Shutterstock

This post was authored by Ruben Lubowski, Chief Natural Resource Economist at EDF, and Alexander Golub, Adjunct Professor of Environmental Science at American University.

For companies that are large emitters of greenhouse gases, uncertainty about policies to address climate change can be a real challenge. But our new paper in the journal Energy shows how companies that invest now in a novel approach to climate mitigation could help manage their risk of future policy obligations more effectively and at a lower cost.

The challenge

In Energy, we demonstrate how policy uncertainty puts greenhouse gas emitting companies in a bind, raising risks for these companies and making it likely that carbon prices—an indicator of costs—will rise in a series of sudden bursts, rather than following a smooth transition.

Policy uncertainty discourages private investment in low-carbon technologies. However, when credible climate policy is finally in place, industry will have missed out on prudent investment opportunities and face spiking costs as they rush to catch up with tightened emissions controls requirements.

In the paper, we show that companies have a latent demand for suitable strategies that can help manage these risks.

Abatement short squeeze

When a government institutes stronger climate policy, businesses may find themselves over-weighted with carbon-intensive assets. Caught short of investments to reduce or “abate” emissions, companies will rush to rebalance their capital stock in favor of lower carbon technologies. At the same time, other businesses will also be rushing to unload high-carbon assets and adopt the lower carbon technology. This can cause carbon prices and associated costs of reducing emissions to rise dramatically.

This is similar to the case in financial markets when prices jump as investors must rush to square accounts on an investment they have bet against—going “short” rather than “long” — in anticipation of falling prices. Until now, such a “short squeeze” was a phenomenon of the stock market — product of speculations and uncalculated risk. Climate change threatens to create such a squeeze of much broader scope and economic consequences.

A down payment on abatement

Companies need access to strategies to manage the risks of future climate liabilities. In our study, we describe how companies could reduce the costs of meeting pollution targets in an uncertain policy landscape by making relatively small investments today that can preserve the flexibility to reduce emissions more dramatically in the future—essentially putting a down payment into cost-effective climate protection programs from large-scale sources. Such strategies can include investments in research and development that could pay off in the future through the availability of low-carbon technologies.

A conceptually similar way to manage exposure to future climate costs is by helping to secure and preserve low-cost “call options” on future abatement. A “call” is a type of option that gives companies the right but not the obligation to purchase an underlying product (whether it be a stock, commodity, or carbon credit) in the future at a guaranteed price. We highlight tropical forest conservation as an ideal type of program that companies can use to buy large-scale call options on abatement. A down payment on abatement on forest protection programs would yield an immediate impact on protecting climate, biodiversity, and local communities, while protecting companies’ ability to obtain further cost-effective emissions reductions in the future.

Call options on large-scale forest protection programs (REDD+)

Tropical forests contain the world’s largest reservoir of carbon within natural ecosystems that once lost cannot be recovered within the necessary time to avoid dangerous climate disruptions. Protecting these forests is thus a time-limited opportunity, but it doesn’t require expensive new technologies or infrastructure. As a result, tropical forest conservation offers one of the least cost ways to immediately reduce carbon emissions at large scales, while providing a multitude of other local and global benefits. Forests also remove carbon from the atmosphere, and as long as they remain intact they will continue to store that carbon. A relatively small investment in protecting forests now can provide urgent near-term financing for conservation while securing call options on carbon credits from ongoing future forest protection.

Tighter emissions targets could lead companies to rush to invest in renewable energy more or less simultaneously. This spike in investment may well exceed the ability of the global capital market to mobilize capital and investment resources. For example, it would be impossible to double or quadruple production of wind turbines or solar panels over a year or so. The economy may reach a physical limitation that could be hardly compensated by pumping capital.

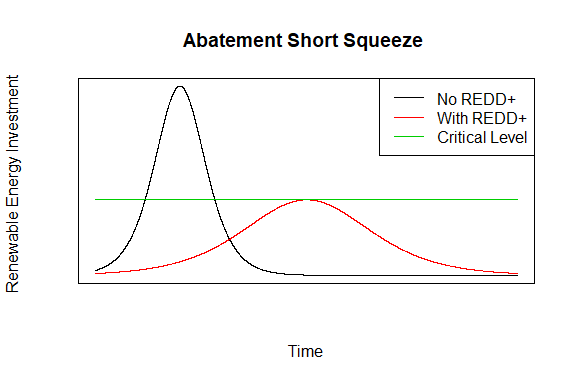

Instead, hedging this risk by investing to secure the ability to generate credits from large-scale programs to protect tropical forests (known as REDD+ programs), companies, and the world, could “flatten the curve” on the costs of capital rebalancing to comply with climate policies. This keeps the total volume of investment below a critical level that could lead to bankruptcy or excessive macro-economic disruption (green line in figure 1).

Who benefits?

By selling REDD+ credits or call options on such credits to firms, forest nations, particularly in the tropics, can start receiving a fair price for keeping their forests protected. Such financing is important to help governments cover their costs of protecting forests and to align incentives of communities, farmers, ranchers and commodity buyers and consumers around forest protection and sustainable agriculture, rather than destructive activities like illegal logging and inefficient cattle ranching.

EDF and partners are pioneering innovative pay-for-performance mechanisms for reducing deforestation. These include the Emergent Forest Finance Accelerator, which links private sector buyers to environmentally rigorous, high-integrity carbon credits from large-scale forest protection programs.

Investments in high-quality REDD+ programs can play an important role in protecting the climate, environment and communities, while allowing companies to better prepare for the moment when society begins implementing more dramatic measures to tackle climate change. To help start the flow of credits, policymakers, companies and other stakeholders should agree on high standards for environmental quality and support the inclusion and prioritization of high-quality REDD+ programs within voluntary climate commitments as well as regulated carbon market systems.

One Comment

Aw, this was an exceptionally nice post. Spending some time and actual effort to produce a good

article… but what can I say… I hesitate a whole lot and

never manage to get nearly anything done.