Canada’s Methane Opportunity and Canadian Jobs Hinge on Strong Alberta Implementation of Federal Methane Rules

The recently approved federal methane rules could create 34,000 jobs and recover billions in wasted gas. Alberta’s participation is the key to unlocking the full opportunity for every province.

This post is authored by Environmental Defense Fund economist Luis Fernández Intriago; Senior Campaign Manager, Canada, Ari Pottens; Manager of Economics and Policy, Christine Gerbode, and University of Waterloo Professor, Juan Moreno-Cruz.

Canada stands at a crossroads. The federal government’s new methane regulations offer a clear path to economic growth, cleaner air, and global competitiveness. Our previous analysis shows they could create approximately 34,000 jobs nationwide and recover billions of dollars in natural gas that currently escapes into the atmosphere.

Alberta, home to over half of Canada’s oil and gas activity, is uniquely positioned to drive the success of these new rules, but its role is still uncertain. In November, Alberta and the federal government laid out a delayed timeline for the province’s methane goals, signing a MOU just weeks before the more ambitious national timelines and targets were finalized. This raises two questions: how will the rules be implemented for Alberta, and will the province embrace the full opportunity of this policy moment?

Canada cannot meet its methane goals without Alberta on board. The province has the largest share of regulated methane-emitting facilities, the largest concentration of skilled energy workers, and over half of Canada’s methane mitigation firm locations within its borders. Alberta’s economy also stands to benefit enormously from developing its own strong regulation that will deliver the same outcomes as the new federal rule. When the country’s largest producing province moves forward, it creates the market scale that domestic mitigation manufacturers need, the regulatory certainty that investors require, and a credible international signal that Canada’s gas meets the climate standards that global buyers increasingly demand.

The Race for Global Market Leadership Has Already Begun

The world is moving toward differentiated gas markets. Europe’s 2030 import standards will require natural gas to come from verified low-emitting sources, and major Asian buyers are increasingly seeking transparency in methane emissions linked to their fuel purchases.

This market shift isn’t a distant hypothetical—it’s happening now, and Canada’s competitors aren’t waiting. Every year without a unified Canadian standard is a year that low-emissions competitors will lock in customers, build relationships, and establish reputations. Once buyers commit to long-term supply contracts with other producers, winning them back becomes exponentially harder.

Canadians have already built critical infrastructure needed to meet this global leadership challenge: a robust domestic methane mitigation industry. A recent inventory found 136 Canadian companies—81 manufacturers and 55 service providers—offering the equipment and expertise needed to cut methane emissions. Most are small and medium-sized businesses, many based or officing in Alberta itself.

A strong domestic market, driven by a boost in demand from the federal framework, would enable these companies to refine their products, train workers, and build the track record that opens international doors. As Canada’s largest producer, Alberta represents the largest potential customer base for these firms. If the federal government requires Alberta to achieve a 72% reduction by 2030, as all provinces are required to do, it would position the province as the anchor market for this growing national industry with international expansion potential. In an era when oil and gas jobs are decreasing even as production rises, this innovative nascent sector could provide well-paying transition pathways for Alberta’s energy sector employees.

If Action Is Delayed, Gas Revenue and Jobs Will Vanish

Methane is the primary component of natural gas, a commodity with real market value. When it leaks from wells, pipelines, and processing facilities, that value literally disappears into thin air. Analysis by EDF previously found that Alberta’s methane emissions represented over $670 million CAD in lost natural gas revenue in a single year, including over $120 million in uncollected royalties and corporate taxes. That’s gas that could have been captured and sold, generating income for producers and revenue for the provincial government

The Pembina Institute estimates that a special 5-year delay for Alberta would result in 1.9 million tonnes of additional methane entering the atmosphere. That’s lost revenue that could be working for Alberta – and it will keep vanishing into the atmosphere until the province acts.

Jobs Delayed Are Opportunities Lost

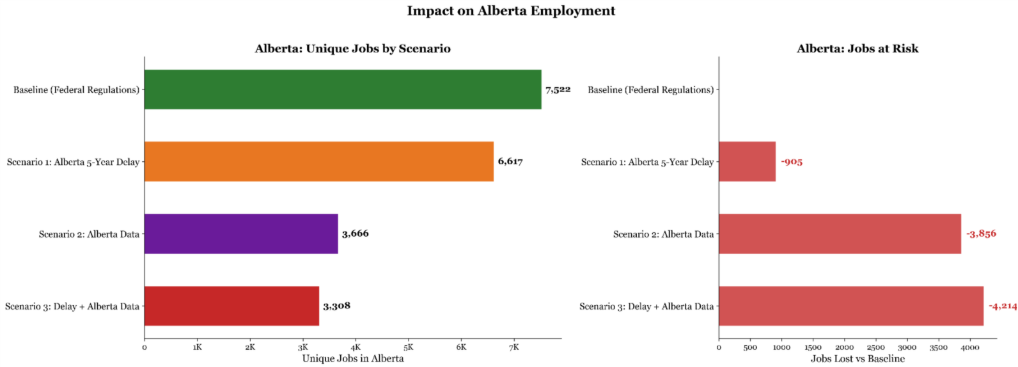

Under full implementation of the new rules on the planned federal timeline, our previous analysis shows that Alberta would see approximately 7,522 unique jobs created, the most of any province. But recent developments could put a portion of these jobs at risk. The November 2025 Canada-Alberta Memorandum of Understanding established a 2035 target date for Alberta to reduce its emissions by 75%. These targets are less ambitious than those laid out in the new federal regulations, which are estimated to achieve a 72% reduction by 2030 and which apply nationwide.

Delays could also come from more subtle changes. For example, the Canadian Association of Petroleum Producers (CAPP) has advocated for using provincial emissions estimates, which are lower than federal estimates, as the basis for compliance targets in equivalency negotiations. Recent measurement-based study of Alberta’s upstream oil and gas emissions have consistently found actual emissions approximately 60% higher than provincial inventory estimates. If compliance targets are set using the lower provincial figures, Alberta could meet the same percentage reduction on paper while requiring significantly less actual mitigation, and generating far fewer jobs. For the purpose of this analysis, we do not take a position here on whether federal or provincial emissions estimates are more accurate; we quantify the employment consequences of the choice, as one target would be more stringent than the other.

We modeled three scenarios to understand the employment implications:

- Scenario 1 — Five-year delay: If Alberta shifts its compliance timeline by five years, approximately 905 unique jobs in Alberta would be lost within the 2027–2040 analysis window.

- Scenario 2 — Reduced stringency: If compliance targets are based on lower provincial emissions estimates rather than federal ones, Alberta would lose approximately 3,856 unique jobs. Lower estimated emissions mean less abatement is required, which translates directly into less compliance spending and fewer employment opportunities.

- Scenario 3 — Combined: If Alberta both delays implementation and operates under reduced stringency, the province would lose approximately 4,214 unique jobs— nearly 56% of the 7,522 positions the federal regulations would create.

These job losses are not simply deferred — many may never materialize. A five-year delay means five fewer years of employment for Alberta workers, job-years that cannot be recovered by accelerating compliance later. But the consequences go beyond timing. Delay shrinks the domestic market that Canadian mitigation companies need to scale, narrows the window to establish Canada’s reputation in increasingly competitive global gas markets, and risks triggering a provincial race to the bottom that further fragments demand. When the ecosystem needed to create these jobs erodes, the jobs erode with it.

Today’s Delays Become Tomorrow’s Problem

A delay in implementing the new standards would also create a growing liability for Alberta. The longer implementing the rules is delayed, the more non-compliant infrastructure operators and regulators will have to deal with a few years down the line—and the more costly eventual compliance may become. Building infrastructure the right way now is almost always cheaper than paying to fix or replace it later.

Provincial fragmentation also creates investment uncertainty. Canada’s federal system allows for provincial equivalency agreements—if a province implements regulations that can achieve equivalent outcomes, federal rules stand down. This flexibility can enable tailored approaches that work for regional circumstances. But that same flexibility can also create a race to the bottom. If Alberta secures a major delay or weaker standards, other provinces may follow suit, creating a patchwork of lower-ambition timelines and standards that fail to add up to national goals. This uncertainty and reduced demand would make it harder for investors to make decisions, as well as for Canada’s young domestic methane mitigation companies to thrive, while also rendering Canadian energy less competitive as compared to cleaner alternatives – the exact opposite of what Canada’s new Climate Competitiveness Strategy hopes to achieve.

Methane regulations also aren’t only about climate change or lost revenue. Reducing methane also protects local air from compounds that damage the health of Alberta’s rural communities. The proposed federal regulations would prevent the release of 1.5 million metric tons of VOCs between 2027 and 2040. As Canada’s largest producer, Alberta bears the brunt of this pollution. A 2025 study from St. Francis Xavier University found an estimated 13% of the province’s population are living within 1.5 kilometers of an active well. The same study found that residents living within this “threat radius” – disproportionately rural Albertans, as well as Indigenous communities – face a 9% to 21% higher risk of cardiovascular or respiratory issues. Delay means these communities keep breathing polluted air while regulators negotiate.

What Kind of Energy Producer Do Canada and Alberta Want to Be?

The global energy transition is not a question of “if”, but of “when” and “how.” Countries and producers that position themselves early as suppliers of low-emission energy will thrive. Those that cling to high-emission production will find their markets shrinking and their products discounted – all while racking up lost revenue, missed job growth, and health harms.

Our findings reinforce an important point: Alberta has more to gain from strong, timely implementation of methane regulations than any other province, from jobs, recovered revenue, and the opportunity to anchor an innovative new global industry. Full participation in the federal framework is not a concession; it is Alberta choosing to claim the largest share of a national economic opportunity.

Canada has the resources, the technology, and the talent to lead globally. What’s missing is the commitment to move forward together. Alberta’s leadership on methane doesn’t just matter for national success— it matters for Alberta itself. The question isn’t whether Alberta can afford to act; the question is whether Alberta can afford to wait.