The safeguards 45V needs to avoid fossil hydrogen regrets

By Morgan Rote and Chelcie Henry-Robertson

As the U.S. invests billions in deploying its hydrogen strategy with the goal of decarbonizing industry and reducing emissions, the 45V Clean Hydrogen Production Tax Credit is the big ticket item on the table aiming to kick-start the emerging hydrogen economy. Unsurprisingly, everyone wants a share of this financial incentive, and the details are being ironed out as we speak. But current loopholes in the rules are opening the door for the very real – if unintentional – prospect of boosting hydrogen that is not clean and will not reduce emissions. Here we lay out three accounting schemes that can be used to classify hydrogen as ‘clean’ but could actually worsen the climate if not addressed. To protect the integrity of our hydrogen decarbonization strategy, our taxpayer investments into new clean solutions, and our policies designed to do this, we have to ensure that the right safeguards are in place and these dangerous loopholes are closed.

What 45V was designed to do

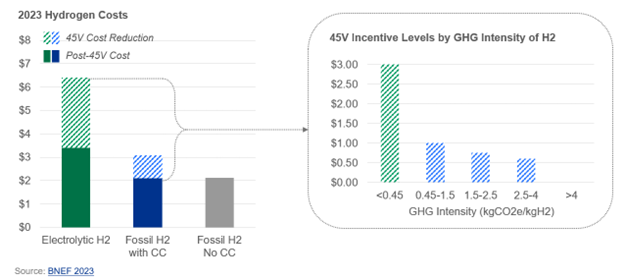

When it comes to clean alternatives to today’s energy and fuels, a major factor is cost. The 45V Clean Hydrogen Tax Credit was designed to incentivize the buildout of new, cleaner forms of hydrogen, bringing their costs down to achieve parity with today’s dirty hydrogen (i.e., fossil fuel-based hydrogen without carbon capture in place). The credit offers different dollar amounts depending on how clean the hydrogen is.

These amounts are not linear; they were specifically designed to meet the unique challenges of different production processes. Electrolytic (or “green”) hydrogen, produced from renewable electricity and representing the cleanest form of hydrogen, was to be eligible for the top $3/kg tier — to alleviate the higher costs associated with that form. Hydrogen produced from fossil fuels with carbon capture (commonly known as “blue” hydrogen), was known to need less cost support — it was already projected to be much closer to the cost of today’s unabated fossil hydrogen.

The safeguards 45V needs to avoid fossil hydrogen regrets Share on XThis lines up with the U.S. Department of Energy’s strategic focus on electrolytic hydrogen. DOE’s nameplate Hydrogen Shot program, designed to reduce clean hydrogen costs to $1/kg by 2031 — along with around $1 billion worth of R&D projects — have been designed specifically around electrolytic hydrogen. And in a June 2023 document responding to stakeholder H2 concerns, DOE stated that it will not fund the development of new fossil-based facilities, but instead focus on outfitting existing facilities with carbon capture.

Treasury came out with draft guidance for 45V back in December 2023, outlining proposed rules for how to calculate the GHG intensity of hydrogen. It established some strong and necessary climate protections for the production of electrolytic hydrogen. But it left several loopholes in place around the production of fossil-based hydrogen.

Each of these loopholes — described in more detail below — would artificially lower the overall GHG intensity, without cleaning up the underlying production process. Either alone or in combination with each other, they would allow polluting fossil-based hydrogen producers to claim the higher tax credit values, even including the top $3/kg tax credit.

This would fundamentally change the hydrogen game. Allowing fossil-based hydrogen to receive $3/kg would make it effectively free to produce. This would shift billions of investment dollars away from zero-emissions pathways and toward fossil-based production and the resulting health risks. And it could waste taxpayer resources on forms of hydrogen that actually worsen the climate crisis.

Three artful accounting schemes to classify fossil hydrogen as “clean”

- Purchasing biomethane or fugitive methane offsets – i.e., artificially subtracting emissions without changing the production process

In the draft 45V guidance, Treasury left open the possibility of dirty hydrogen being artificially counted as clean through the purchase of fugitive methane offsets. Some forms of methane, like biomethane and coal mine methane, can be considered GHG-negative because using them prevents methane from escaping into the atmosphere — and hydrogen producers want to purchase these GHG-negative offsets to lower their overall GHG intensity. This is a crafty accounting trick. A fossil hydrogen producer with CCS could buy a small number of offsets (6% of their total methane inputs) to make their hydrogen look clean enough for the $3 tax credit. And a fossil hydrogen producer without CCS could similarly qualify for the $3 credit by purchasing offsets for only 13% of their inputs.

Under this loophole, a facility could release extremely high levels of GHG emissions (from upstream methane and carbon dioxide), yet be financially rewarded as though they were emissions-free.

Given how much cheaper it is to produce, this would drastically shift investment toward fossil-based hydrogen — including facilities with no carbon capture.

Moreover, it is not legally justified: 45V was not set up to be a tradable emissions system with enforceable emissions limits and verification of offsets across sectors; rather, it is an unbounded subsidy specifically designed to drive investment towards clean hydrogen.

Action required to close the loophole: Treasury must block the use of GHG-negative offsetting and hold hydrogen producers accountable for their true facility emissions.

- Co-product allocation – i.e., shifting pollution to non-hydrogen products

Some fossil hydrogen producers are pushing to allocate a portion of their emissions to “byproducts” such as steam, which would lower their GHG intensity score substantially — potentially enough to reach the $3 tax credit. The steam could then be used in entirely unrelated (and unregulated) processes, for example, to produce chemicals in a nearby petrochemical facility.

45V funds were specifically earmarked to encourage the cleanest production of hydrogen possible — not to subsidize unrelated energy or industrial products downstream.

And in the context of 45V, this accounting practice equates to pushing pollution from where it’s being counted (i.e., hydrogen) to where it’s not (i.e., steam processes) in order to access more taxpayer dollars. This is clearly a gaming of the system and a manipulation of a highly lucrative tax credit. Decisions here will set an important precedent for other tax credits as well, and precautions are warranted across the board.

Action required to close the loophole: To make sure hydrogen producers aren’t gaming lifecycle emissions rates, Treasury should put restrictions in place on co-product allocation.

- Providing optionality for user-specific methane numbers – i.e., cherry-picking numbers to suit your need

In its draft 45V guidance, Treasury asked for input on allowing user-specific methane estimates instead of the default national average. Many fossil hydrogen producers are pushing to allow this as an option – i.e., they would input their own number if below the national average, or use the national average if above it. Because the methane input assumption matters so much for the hydrogen’s GHG-intensity, this could substantially change the tax credit level being claimed.

For instance, a producer could claim that they have methane emissions of only 0.01% and receive $0.75/kg, rather than the $0.60/kg they would receive with the national average rate (0.9%). Meanwhile a producer with actual methane emissions of 3% (which has been measured in the Permian Basin) shouldn’t be eligible for the tax credit at all. But by having the option to claim the national average, they would gain eligibility and receive $0.60/kg.

Optionality would thus offer a substantial carrot for outperformers while doing nothing to discourage underperformance — and in some cases, even rewarding underperformance.

Worst still, allowing user optionality would skew the picture of how the industry, as a whole, is performing. If the outperformers are claiming their own lower numbers, then the residual national average should actually be raised even higher. Since we know, from several years of data from satellite and other field studies, that our current national average is an underestimate, the impact of a cherry-picking system becomes even more severe.

Lastly, until we have a robust verification method in place, there’s no way to validate that any extra-low methane numbers are truly backed by measurement data.

Action required to close the loophole: To prevent this numbers-gaming, Treasury should incorporate basin-specific methane rates, which still reward producers for sourcing low-emissions gas, but rely on verified, peer-reviewed measurement data. Over time, with the build-out of a verification system, user-specific numbers could be allowed — but on an everyone-or-no-one basis.

Closing the loopholes

Each of the loopholes above represent a danger to the new clean hydrogen economy, and to the U.S.’s climate targets. Some of them are enough for fossil projects to reach the $3 tax credit on their own; while others are no less threatening when stacked together.

Moreover, these risks of undercounting CO2 and methane emissions exist while the true scope of climate-warming emissions isn’t even included in the calculation. Hydrogen emissions themselves contribute to warming at a level nearly 40 times more potent than carbon dioxide in the first 20 years. Treasury has determined that hydrogen lost to the atmosphere is not eligible for the tax credit, but the warming effect of these lost volumes is not currently included in the GREET model, which underpins 45V. This means that all producers — both fossil-based and electrolytic — are ignoring a significant part of their climate impact.

Protecting the intention of the 45V tax credit to support the build-out of a new clean hydrogen market requires being transparent about the true climate impacts of a project — and ensuring that taxpayer dollars are being used only to incentivize and lower costs of hydrogen production that is truly clean. By not protecting against the accounting loopholes described above, we will almost certainly fail to see the climate benefits we expected from 45V — and we may even fund projects that worsen the climate. The 45V tax credit is an important investment into the clean hydrogen economy, and guardrails must be put in place to protect it from being misused.