One person’s cost, another’s opportunity

Transitioning into a new, low-carbon energy future costs money. No doubt about it. Yet the flip-side of cost is opportunity.

Pew just released a new study on Global Clean Power: A $2.3 Trillion Opportunity. Is this just a smart attempt at rebranding the inevitable, or is there more behind this?

Costs now, savings later

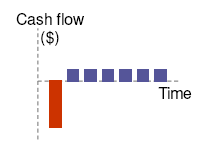

First, a quick qualifier on costs. Yes, investing in low-carbon technology costs money upfront. It’s also true, though, that many investments in clean technology reap savings later.

First, a quick qualifier on costs. Yes, investing in low-carbon technology costs money upfront. It’s also true, though, that many investments in clean technology reap savings later.

The up-front capital expenditures for wind, solar, nuclear, and other low-carbon technologies are large. But operating costs are much cheaper than using fossils fuels (and I’m not even including the costs of climate change from carbon emissions, which have long been socialized).

That still doesn’t make the transition a freebie, but it makes it much cheaper over time. McKinsey has run the numbers. Global net incremental capital expenditures for a clean energy future are significantly lower than upfront capital investments, once we consider operational cost savings.

That still doesn’t make the transition a freebie, but it makes it much cheaper over time. McKinsey has run the numbers. Global net incremental capital expenditures for a clean energy future are significantly lower than upfront capital investments, once we consider operational cost savings.

These operational cost savings could, in fact, be called “opportunities.” But that’s not what the Pew report has in mind. It refers to the actual costs.

Cost = Opportunity ?

Higher costs imply more money changing hands. So costs do, in fact, equal opportunities in a very real sense for anyone on the receiving end of the transaction.

If you decide which career to pursue, you may well want to opt for renewables instead of, say, petroleum engineering. Your chance of landing a job is much greater. The former will add many more jobs in the foreseeable future. And once you are in a particular industry, you want as much money to come your way as possible. (Of course, a scarcity of petroleum engineers would imply a salary premium for the few who do opt to study a 19th century technology.)

That is different from society’s and especially the government’s perspective, where cost minimization is de rigueur. That’s also what makes market incentives—a cap on carbon emissions—so crucial: it unleashes private investment dollars without government spending.

Investment + Recession = Opportunity

But even the social picture changes completely once we find ourselves in a situation we are in right now.

In a recession, with lots of spare capacity and industry literally sitting on $1 trillion in idle cash, creating incentives for more spending is exactly what we want to do as a society.

Investing in renewable energy, of course, has the added benefit that it also comes with an enormous social benefit—by decreasing the now socialized costs of carbon emissions. That’s one cost we definitely want to avoid.