New study charts medium- and heavy-duty charging needs for 18 states and Washington, D.C.

By Michael Zimmerman and Neda Deylami

The market for electric medium- and heavy-duty vehicles in the U.S. is rapidly expanding. As of October 2024, 11 states have adopted the Advanced Clean Trucks rule, which requires manufacturers to produce increasing amounts of zero-emission MHDVs, and more are considering adopting this standard. Key policies like the ACT will be essential to ensuring customers’ access to zero-emission trucks and buses.

But what level of charging infrastructure investment will be needed to support the sales targets in the ACT? To help answer this question, EDF retained Atlas Public Policy to model, for 18 states plus the District of Columbia, the number of charging ports that would be needed in each state to meet ACT targets through 2032.

New study charts medium- and heavy-duty charging needs for 18 states and Washington, D.C. Share on XThe study’s results add to the significant documentation on the feasibility of the ACT. The study demonstrates that the annual build out of charging infrastructure to support ACT will be modest. This finding is consistent with a previous report from the Analysis Group that examined charging port implications of U.S. EPA Phase 3 greenhouse gas standards for heavy-duty vehicles.

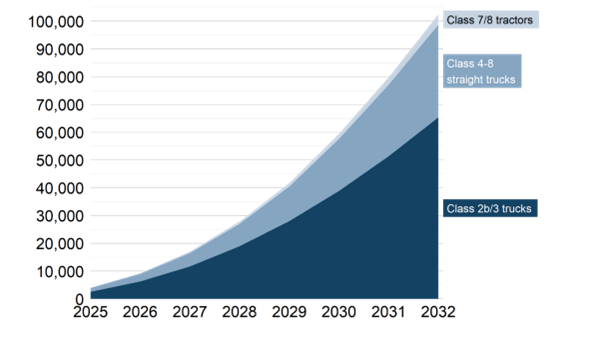

For example, take New Jersey. The study shows that the ACT could result in approximately 103,000 electric MHDVs in New Jersey by 2032, ultimately making up 10-16% of trucks and buses on the road.

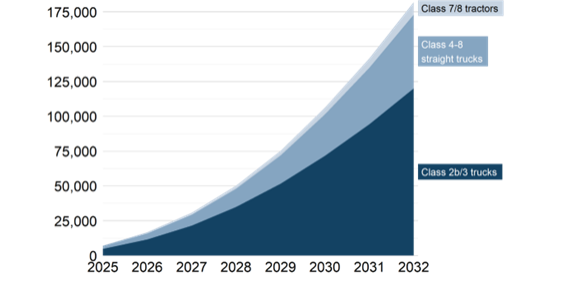

Similarly, Pennsylvania could see about 7-15% penetration of electric trucks and buses:

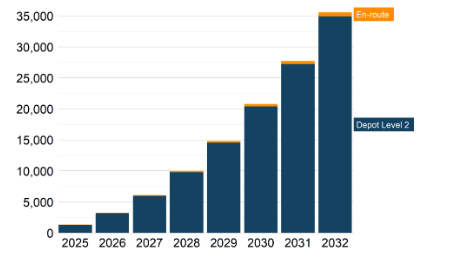

These first fleets to electrify will be those for which electrification makes the most business sense. The vast majority of these vehicles will be class 3 or smaller vehicles, such as cargo vans, based at depots with significant dwell period and travel predictable short- and medium-length routes. Level 2 charging, which is relatively low power, will meet much of this charging needs.

En-route and high-power charging stations will make up a relatively small proportion of the state’s charging needs for these vehicles.

To illustrate: the study suggests that class 2b and 3 vehicles in New Jersey, such as last-mile delivery vans, will need about 80 new en-route fast charging ports added each year — compared to the 247 public fast charging ports that were deployed in 2023 alone in the state.

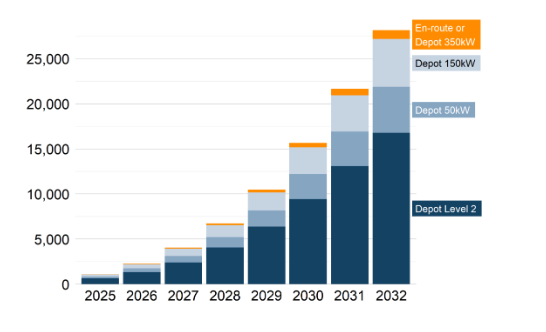

Larger class 4-8 trucks will need more high-power chargers, but at levels that remain reasonable relative to total class 4-8 trucks on the road (which will likely still be primarily fossil-fueled by 2032). By way of illustration: New Jersey will need about 28,000 charging ports for class 4-8 vehicles by 2032, which translates to about one Level 2 port per 14 total class 4-8 vehicles registered in the state, and one higher powered (50kW or greater) port per 22 vehicles. The need for high-power charging relative to Level 2 increases with vehicle size, but this model suggests that Level 2 charging (modeled here at 19kW) can make up about 35% of charging ports for larger class 6-8 vehicles, particularly for those vehicles with routine low-mileage routes such as school buses.

The study found similar trends in the other 18 jurisdictions examined. For example, Pennsylvania would need to add an average of 150 en-route charging ports per year from 2025 onward to serve class 2b and 3 vehicles. For comparison, 321 public fast charging ports were deployed in 2023 alone for light-duty vehicles in the state.

The study’s findings have multiple uses, depending on a given state’s needs. For example, the study could help inform fleet depot permitting and land-use decisions, utility investment plans to prepare the grid in anticipation of charging loads, or technical assistance program design. In every instance, however, the findings illustrate ACT’s feasibility and achievability and should help policymakers implement it with confidence.