generation has reduced wholesale and retail energy prices during some periods and has been instrumental in moderating price increases during periods in which the cost of natural gas was increasing.” Back then, this was seen as a good thing because there was a need for a moderating influence on high natural gas prices at the time.

Times have changed though, and lately PUC commissioners have taken to blaming wind energy for their current troubles, even when their own paid experts tell them otherwise. In a Senate Natural Resources hearing last week, PUC Chairman Nelson stated that “the market distortions caused by renewable energy incentives are one of the primary causes, I believe, of our current resource adequacy issues.”

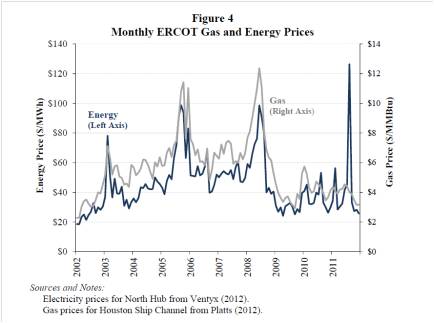

The problem with this claim is that it isn’t supported by the facts, and most industry experts agree that the real problem (if you want to call low energy prices a problem) is a combination of a market structure in need of reform and consistently low natural gas prices. In the Brattle Group’s report on resource adequacy issues in ERCOT they make a pretty strong case that gas, not wind, is responsible for setting the bulk of market prices. Perhaps the best way to look at it is this chart showing how electric rates lined up with gas prices over the last decade.

This simple correlation isn’t the only area where reality conflicts with those who seek to blame wind for our current market problems. The Brattle Report also found that negative prices from wind (the “market distortions” Nelson refers to) “have largely been confined to the ERCOT’s West Zone, while the other 3 zones have not had more than 0.4 percent of hours with negative prices.” 0.4 doesn’t really sound like a primary cause, although the report does note that the West Zone experiences negative prices for 8-9 percent of the hours in 2011. Even that statistic belies the fact that in reality the impact of negative prices is far smaller, since over 90 percent of non-wind the power plants in ERCOT are built outside of the West Zone.

What this really means is that for 90 percent of the non-wind capacity in ERCOT, they experience negative prices resulting from wind 0.4 percent of the time. That might influence an investment decision for a new power plant in ERCOT, but it pales in comparison to the impact of natural gas prices which have fallen 53 percent since their peak in 2008. The Brattle Group isn’t the only market expert with this viewpoint: ERCOT’s Independent Market Monitor found in their most recent “State of the Market” report that coal and gas set the marginal price of energy somewhere around 90 percent of the time, meaning that 90 percent of the prices influencing investment decisions are set by coal and natural gas, not wind.

The danger here is that we run the risk of falling into a familiar trap, but this time on different sides: the PUC has historically refused to act on the 500 megawatt Renewable Portfolio Standard out of concern that it would drive rates too high, but now apparently the concern is that it drives rates too low. The problems that the PUC and ERCOT face are very serious, and meaningful market reforms are in fact needed, but the reforms should be based on what the market needs: smarter, faster, automated resources in areas with congestion and peak demand problems. Blaming a specific technology, especially one which the evidence overwhelmingly shows is not responsible for our current troubles only distracts from efforts to solve the underlying problem. Let’s stay on the hunt for a meaningful solution and not go chasing after a red herring.