A new report by Resources for the Future, “Toward a New National Energy Policy: Assessing the Options,” provides a thorough analysis of the various energy, oil savings and climate policies currently under debate. The analysis is especially helpful because it employs an “apples to apples” comparison approach by running differing policies through the same economic model and scoring them on the same two effectiveness metrics:“reduction in barrels of oil consumed and reduction in tons of CO2 emitted.” The model also tallies the projected costs of each policy allowing for a cost-effectiveness analysis. The report does not allow for political calculations but does provide a good basis for policy comparisons.

Climate 411

New Report Provides Comparison of Energy, Oil Savings and Climate Policies

Important Caveats to Last Week’s CRS Analysis of Climate and Energy Bills

The Congressional Research Service released a brief report last week comparing three energy and climate bills currently under discussion in the Senate. This comparison is useful to anyone looking for a fairly objective look at the three proposals. One key point to recognize though is that the analysis solely focuses on the policy mechanisms proposed in each of the three bills, it does not compare or contrast effects (economic and otherwise) of the bills.

For example, in the bill proposed by Senators Cantwell and Collins, the Carbon Limits and Energy for America’s Renewal (CLEAR) Act, the analysis does mention that the bill includes a “safety valve” as a mechanism to control the price of carbon. A safety valve works by allowing for the increase of emission allowances if the price of carbon rises above a certain level. Intended as a cost containment measure, the so-called safety valve undermines the proposal’s ability to achieve the targeted levels of CO2 emissions reductions (in 2050, 83% below 2005 levels), put forth by its authors. When the safety valve is used, the targeted carbon reductions fly out through the window. The CRS report makes no mention of this significant potential consequence of the mechanism.

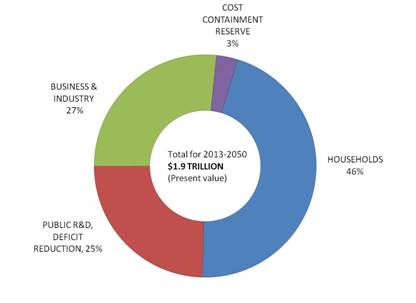

Another issue to keep in mind is that the CRS analysis does not consider the long-term trajectory of allowance allocations in the American Power Act, the bill Senators Kerry and Lieberman co-authored. The Congressional Research Service includes only a snapshot view of allowance allocations for the year 2016. Since allowance allocations vary in the later years on the proposal, it is more helpful to asses the allowance allocations for the full duration of the legislative period (2013 to 2050). The chart below shows the projected allowance allocations divided by sector, for the time period 2013 to 2050, in net present value and therefore offers a more complete picture. As this graph shows, 46% of the allowance value is directed at households over the course of the bill.

When attempting to compare Senate proposals, it is important to focus attention on both the proposed policy but especially its likely effects. This CRS analysis is a helpful tool in understanding the former, but it is essential to remember to also consider the latter before drawing any substantive conclusions on which proposal will work best to create clean energy jobs, control carbon emissions and keep America safe. The more comprehensive a climate and energy bill, and the less loopholes, the more benefits will accrue.

API Misses the Mark: Why Refineries Will Do Just Fine Under ACES

The American Petroleum Institute (API) recently took a break from hosting anti-cap-and-trade rallies for oil company employees, and used its spare time to put out a study claiming the American Clean Energy and Security Act (ACES) would be unfair to American oil refineries. Unfortunately their study uses some dubious assumptions – and makes some even more questionable claims.

API’s study (carried out by consulting firm Ensys Energy) outlines two major complaints.

- First, API whines that the bill only sets aside 2.25 percent of emissions allowances for refiners, while the electricity sector gets 35 percent of the available allowances.

- The second, related claim is that ACES would increase the cost of doing business so much that companies would turn to cheaper overseas refineries instead.

Before we even address those complaints, there’s one thing I have to point out — API is relying on bad modeling and cherry-picked results to create its case.

- The results quoted in API’s news release come from running a scenario that severely restricts international offsets and allows no expansion of low-carbon technologies beyond what would happen without a clean energy bill. There’s no basis for those assumptions, but they do manage to skew the results to make refineries look more vulnerable.

- However, if we consider the “basic case” (or, “most likely”) model outcome in Ensys’ report, it is clear that the activity of domestic refineries is expected to increase compared to their current levels.

But let’s ignore the study results for a minute, and just take a look at API’s two complaints.

First, API seems to think refineries are getting picked on because they aren’t getting as many free allowances as the electricity sector. But — they ignore the reasons why the two are not comparable.

- The electricity sector allowances they’re talking about actually benefit American consumers. The allowances are first handed to local distribution companies, or LDC’s, but the value of the allowances doesn’t stay there. LDCs are required to use the value of those allowances to protect consumers from electricity price increases. Giving allowances to the LDC’s really means giving allowances to American ratepayers.

- Oil refineries, in contrast, are private companies whose owners are free to pocket any money they get from their emissions allowances. So giving allowances to oil refiners really means — giving money to oil refiners. (API might like those two ideas equally, but no one else does.)

Of course, if the oil refiners were willing to accept the same regulations as utilities, and guarantee that their emissions allowances would be used to lower the price of a gallon of gasoline, that’s an idea worth discussing. API’s study doesn’t put that offer on the table, though.

Second, API says that America could become dangerously dependent on foreign refineries. (API President Jack Gerard says, “Climate legislation should not come at the expense of U.S. economic and energy security.”)

But – U.S. refineries have cornered 90 percent of the market for domestic gasoline. Homegrown refineries dominate the market because there are, inherently, strong cost advantages for domestic production, and little incentive to send business overseas.

- Different states have different regulations governing oil refining, which favors local businesses and makes it difficult or impossible for foreign refineries to compete. In fact, in other environmental scenarios, such as emissions standards for cars, industries claimed exactly that – no company could possibly create 50 slightly different products to sell under 50 different state rules, and only local businesses could thrive under those conditions.

- It’s also significantly easier and cheaper to ship crude oil than refined gasoline. That makes it much more efficient to import crude oil and do the refining right here at home. That’s a physical difference that won’t go away if we pass a clean energy bill.

EDF did our own analysis of the impact of climate legislation on oil refineries. Here’s what we found:

- The expected added cost from a clean energy bill, per gallon of refined gasoline, is less than one cent per gallon.

- Analysis also suggests that refiners can be expected to pass on the majority of any cost increase to their customers.

- As a result, between 1.4 and 1.7 percent of total allowances would be enough to compensate domestic refineries – in full — for the added costs associated with reducing their process emissions.

- Since ACES allocates 2.25 percent of allowances to oil refiners, EDF believes the allocations set out in ACES are more than generous.

Given all this, the bill should not affect the competitiveness of American refineries.

A larger problem might be the unfortunate effect of API’s study on the average American consumer. Outside the industry, a lot of people don’t draw a distinction between “oil” and “gasoline.” A quick read of news articles about the study could imply that ACES will increase America’s dependence on foreign oil – when one of the most valuable aspects of the bill is that it will do just the opposite. Under ACES, the EIA predicts that the U.S. would reduce its consumption of oil by 344 million barrels in the year 2030 alone. That’s a vital benefit to our national security as well as our environment.

A whopping amount of our own oil and the imported oil would still be refined into gasoline here, in spite of API’s fears. After all, even their own biased study predicts increasing U.S. refinery activity. All in all, clean energy legislation is still good for all Americans – including oil refineries.