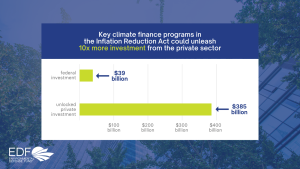

Key climate finance programs in the Inflation Reduction Act could unleash 10 times more private investment

This blog was co-authored by Nicole Buell, Director for Federal Climate Innovation at EDF.

The Inflation Reduction Act puts a nearly $370 billion down payment on clean energy and climate progress, making it the most significant climate action ever taken by Congress. But this federal funding only scratches the surface of the law’s transformative impact on our economy.

A new policy brief from Environmental Defense Fund shows that investment in a few of the law’s key climate finance programs could pack an even greater punch, catalyzing 10 times greater investment from the private sector. Finance programs, including a new federal green bank, a program to reinvest in energy infrastructure and additional support for existing Department of Energy loan programs, could translate $38.7 billion of federal spending into $385 billion of private investment.

Here are some of the main ways the law can unleash more private dollars.

Bumping up Department of Energy loans

The Inflation Reduction Act expands several loan programs under DOE’s Loan Program Office, including for emerging climate technologies, clean vehicle manufacturing and energy projects on tribal lands. These loans can overcome a critical financing gap by providing tools to help proven, high-potential energy technologies reach the market and attract more investor interest.

A brand new loan program established in the law, the Energy Infrastructure Reinvestment Financing Program, has the biggest potential to spur private dollars – catalyzing an estimated $245.8 billion in investment. These loans would help retool, repower, repurpose or replace retired energy infrastructure like power plants, potentially unlocking a wealth of new economic opportunities for communities that may have otherwise been lost.

In all, $11.7 billion of appropriations to support these loans could result in $312.6 billion of new energy investments from the private sector.

Establishing a federal green bank, aka the Greenhouse Gas Reduction Fund

The law also creates a Greenhouse Gas Reduction Fund within EPA to finance the wide-scale deployment of low-cost, clean energy technologies like solar, wind and batteries. Critically, the fund will direct over half of its investments to low-income and disadvantaged communities which stand to benefit the most from a rapid clean energy transition.

Overall, this $27 billion federal fund could lead to over $72 billion in additional private sector investment.

How would it work? Federal funds would primarily go to state and local green banks or institutions which leverage some amount of public money to attract private investment in climate and clean energy technologies. And some funds would go toward setting up new green banks in states or communities that don’t currently have one.

Many states and communities across the U.S. have already seen the benefits of green banks: Over 20 subnational green banks have leveraged an average of $2.68 in private investment for every public dollar spent. Injecting new federal spending will expand their impact and make clean energy projects a reality where new banks open up.

It’s important to note this brief does not cover all the clean energy loan programs in the law – only key ones where data is readily available. Further analysis could reveal even more money available to leverage for our climate goals. It’s also critical to recognize that much of the success of the programs analyzed here depends on how optimally public funds can be deployed in the coming years.

But taken together, these climate finance programs have the ability to unlock hundreds of billions of dollars from the private sector. This could bolster the law’s power to lower energy costs, build healthier communities, create good-paying jobs and drive progress on our climate goals. We know that businesses and investors are eager to accelerate – there’s a whopping $23 trillion global clean energy market expected at the end of the decade. The Inflation Reduction Act finally positions America to take hold of it.

Read more details in our policy brief.

One Comment

its a very informative blog thanks for sharing this kind of information. Also check Account-Ease