California regulators prioritize keeping electric bills affordable over increasing utility shareholder profits

Energy bills have been on the rise across the nation — and California is no different. A recent study highlights a variety of factors impacting Californians electric costs, including increased costs to harden the system from wildfires and more investments in fixed-capital infrastructure.

Fortunately, energy regulators in California are poised to take two steps to address energy bill affordability, while still protecting the environment. The first is a critical decision on how energy utilities structure their profits, known as the “cost of capital”, and the second is a new set of rules focused on how California measures the affordability of utility services.

EDF projects that, by bringing shareholder profits in check, these actions could result in over $300 million in annual savings for Californians.

Step 1: Regulating utility shareholder profits

In the United States, investor-owned utilities are regulated in all aspects of their business, including the amount of profit their shareholders can earn. Therefore regulators determine an upper limit of authorized profit that a utility could earn. It is up to each individual state to determine what amount of utility shareholder profit is reasonable.

In California, regulators make this determination for the four largest energy utilities — Pacific Gas and Electric Company (PG&E), Southern California Edison Company (SCE), San Diego Gas & Electric Company (SDG&E) and Southern California Gas Company (SoCalGas) — at once, since the investment climate is the same for them as a batch.

States have a large amount of discretion to figure out what amount of potential profit and overall capital structure makes the most sense for their energy utilities. Ideally, the regulator will ensure that the shareholder profit is just high enough to project confidence in the financial soundness of the utility to enable it to raise the money necessary to ensure safe and reliable service.

The goal of regulators should be to cover the big infrastructure needed by utilities, such as poles and wires, which are very expensive and customers will pay for over a long period of time. Regulators have to determine the return on both debt and equity, and how much of each the utility should have.

The determination on the return on equity and debt should also be commensurate with alternative investments of comparable risks. In essence, a utility regulator should look to other utilities and not to unrelated sectors to help make this determination.

The four largest energy utilities in California have all argued that they are a riskier investment when compared to their peers and therefore their shareholders were entitled to earn more profit. Amongst their rationales for being riskier was that California’s suite of clean energy policies (including the renewable portfolio standard, cap-and-invest and wildfires) make California a riskier place to do business.

Regulators rightly are rejecting this argument. In fact, in the context of the extensive set of legislative and regulatory actions in these areas, they are proposing that California has been overpaying shareholders and is going to cut the profit earning potential of each utility. This will ultimately result in lower energy costs for customers.

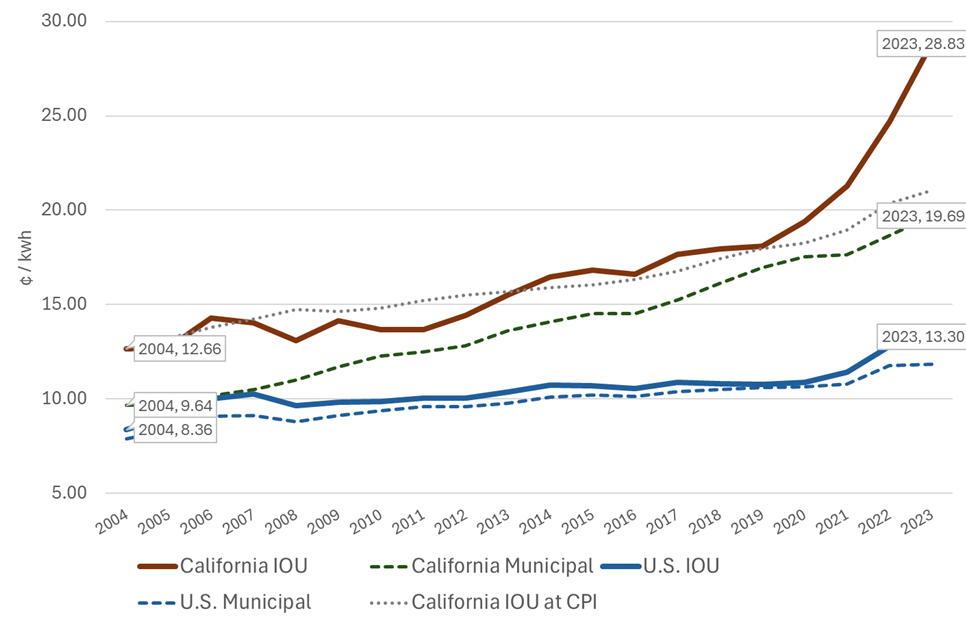

This overpayment is not a new phenomenon. Looking over the last twenty years, as demonstrated in the chart above, California’s investor owned utilities have been receiving a premium compared to the national average. And that national average itself is trending downwards.

In the last 12 months, there has been a noticeable downwards shift in utilities’ return on equity nationally. California’s regulators are proposing to follow this downward trend, and the cut to the authorized utility profits (their return on equity) will all be below 10% for the first time in a generation.

| Utility | Current Authorized Utility Profit (Return on Equity) | Proposed Authorized Utility Profit (Return on Equity) | Annual customer savings from this change |

|---|---|---|---|

| PG&E | 10.28% | 9.93% | $136,378,000 |

| SCE | 10.33% | 9.98% | $108,021,000 |

| SDG&E | 10.23% | 9.88% | $24,143,000 |

| SoCalGas | 10.08% | 9.73% | $34,408,000 |

| Total | $302,950,000 |

Proposed Customer Savings by Utility

This proposed action will save customers over $300 million of dollars annually, without compromising system safety and operations. Essentially, regulators are rejecting the utilities’ claim that the state’s progressive environmental agenda made the state a riskier place to do business and are choosing to put the needs of ratepayers first.

Step 2: Monitoring electric bill affordability

In addition to the work on the authorized capital structure, regulators are separately creating a new set of rules on tracking affordability. Regulators are ordering each utility to compile new annual reports on their overall bill affordability using updated metrics. The utilities must provide a broader context for how their customer bills stack up compared to other needs. This will also include new mapping tools where we can see affordability for all utility services in a geographic area.

This action will help address energy bill affordability by helping regulators monitor changes the utility goods services, including electricity, gas and water. Given that most customers prioritize paying a utility bill ahead of other basic needs such as food and medicine, these updated metrics will be a critical tool to ensure that energy services will remain affordable in the long run.

Next steps

There is still much more work that California regulators need to do to ensure that the state’s energy system is affordable, clean and safe. These two actions are critical interim steps and will continue to set the tone for years to come.