Methane mitigation: To stay competitive, Louisiana must meet the demand for cleaner energy

Louisiana’s state and federal lawmakers recognize the energy landscape is changing and see the opportunity to leverage the state’s long history in fossil fuel extraction, transportation and processing to attract investment in the booming climate technology sector.

Ranking high on this list of global shifts is the growing scrutiny of methane emissions from the oil and gas industry and their disastrous impact on the climate. The European Union, the world’s largest importer of fossil fuels, has adopted legislation to reduce methane pollution from fossil energy production. Once fully implemented, the rules will also require methane emissions reporting and compliance with intensity standards for imported fossil fuels, including liquified natural gas. In addition, Japan and South Korea (also large importers of natural gas) have formed the Coalition for LNG Emissions Abatement toward Net Zero (the CLEAN Initiative) that requires LNG exporters to disclose their supply chain emissions and methane abatement practices prior to selling to coalition member buyers. Global gas markets are demanding better methane performance from providers. As the world’s largest LNG exporter, the U.S. — and major producing states such as Louisiana — will fall behind if methane emissions are not curbed significantly.

Methane mitigation: To stay competitive, Louisiana must meet the demand for cleaner energy Share on XLouisiana is home to nearly 60% of the U.S.’s current liquified natural gas, or LNG, export capacity. More expansion is planned, yet deeply opposed by many directly impacted communities due to the ongoing health, environmental and climate impacts. As the U.S. and the world works to transition to zero-carbon sources of energy, we must also drastically reduce all of the pollution associated with the fossil fuels we continue to use during this transition, to address the disproportionate burden these communities bear and slow the rate of global warming.

The good news is that Louisiana can reduce these impacts and stay competitive as the market evolves by cutting methane waste through speedy implementation of the U.S. EPA methane rule. In addition to the health and climate benefits, meeting domestic standards for methane emissions has meaningful economic implications for the state and beyond.

Global markets dynamics demand improved methane performance

Major players in global energy markets are increasingly demanding more transparency of supply chain greenhouse gas emissions and lower emission intensity oil and gas.

As stated above, the European Union finalized legislation earlier this year to cut methane emissions from its own energy sector, and critically, from its imports and their supply chains. EU’s new methane regulations will be phased in over several years, with several key details yet to be established, but importers are working to improve their measurement and reporting of methane emissions and how to improve their production and transportation practices to minimize those emissions in order to comply with these coming requirements.

Looking East, governments and gas consumers in Japan and South Korea, the world’s second and third largest LNG importers, respectively, are undertaking similar efforts to collaboratively use their buying power to gather data on emissions from suppliers and accelerate methane mitigation activities. Earlier this month, more than twenty companies joined an expansion of Japan and South Korea’s CLEAN Initiative, a public-private partnership collectively representing 25% of global demand for LNG, aimed at reducing the LNG supply chain’s methane footprint through transparency and cooperation.

Additionally, a growing number of investors are recognizing the fundamental financial risk that methane emissions pose the oil and gas industry and are beginning to incorporate methane-related metrics in their investment decisions.

Louisiana’s methane emissions challenge

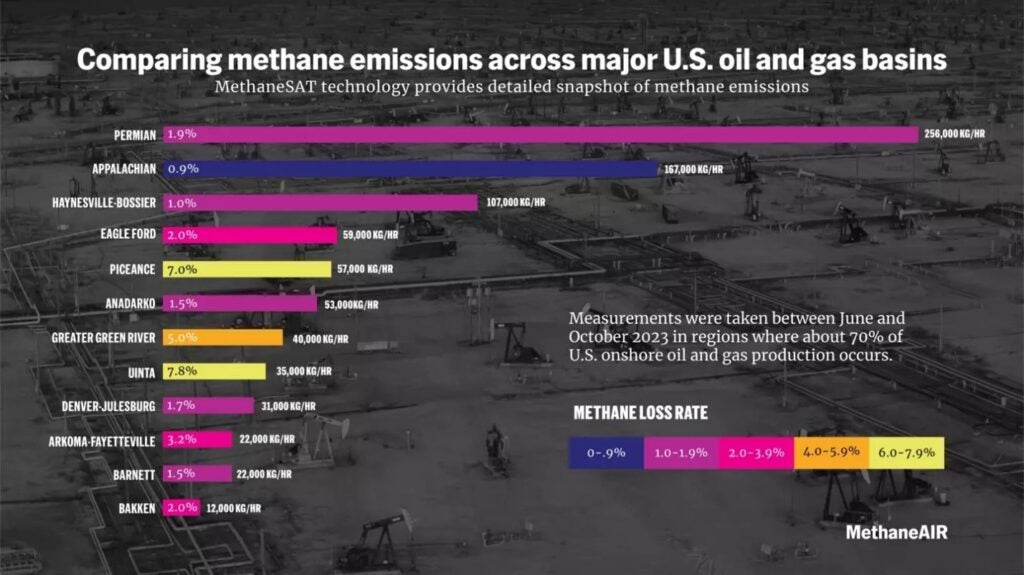

Comprehensive aerial measurements of the United States’ major production basins show that methane emissions in the Haynesville-Bossier basin in Louisiana and East Texas are unacceptably high. Based on EDF’s recent MethaneAIR surveys, Haynesville is the third highest emitting basin in the country, with a staggering loss rate of five times the industry target.

In 2019 alone, Louisiana’s oil and gas operators wasted $82 million of gas through venting, leaks, and flaring, an amount of gas equal to well over two-thirds of all residential gas consumption in Louisiana. And operators avoid paying taxes and royalties on wasted gas so state and federal governments lose out on revenue. The 27.2 billion cubic feet lost in 2019 translated into $2.5 million in lost revenue for state and federal governments.

Drastically reducing these emissions will have immense climate and public health benefits and allow producers and exporters to maintain access to global markets increasingly demanding cleaner energy products while creating Louisiana jobs in the methane mitigation industry and increasing revenue for Louisiana communities. A key feature of global efforts to clean up supply chains is increased transparency into the emissions associated with the production and transportation of imported oil and gas. Powerful new tools like MethaneSAT and global accountability frameworks will bring new, radically transparent visibility into whether the industry is making good on pledges to minimize harmful methane emissions in their operations and whether regulators are adequately addressing the industry’s emissions.

Thankfully, regulators across the country have been working hard to understand and regulate the industry’s methane emissions. This year, EPA finalized commonsense standards to control methane and other harmful pollution from the oil and gas production and transportation sectors. These rules enjoyed historic support from the oil and gas industry, portions of which have acknowledged for years that near-zero methane emissions are critical for the industry’s future.

What’s in it for Louisiana?

In addition to resounding climate and health benefits, investing in methane mitigation is a pragmatic step to help ensure Louisiana’s future and economic competitiveness in the traditional energy sector during an energy transformation. Louisiana is the country’s third largest producer of natural gas and chief exporter of LNG. It is imperative that industry and regulators in the state grapple with the sector’s upstream methane emissions not only so communities and our climate aren’t left behind with the pollution but also because global markets are demanding it.

Louisiana has the opportunity to develop its own program to rein in the oil and gas industry’s methane emissions. The state has already begun that critical work by tightening rules around venting and flaring, amending its oil and gas permit to incorporate the EPA’s standards for new sources and standing up a program to help operators plug end-of-life wells that can emit disproportionally large amounts of methane. Next, Louisiana’s regulators must develop strong rules to cut methane waste and pollution from existing facilities, ensuring that all operators are minimizing their methane emissions through common-sense requirements like regular leak detection and repair and replacing outdated, intentionally polluting equipment with modern, zero-emitting devices.

Failure to create this clear pathway for broad methane emissions reductions in Louisiana’s oil and gas industry could hinder future access to global markets and put its producers at a competitive disadvantage to those in states taking on the methane challenge. Meanwhile, communities will continue to be impacted by pollution until EPA develops, issues, and enforces a federal plan for sources in the state. Strong and comprehensive regulations can benefit oil and gas producers and exporters, Louisiana’s climate, and frontline communities.

There is a clear opportunity to help industry transition to a cleaner and more efficient energy system while fighting climate change and protecting public health. The question is, will Louisiana take it?