Getting Climate Finance Right at COP29: Key Issues to Address in Baku

Negotiations at the United Nations climate talks in Azerbaijan, COP29, are now picking up. Global leaders are tasked with deciding on a new goal for how much money will be provided to developing countries to take climate action. The New Collective Quantified Goal (NCQG) on climate finance represents a critical opportunity to reshape how we support developing countries in their fight against climate change.

As negotiations continue and the negotiation text is revised, we need to see several core principles included in the NCQG to serve its purpose. EDF has reviewed some key issues for the NCQG to bring quality into climate finance, and these are some issues we must address in Baku:

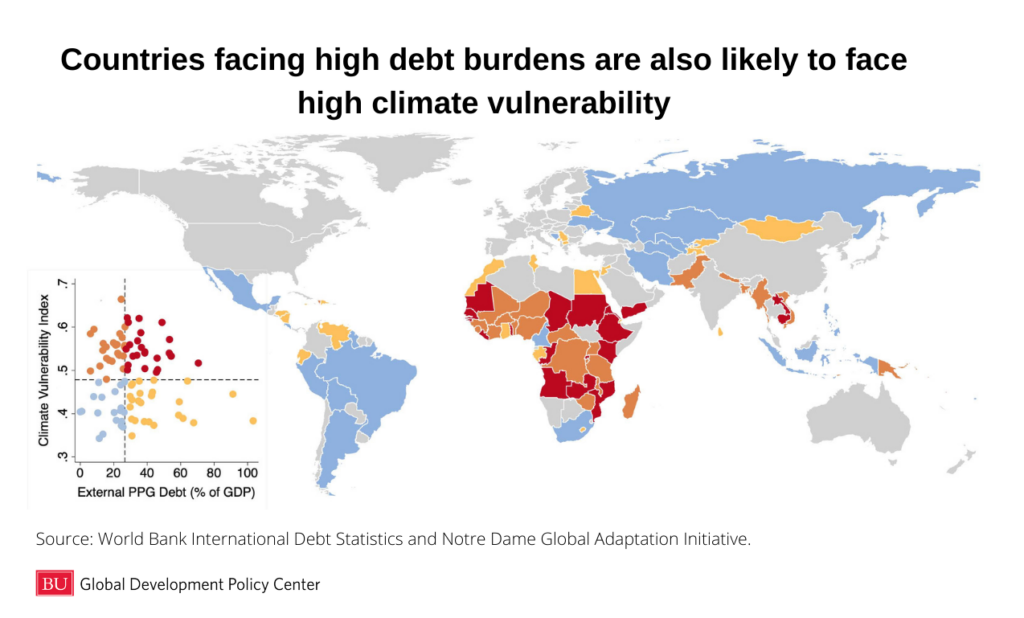

- Unlock Economic Opportunities, Don’t Lock in Debt

First and foremost, the new finance goal must break away from traditional financing models that burden developing countries with additional debt, which further hampers their ability to take climate action. Market-rate loans and private finance at unfair market returns should not be counted as climate finance. As revealed in recent studies, many developing countries are already struggling with debt distress, making it crucial that climate finance comes primarily through quality climate finance.

The NCQG must transform climate finance into an engine for economic opportunity rather than a source of debt burden. This means structuring climate finance to unlock new markets, create jobs, and build resilient economies while avoiding the debt trap that has historically hindered development. The focus should be on enabling countries to seize the economic opportunities of the green transition through grants, concessional finance, and strategic investment in capacity building.

- Agree on What We’re Talking About: Define Climate Finance

Transparency is another cornerstone of the NCQG framework. We need clear, standardized definitions of what constitutes climate finance. Currently, the climate finance landscape is ambiguous, with some countries counting official development assistance (ODA) or non-climate-specific funding toward their climate commitments. The NCQG must establish precise criteria for what qualifies as climate finance, ensuring accountability and preventing the inflation of reported contributions.

- Cut the Red Tape

Access to finance remains a significant hurdle for many developing nations. The NCQG must mandate efficient, streamlined access channels that minimize bureaucratic barriers. Current systems often involve complex application processes and stringent requirements that can delay or prevent countries from accessing crucial funding. The new framework should prioritize swift, direct access while maintaining appropriate oversight.

- Remove the Roadblocks

A critical aspect often overlooked is the need to address “dis-enablers” – structural barriers that prevent effective climate finance deployment. High capital costs, excessive transaction fees, and unilateral measures like carbon border adjustments can significantly reduce the real value of climate finance reaching developing countries. For instance, some developing nations face interest rates two to three times higher than developed countries for renewable energy projects, making clean energy transitions unnecessarily expensive.

- Make Finance Predictable

The NCQG must ensure predictability in climate finance flows, so developing countries can plan long-term climate strategies with confidence that they will be supported. Currently, financing often arrives unpredictably or later than promised. By establishing clear timelines and reliable funding mechanisms, the NCQG can enable better planning and more effective implementation of climate projects.

- Public-Private Finance: Getting the Balance Right

Public finance must remain the cornerstone of the NCQG framework, while strategically leveraging private sector involvement. Currently, multilateral development banks mobilize only about $0.60 in private capital for every $1 of financing – far below what’s needed. While private investment is crucial for scaling up climate solutions, particularly in renewable energy and green technology, it cannot replace public finance. This is especially true for adaptation projects that protect vulnerable communities. Public funding through grants and concessional instruments can de-risk investments and catalyze private capital, while ensuring developing nations maintain sovereignty over their climate priorities.

Make COP29 outcomes matter if we want 2025 to succeed

Looking ahead, the success of the NCQG will depend on how well it addresses these fundamental issues. Simply setting a higher numerical target without addressing quality, access, and structural barriers would perpetuate existing challenges in climate finance. We need a comprehensive approach that combines ambitious funding goals with practical mechanisms for effective delivery.

As negotiations continue, world leaders should remain focused on solutions to make our climate finance system more equitable, efficient, and impactful. By ensuring unconditional access, emphasizing grants and concessional funding, maintaining transparency, and addressing structural barriers, we can build a framework that genuinely serves the needs of developing nations in their fight against climate change.

For more, read EDF’s latest report on climate finance quality: “Quality Matters: Strengthening Climate Finance to Drive Climate Action”.