This blog was co-authored by Taylor Bacon, Analyst with the U.S. Clean Air team at EDF.

Editor’s note: This post was last updated Sept 27, 2021.

As Pennsylvania moves forward with the Regional Greenhouse Gas Initiative (RGGI), questions are being raised about how this will impact Pennsylvania’s neighbors: West Virginia and Ohio. Will coal plant jobs be lost to these states? And will emissions from Pennsylvania shift there too?

While ultimately, to achieve our climate goals, we need power generation across the country covered by a program that reduces carbon pollution, Pennsylvania’s move to tackle carbon pollution now — before states like Ohio and West Virginia — will help the state prepare to be a leader in the zero carbon future and protect the communities that are impacted by the energy transition already underway.

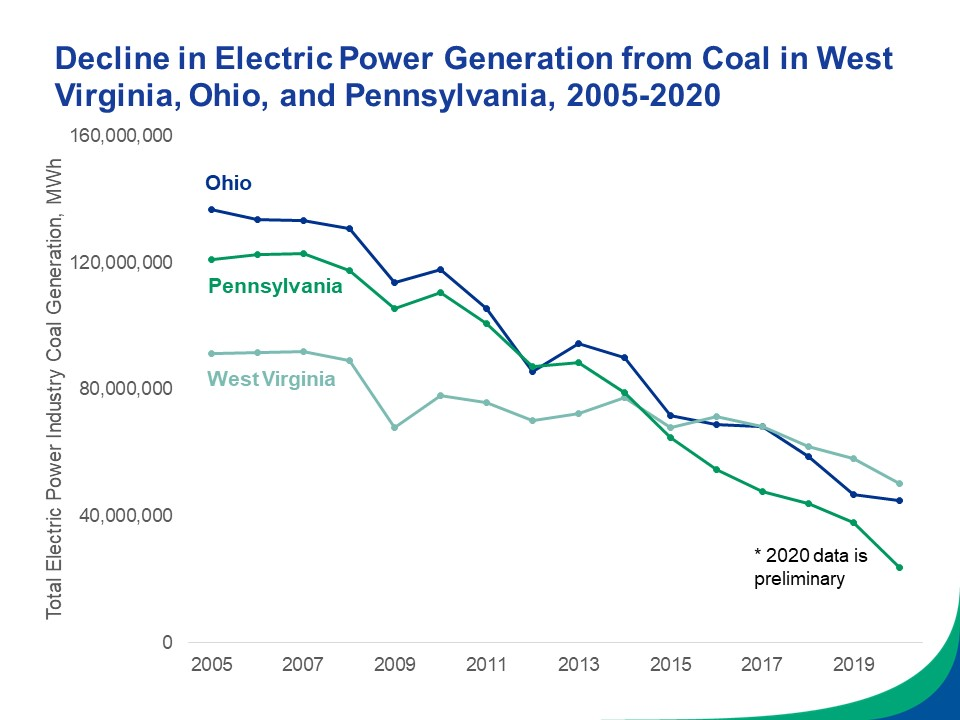

Coal generation in Pennsylvania, as well as in Ohio and West Virginia, has already declined dramatically and data shows that coal-fired power will continue to decline across the U.S. as lower cost alternatives like renewable energy become cheaper. The question is not if states – including West Virginia and Ohio – will transition away from coal, but how? The good news for Pennsylvanians is that state lawmakers are proposing major investments for workers and communities impacted by the energy transition, setting an example for how the region can protect the communities that have powered the country for so long.

The status of West Virginia and Ohio coal

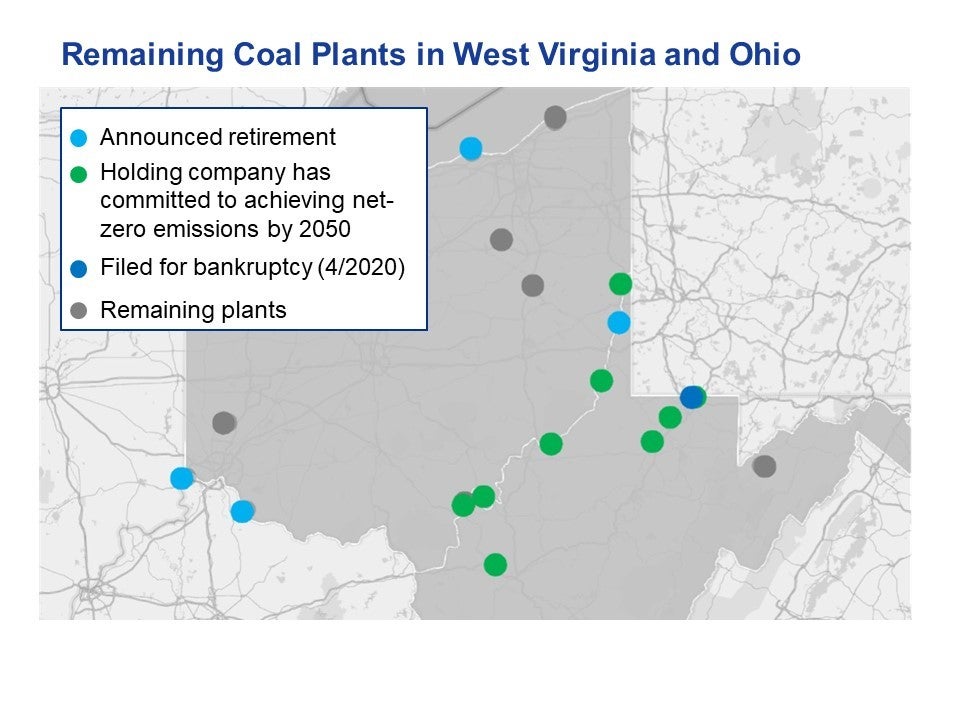

To understand if coal jobs could be lost to Pennsylvania’s neighbors, we need to understand the status of coal plants in the region. Of Pennsylvania’s six remaining conventional coal-fired power plants, only three do not have retirement or transition plans. In the last decade, over a dozen Pennsylvania coal plants have retired.

Across the country, coal plants are facing significant headwinds because of their relative high cost of operation, the climate goals of major power companies, potential federal regulation of the many pollutants that are emitted in large amounts by coal plants, demand of many major businesses that want to meet their own climate goals with clean power, public outcry and the advanced age of many of the facilities.

This is the case for the remaining 9 plants in West Virginia and 11 in Ohio. The average age of the West Virginia and Ohio coal fleet (based on the online year of the earliest unit) is 48 years, with only four plants younger than 40 years. The average retirement age of U.S. coal plants from 2000-2018 was 50 years, which suggests that many of the remaining plants will face imminent retirement. A quarter of the remaining plants in West Virginia and Ohio already have retirements scheduled between 2021 and 2027, and 20% of the plants are scheduled to close next year:

- Five of the plants are owned by American Electric Power (AEP), which had committed to reducing emissions 80% by 2030 and retiring nearly half of its coal by the same date.

- FirstEnergy owns four of the plants and plans to retire their last Ohio plant and one of the West Virginia plants in 2022. They have committed to being climate neutral by 2050.

- Longview Power, which owns one coal plant in West Virginia, filed for bankruptcy in April 2020.

- Vistra Energy announced in October 2020 plans to retire their two remaining Ohio coal plants by 2027, and just recently moved up the retirement date for one of the plants to 2022.

- GenOn announced the sale of the Avon Lake power plant in Ohio to Charah Solutions to remediate and redevelop the lake-front property for public access and recreational use. The transfer is scheduled to be completed in April 2022.

Recently, AEP proposed to charge ratepayers up to $317 million to upgrade remaining West Virginia coal plants. While these investments are intended to keep coal plants in compliance with environmental regulations, they show just how costly coal is in comparison to other options. In fact, a recent study found that 80% of existing coal generation in the U.S. could be replaced by new renewable generation at a lower cost.

The data is clear: coal is becoming less and less cost-competitive, and most remaining coal plants in West Virginia and Ohio are under economic threat.

Emissions across the region will go down

Additionally, analysis by EDF and M.J. Bradley & Associates looking at RGGI’s impact on regional emissions shows that Pennsylvania’s participation in the program will help lower overall emissions, while continuing to grow the state’s role as a net energy exporter.

Specifically, the analysis found that a RGGI-consistent cap trajectory in the 12-state RGGI region, including Pennsylvania, would reduce annual climate-warming emissions by 43 million tons in 2030 across the region compared to the scenario where Pennsylvania does not participate.

The outlook has shifted for communities previously left behind

Unfortunately, when coal plants shut down, there is too often limited notice and support for the workers that rely on these jobs. Such job losses can cause a ripple effect, as the communities built around these coal plants often lose revenues that sustain public services like schools and infrastructure.

While federal policy is critical for creating new economic opportunities in coal communities around the country, as well as protecting these workers’ benefits and more, state lawmakers have an important role to play, too. For Pennsylvania, which is facing a transition with coal plants expected to close with or without RGGI, there is an opportunity to leverage the proceeds from RGGI to make strategic investments that can help deliver fairness for workers and communities – including for communities that already have seen plants close without investments made to help replace those lost jobs and wages.

The recently-announced RGGI Investments Act, by Sen. Carolyn Comitta (D-Chester) and Rep. Dianne Herrin (D-Chester), enables the creation of an Environmental Communities Trust Fund that supports investment in coal communities with worker training programs and environmental development opportunities. Based on recent RGGI auction prices, it is estimated that Pennsylvania could see hundreds of millions of dollars annually in RGGI proceeds. With legislative leadership, this Fund moves from blueprint to reality and can begin to direct investment to assist workers in the first quarter of RGGI participation.

A new report from the Ohio River Valley Institute shows how Pennsylvania can look to other states for ideas and best practices in applying these funds to support coal workers and communities in transition. For example, RGGI states New York and Massachusetts have leveraged proceeds from RGGI to immediately shore up local tax revenues in the wake of coal plant closures.

Coal’s decline is inevitable, not just in Pennsylvania, but in neighboring states as well. Pennsylvania sees the writing on the wall: the transition toward a clean economy is well underway. States that get ahead with bold action now will gain the biggest rewards, including new clean energy and manufacturing jobs, healthier air and lower emissions. Investors are sounding the alarm as well — with BlackRock, the largest asset manager in the world that oversees $9 trillion in assets, recently stating, “we are increasingly seeing the impacts of climate change not only across our portfolios but also across the global economy.” Investors and businesses around the world and in Pennsylvania are asking for climate action. States that don’t move forward risk getting left behind.

3 Comments

Pennsylvania just reached a critical milestone on the path to a clean energy future. Pennsylvania needs a renewable energy future, despite COVID-19 challenges. Pennsylvania has an opportunity to reinvent how we generate, transport and use our electric power.

Pennsylvania needs a renewable energy future, despite COVID-19 challenges. Pennsylvania has an opportunity to reinvent how we generate, transport and use our electric power. Pennsylvania just reached a critical milestone on the path to a clean energy future.

thanks alot of information