4 signs of a growing U.S. supply chain for zero-emission trucks and buses

Transitioning to zero-emission trucks and buses is necessary for both climate stability and to protect communities from air pollution. With nearly 23 million diesel-fueled medium and heavy duty trucks and buses operating on roads today in the U.S., moving to zero-emission technology will result in significant investments in manufacturing, infrastructure, operations and maintenance training, research and development and midlife vehicle businesses.

Transitioning to zero-emission trucks and buses is necessary for both climate stability and to protect communities from air pollution. With nearly 23 million diesel-fueled medium and heavy duty trucks and buses operating on roads today in the U.S., moving to zero-emission technology will result in significant investments in manufacturing, infrastructure, operations and maintenance training, research and development and midlife vehicle businesses.

According to an analysis conducted by EDF and the consulting firm PwC, a significant amount of investments in the electric truck and bus supply chain has already taken place — yielding a strong and growing domestic supply chain for zero-emissions medium- and heavy-duty vehicles. Amidst the findings by EDF and PwC, four indicators stand out most:

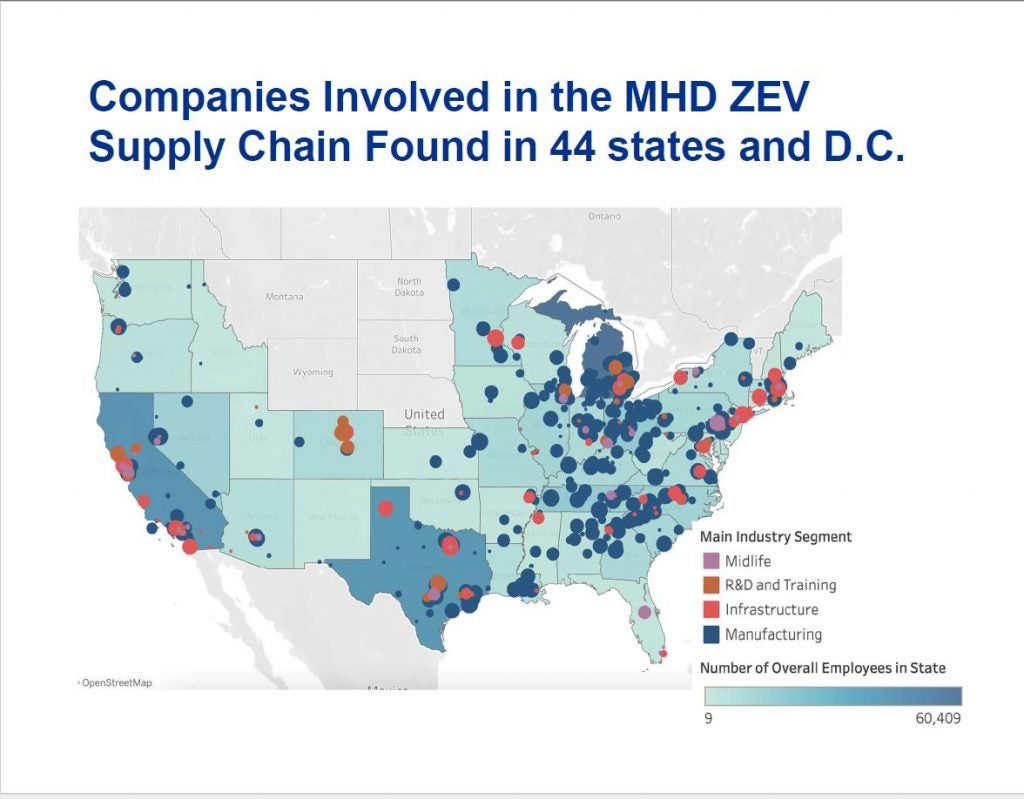

1. The market is geographically diverse — touching nearly all corners of the U.S. economy

According to the study, 375 discrete companies were found to be involved in the zero-emission truck and bus supply chain — operating in over 1,000 business locations, and present in 44 out of 50 states. Further, at least 20 states have 10 or more company locations involved in the zero-emission supply chain. These businesses include both new and existing locations, and many that are expanding or modifying their operations to provide zero-emission equipment.

2. $42 billion and counting in announced corporate investments

Based on a review of public corporate statements and filings, and industry analyses, EDF and PwC found U.S.-based corporate investments in zero-emission technology totaling over $42 billion since Tesla first announced its battery gigafactory 2014. Additionally, according to the analysis, at least 22 states have been home to over $100 million in announced corporate investments.

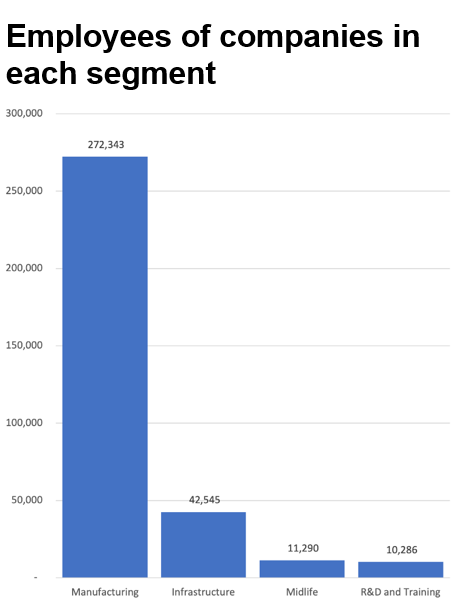

New study: Four signs of a growing U.S. supply chain for zero-emission trucks and buses Share on X3. Investments in zero-emission trucks and buses support vast numbers of workers, mostly in manufacturing and infrastructure

While investments in zero-emission technology certainly presents an opportunity for companies to make money, these investments also create and supports jobs. According to EDF and PwC, nearly 336,000 workers are located at company locations across the U.S., with Michigan, California and Texas having the most. There are also at least 8 states with businesses in the supply chain employing over 10,000 people, and 35 states with over 1,000 workers at these businesses. Of the 336,000 workers, over 80% were located at companies involved in the manufacturing part of the supply chain.

4. Companies in the zero-emission supply chain are present in over half of the U.S. congressional districts, demonstrating the broad value of additional support for the sector

One of the major needs for continued growth in the zero-emission vehicle sector is the establishment of durable state and federal public policy signals that promote additional corporate investment, make it easier to buy and operate the vehicles, and ensure sufficient infrastructure can support rapid and vast deployment. According to the analysis, supply chain businesses were found in 285 of the U.S. congressional districts, with districts in California and Michigan leading the way. Additionally, 11 congressional districts were found to have been home to over $1 billion in announced investments across a wide array of states.

These four factors indicate a strong and growing market for zero-emission trucks and buses. While many other indicators can be pulled from the EDF and PwC report, the information should also be paired with recent analyses demonstrating a rapid increase in vehicle model availability and manufacturer commitments. When combined, the data and facts clearly demonstrate that a transition to zero-emission trucks and buses presents a compelling need and opportunity for communities and companies across the U.S.