Here’s what the Advanced Clean Trucks rule means for Illinois manufacturers

Blog update: Last summer, Illinois advocates filed a citizen petition with the state’s Pollution Control Board to urge the Pritzker administration to adopt the Advanced Clean Trucks rule along with other tailpipe-pollution reduction programs. The final hearing on the clean trucks standards will be March 10-12, 2025, in Springfield. Because of the calendar year change, the model year the standards would take effect has also changed. We have updated the model year in the post below to reflect the standard being adopted in 2025.

Misinformation about zero-emission vehicles and confusion around federal Environmental Protection Agency standards versus those states can adopt under the Clean Air Act waiver has left many manufacturers, small businesses and fleet managers wondering what market-based policies like the Advanced Clean Trucks rule could mean for their operations and bottom line.

The ACT sets and gradually increases sales targets of zero-emission vehicles for medium- and heavy-duty vehicle manufacturers. This is distinct from the federal EPA Phase 3 standard, which is based on manufacturers’ total national fleet average greenhouse gas emissions and allows manufacturers to demonstrate compliance using a range of different technologies. The ACT ensures MHDZEVs are actually sold in a particular state, ensuring choice and supply for fleets and market certainty for manufacturers. Certainty allows for utility planning, more rapid and robust charging infrastructure and effective fleet turnover.

Here’s what the Advanced Clean Trucks rule means for manufacturers Share on XIllinois is a burgeoning EV manufacturing destination with MHDVs and batteries built here. But right now, MHDZEV manufacturers in Illinois must prioritize ACT states for vehicle supply and delivery, so the 11 states that have already adopted the rule not only reap the cleaner air and lower operating costs ZEVs provide, but also the tax revenue. If these trucks were being sold in Illinois, that revenue would stay in the state and benefit Illinois businesses and consumers. We need the ACT in Illinois to further support our economic growth, create clean jobs and to help make Illinois a leader in zero-emission vehicle deployment.

For small businesses looking to switch to ZEVs, the ACT will bring much-needed MHDZEV supply to Illinois, where market certainty for manufacturers means competitive prices and more used options. Because of the wide range of ACT-compliant vehicles, businesses do not need to be big logistics providers to take advantage of it. Class 2b and 3 vehicles like cargo vans and heavy-duty pickup trucks are included in the ACT.

Here’s what it takes from manufacturers and fleets to comply with the rule:

When?

Under the Clean Air Act, states may not begin enforcing stronger state emissions standards, like ACT, until two years after their adoption. If Illinois were to adopt the ACT in 2025, the rule would start applying in model year 2029, which begins on January 1, 2028. Most states allow early compliance before enforcement begins to encourage sooner clean air benefits.

How much?

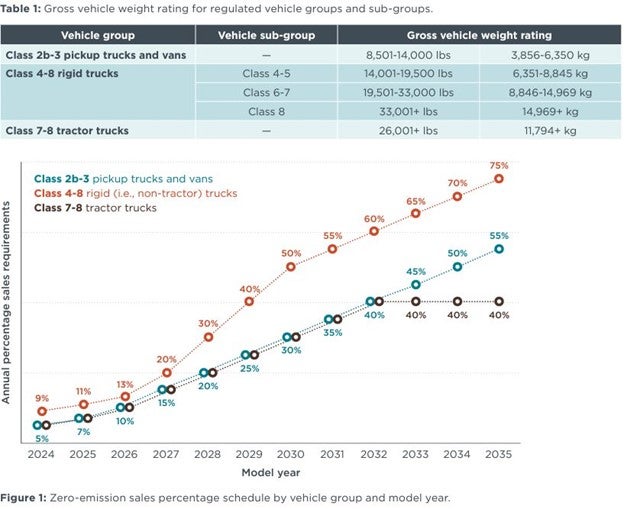

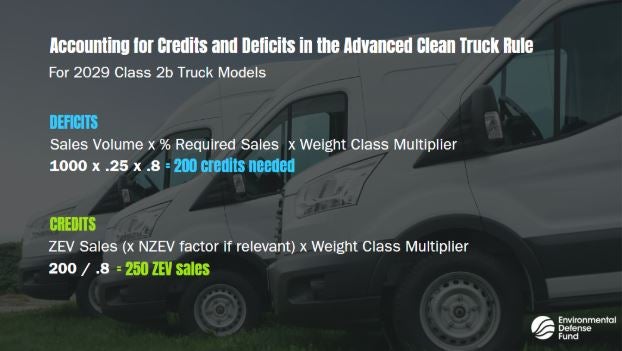

At its core, the ACT program is a credit and deficit banking system. Manufacturers accrue deficits on MHDV sales in the state and generate credits for ZEVs (or to a lesser degree, near zero-emission vehicles) sold. The calculation accounts for differences in emissions by vehicle size, too: weight class multipliers generate larger deficits for larger vehicles, and similarly, generate higher credit value per ZEV sold in that class. For model year 2029, the annual percentage sales requirement for Class 2b-3 and 7-8 tractor trucks is 25% and 40% for Class 4-8 rigid trucks.

The ACT incorporates multiple flexibilities to account for different markets of vehicles and manufacturer progress. The targets never reach 100% of all vehicles, they end at 40-75% of new sales, depending on class. Manufacturers may trade and sell credits among themselves and between vehicle classes. Medium- and heavy-duty sales and deployments through federal funding awards after ACT adoption could generate early credits and help manufacturers reach targets sooner. Manufacturers selling fewer than 500 vehicles a year in a state are not covered under the ACT.

Consider a manufacturer of delivery vans (Class 2b vehicles make up 80% of the zero-emission truck market, and accounted for 87% of deployments in 2023). In this example, a manufacturer sells 1000 Class 2b vehicles a year in Illinois. The deficit for a given year is calculated by multiplying total sales volume (1000) times the relevant model year sales percentage requirement (25%, or 0.25) times the relevant weight class modifier (0.8 for Class 2b), equaling 200. This manufacturer would have to generate an equal or greater number of credits (an excess of which can be banked for five model years) to achieve compliance. Let’s assume the manufacturer does so by either purchasing credits from an electric delivery van manufacturer like Illinois’ Rivian or produces and sells its own. Selling 250 ZEVs would generate enough credits (25%, or 200 needed credits divided by 0.8) to be in compliance for MY2029. Manufacturers have one model year to account for outstanding deficits, which may only be satisfied with ZEV (not NZEV) credits.

Freight and logistics businesses may already know that by 2030 the total operating costs of ZEV heavy-duty vehicles will be significantly lower than their diesel counterparts across all segments of the market due to extensive maintenance and fuel cost savings. The ACT is a crucial policy lever to provide that choice and supply for businesses: states that have adopted the ACT are already 38% of the MHDZEV market despite making up only 25% of the overall truck market.

Right now, historic federal funding and incentive opportunities are making it easier than ever to build ZEVs:

- The Clean Heavy-Duty Vehicle Program funds $1 billion to replace existing Class 6 and 7 vehicles with zero-emission models. Although the latest $932 million Notice of Funding Opportunity, meant to replace school buses and vocational trucks like refuse haulers and utility trucks, is not open to private businesses, the EPA encourages vehicle manufacturers to work with applicants through the bidding process after awards are granted.

- The Advanced Manufacturing Production Credit (45X) encourages domestic battery manufacturing by offering $35 per kilowatt-hour for battery cells, $10 per kilowatt-hour for battery modules and 10 percent production cost credit for mining critical materials and producing electrode active materials.

- The $25 billion Advanced Technology Vehicles Manufacturing Loan Program provides low-cost capital investment in clean vehicle and charging infrastructure manufacturing, including to build new facilities or reequip existing ones.

If Illinois adopted the ACT along with the Heavy Duty Omnibus Low NOx rule it could result in 50% of on-road MHDVs being zero-emission by 2050 and reduce health-harming pollution like NOx by 90%. Moving forward with a zero-emission vehicle goal will further spur the manufacturing of zero-emission vehicles, bring down cost as economies of scale continue to increase, and ensure that Illinois benefits from these investments and clean vehicles. Illinois must adopt the Advanced Clean Trucks rule — the time to act is now.