The Texas Electric Market Isn’t Being Manipulated, It’s Just Built That Way (…And That’s Not A Good Thing)

Last week, the Independent Market Monitor for the Electric Reliability Council of Texas (ERCOT) released a report showing that the violent prices fluctuations of June 25 and 26 were not the result of market manipulation, as asserted by earlier reports. Most have greeted this as welcome news, but the finding could spell rocky years ahead with wild swings in electric prices from day to day, which makes it difficult for investors, generators and most importantly customers to plan ahead. To understand why, let’s back up a second and talk about what these findings mean.

Last week, the Independent Market Monitor for the Electric Reliability Council of Texas (ERCOT) released a report showing that the violent prices fluctuations of June 25 and 26 were not the result of market manipulation, as asserted by earlier reports. Most have greeted this as welcome news, but the finding could spell rocky years ahead with wild swings in electric prices from day to day, which makes it difficult for investors, generators and most importantly customers to plan ahead. To understand why, let’s back up a second and talk about what these findings mean.

Wild Mood Swings

If the market isn’t being manipulated, it is at least feeling a little bipolar: one hot summer day with high demand prices are up slightly but everything was working fine. The next day however, a 2 percent uptick in demand combined with an unexpected loss of 1.6 percent sent prices soaring. The peak price on June 25 hit $438/ megawatt hour (MWh), but on June 26 prices maxed out at $3,000/MWh, meanwhile average prices skyrocketed to 640 percent above the average for the 25th.

In a well functioning market these price swings wouldn’t be so dramatic and unpredictable, and those swings point to fundamental problems with the electric markets in Texas. In extreme situations prices and profits may increase enough to support new investment but those extremes are so unpredictable that no power company can plan well for them, much less finance new investments. As Brattle Group says in their report to ERCOT, “reliance on scarcity prices is unlikely to achieve ERCOT’s current reliability objectives.” The solution? Reduce our reliability standards or implement reforms that will lead to reliable electricity over the long term without the need for emergency regulatory intervention.

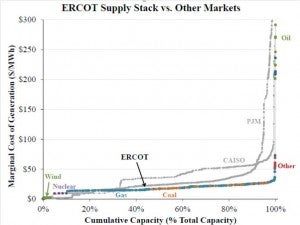

The reason for these swings is pretty simple, and outlined in the Brattle Report: the ERCOT supply curve does not efficiently reflect current or upcoming scarcity conditions in the market. The supply curve is dominated by low price resources like wind, efficient natural gas power plants, along with nuclear power and some cheaper coal, all of which come in at or under about $30/MWh. But as the chart shows, when you start getting near the 100 percent peak demand level there’s a sharp “hockey stick” curve upwards in price. This means that when we’re in that high demand territory, a single power plant going offline or an unexpected spike in demand can send electric prices from $30/MWh to $3,000/MWh without warning, like we saw in late June. Other regions have a more gradual supply curve of price increases during scarcity conditions, providing a kind of ‘warning’ to the market that the Brattle Report suggests as part of its suite of recommended market reforms. That gradual curve is important because it allows demand-side resources to help stabilize prices and at the same time it provides potential investors with the kind of predictable certainty that allows them to consider investing in Texas.

Solving the Problem

As we said above scarcity pricing by itself, especially when it’s so dependent on weather extremes, is not enough to keep the lights on in Texas. To do so, regulators and stakeholders will need to roll up their sleeves, put politics aside and find a solution that works for all Texans. As a many have pointed out, the Public Utility Commission (PUC) made the decision to raise the offer cap without even a cursory analysis of the impact on ratepayers, an oversight that hopefully won’t happen again.

If and when ratepayer impacts are taken into account, demand-side resources will be seen as playing a key role not only in maintaining reliability, but also in reducing the impact to ratepayers. According to the Brattle Report we can reduce our peak demand needs 15 percent with such demand-side resources, with residential customers and small businesses making up 72 percent of the reduction during the hottest days of the year, but only if serious changes are made to the market. In PJM (another grid operator) , where demand-side resources are allowed to participate in energy and capacity markets, participants have received over $174 million for over 10,000 MW of customer provided demand-side resources, over $20 million of the payments went to residential customers. In Texas, as we consider implementing new policies that improve reliability and provide stable predictable market signals it will be critical to include demand response, and to tap into growing residential and small business markets.