North Carolina can still avoid huge amounts of emissions (and stranded carbon emitting assets) under the state’s Carbon Plan Law. Here’s how.

On November 1, the North Carolina Utilities Commission issued an order in the Carbon Plan docket, almost two months ahead of schedule. It largely ratifies an agreement reached by Duke Energy and the state’s Public Staff, who are charged with protecting the state’s ratepayers. While the Commission drops the requirement for Duke Energy to model hitting the 70% carbon emission reduction by 2030 in state law, largely due to a boom in electricity demand, the utility is still required to take “all reasonable steps” to hit the target by the “earliest possible date.” Which begs the question, what is the earliest possible date? A new white paper from EDF comes to the conclusion that North Carolina can still hit the target by 2032, even with the new carbon-emitting resources moving forward under this order.

Throughout the past year’s Carbon Plan process in North Carolina, one central fact has been easy to lose sight of: how do the various proposals put forward actually reduce emissions from the power sector? EDF is committed to keeping this question front and center, as state law requires, putting carbon reduction on equal footing with affordability and reliability as state regulators consider the next generation of power sector investments.

Indeed, when Duke Energy, the Public Staff and several private entities submitted a proposed stipulation to the NC Utilities Commission in July of this year, that document did not include emissions estimates for the generation portfolio it proposed. This new analysis by third-party experts remedies that deficiency by comparing the projected emissions of the proposed stipulation in context of the Attorney General’s office, NC Utilities Commission Public Staff, and Duke Energy’s previously submitted portfolios. Finally, it offers an EDF scenario which substantially reduces emissions by making limited, realistic adjustments to the amount of clean resources brought online in the next decade and moving forward the retirement schedule of North Carolina’s aging coal fleet.

Report findings

Our experts found that modest alterations to the proposed stipulation could put us back on target to hit the 70% by 2030-32 interim target that House Bill 951 put into law in 2021 by overwhelming, bi-partisan majorities. In the simplest terms, modestly increasing our annual solar procurement targets and adopting an offshore wind build schedule consistent with what developers have publicly committed to delivering would allow us to accelerate coal retirement and avoid construction of much of the new gas generation contemplated in Duke Energy’s and the Public Staff’s stipulation.

This analysis was not filed with the NC Utilities Commission but instead is intended to serve as a public-facing guide to the implications of the proposals put forward in that proceeding to date. Our experts found, “key technical deficiencies in the Duke analysis that undermine its integrity and amount to pre-engineering the modeled outcomes,” making it important to offer a rigorous analysis outside of the proprietary modeling framework required within the Carbon Plan proceeding.

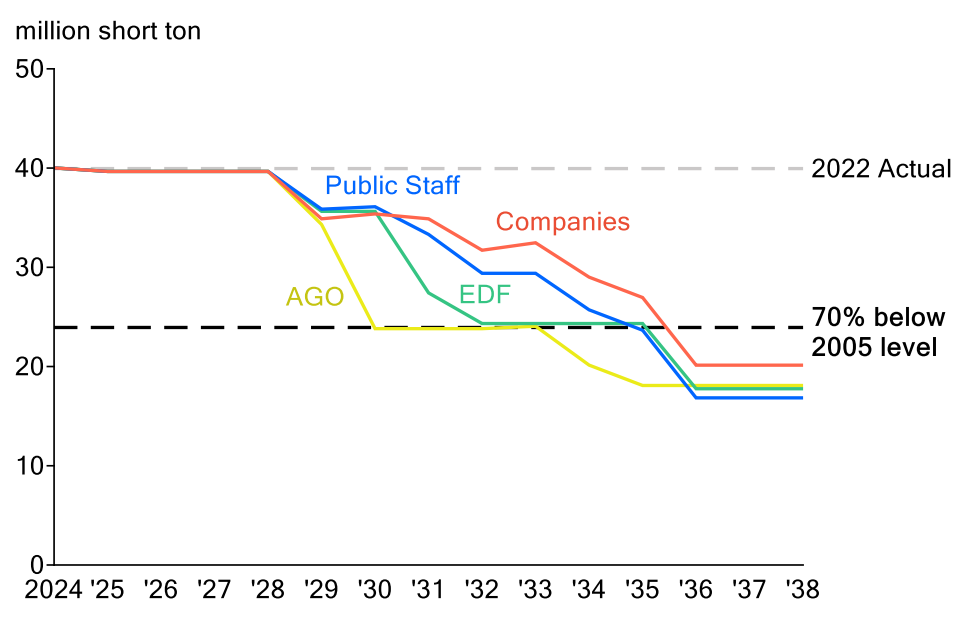

To put it in visual terms, here are the proposed portfolios’ projected emissions:

Key findings

- The EDF Scenario reduces CO2 emissions from the North Carolina Duke Energy Progress (DEP) and Duke Energy Carolinas (DEC) fleets by 7.5%, or 36.4 million tons, on a cumulative basis between 2024-2038, compared with the Companies Stipulation scenario and achieves 70% reduction in annual emissions by 2032 (relative to 2005).

- The steps suggested under the EDF Scenario would also deliver a lower risk path in terms of both CO2 emission reduction and potential stranded assets for electricity consumers of North Carolina.

- Retiring more coal facilities earlier than currently scheduled is the most impactful step Duke can take to reduce cumulative emissions and minimize stranded asset risk.

- Hardcoded assumptions in Duke’s modeling approach result in artificially low solar new-builds. Forced caps on how much solar capacity can be added each year as well as cost adders, assumed limitations that do not apply to natural gas-fired resources, create biases that lead the model to select fewer solar new-builds and more natural gas-fired resources.

- A different set of — and potentially more realistic — assumptions and analytical methods would have introduced a broader array of clean resource technologies in an accelerated time frame in Duke’s modeling.

How does the EDF scenario differ from Duke’s proposal?

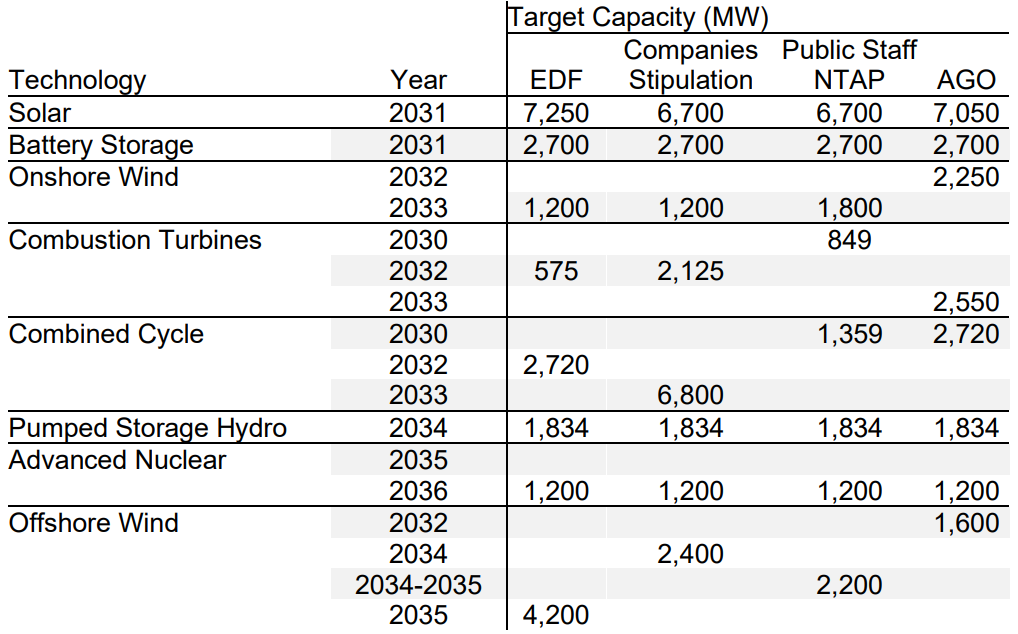

The EDF Scenario shows that the key modifications that would benefit the emissions performance of the DEC and DEP fleet are the following, which are well-aligned with Public Staff’s NTAP and the AGO’s recommendations:

- Eliminate three planned new combined cycle (CC) units.

- Add 1,750 MW per year of new solar capacity beginning in 2028 until 2030, and 2,000 MW in 2031 and each year thereafter through 2038 to replace the generation gap that may arise as a result of eliminating the new CC builds; all or part of the new solar capacity may be combined with energy storage systems to support resource adequacy requirements, as is also envisioned under the Companies Stipulation.

- Add 1,200 MW of land-based wind by 2032, with another 600 MW, or 125 MW per year, between 2033 and 2038, totaling 1,800 MW of land-based wind by 2038.

- Advance the timeline for building and connecting offshore wind resources in order to displace potential demand for the new CC units, and ensure that all offshore wind is built and operational by 2035, with at least 800 MW of capacity added in 2031, and 850 MW each year from 2032 to 2035.

- Retire most coal units in North Carolina by the end of 2031 —with the exception of Belews Creek units 1 and 2 which retire in 2036.

These findings differ from Duke’s proposed stipulation with Public Staff, which proposes significant additional gas, marginally less solar and does not fully build out North Carolina’s available wind lease areas. Battery storage, onshore wind, pumped hydro and advanced nuclear are consistent between the EDF scenario and the Duke/Public Staff stipulation.

Emissions

The emissions impact of these modest modifications would be significant, enabling North Carolina to meet the 70% interim reduction target as defined in HB951.

The EDF portfolio is projected to emit 35.6 million short tons in 2030, a 56% reduction below 2005, and 24.3 million short tons in 2032, achieving the HB951 interim target of 70% below 2005.

Cumulative emissions reduction

The EDF portfolio would reduce CO2 emissions from the DEP and DEC fleets by 7.5%, or 36.4 million tons, on a cumulative basis between 2024-2038, compared with the Companies Stipulation scenario, and would deliver a lower risk path in terms of both CO2 emissions and potential stranded assets.

Conclusion

North Carolina can still achieve its 70% from 2005 interim target emissions reductions by 2032 as currently allowed for in state law. The Utilities Commission still has an opportunity to order Duke to take reasonable steps to expedite development of clean resources while reining in Duke Energy’s requests for new fossil capacity. If the Commission does this, we can put ourselves on a declining emissions trajectory that also reduces fuel price volatility and stranded asset risk.