International trading of emissions reductions could greatly increase global climate ambition

This post was authored by Gabriela Leslie, Pedro Piris-Cabezas and Ruben Lubowski

For more information, read our factsheet, The Power of Markets to Increase Ambition.

Update: the analysis in this blog has been published in the journal World Development (open source).

Carbon pricing is steadily growing worldwide and increasingly recognized as a way to achieve emissions reductions at lower cost than with standard regulations. A recent economic analysis from Environmental Defense Fund found that these cost savings from international trading of emissions could translate into direct gains for the atmosphere – and could produce nearly double the climate ambition at the same overall cost as countries’ complying with their Paris Agreement targets without international markets.

The cost savings from international emissions trading could produce nearly double the climate ambition at the same overall cost as complying with Paris Agreement targets without international markets.

Global emissions trading reduces the cost of meeting NDCs

For this analysis, we first took a look at the overall level of emissions reductions the world would achieve if every nation successfully met the goals established in their nationally determined contributions (NDCs) under the Paris Agreement relative to business as usual. We then considered different scenarios with and without the ability to reallocate where reductions occur across countries and sectors through international trading.

The results indicated that global emissions trading could reduce the total mitigation cost of meeting current Paris pledges by 59 percent to 79 percent. This translates to about $300 to $400 billion in current value terms over 2020-2035, with the high end of the range assuming that Reductions in Emissions from Deforestation and Forest Degradation (REDD+), over and beyond what is needed to meet NDCs, are included in markets.

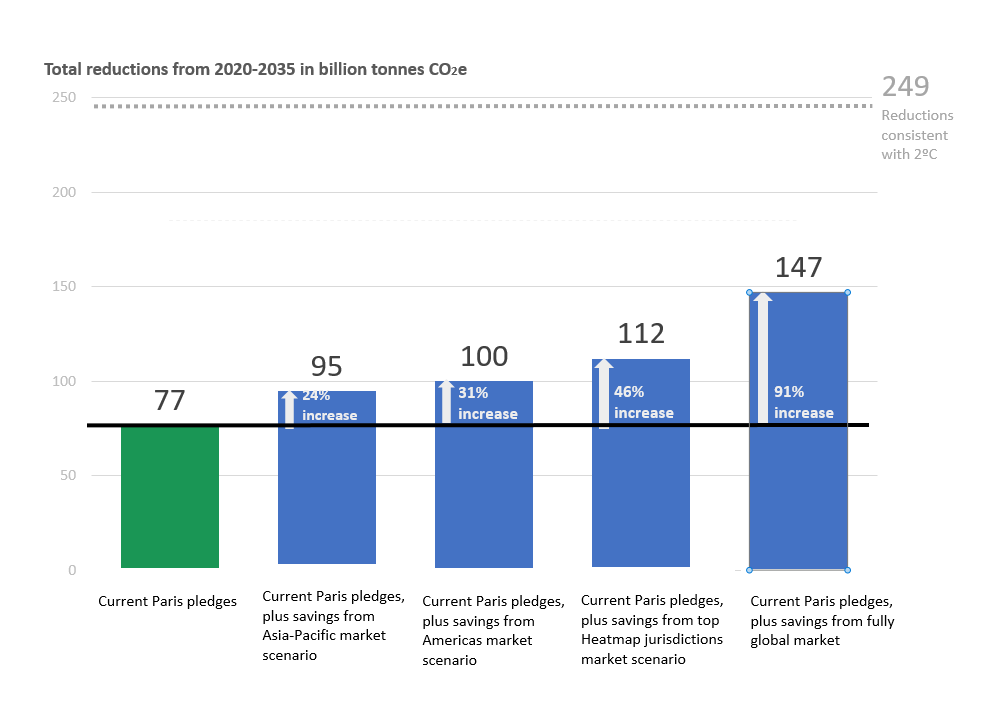

What’s more, if these cost savings were re-invested into greater emissions reductions, the model estimates that cumulative emissions reductions over the period 2020-2035 would nearly double the emissions reductions that would be achieved using only current policies – from 77 GTCO2e in the non-trading base case to 147 GTCO2e in a scenario with full global emissions trading, a 91% increase. (See Figure 1)

Ambition increases even with limited global markets

Next, we considered a number of trading scenarios where different groups of nations could trade emissions reductions across borders to maximize their economic benefits over time.

We found even partial coverage of carbon markets could lead to more ambitious climate targets, at no added cost. For example, as shown in Figure 1, four different scenarios were assessed relative to a “current policy” baseline. Each scenario first assumes that carbon markets at least partially covered the United States, EU, China, and emissions from international aviation. Then, different scenarios were expanded to include:

- a regional carbon market in the Asia-Pacific region, which yielded a 24% increase in climate ambition.

- a regional market across the Americas (United States, Canada and Mexico), which yielded a 31% increase in climate ambition.

- a market across 25 countries EDF has identified as being best placed to move on carbon pricing (based on a previous analysis), which yielded a 46% increase in climate ambition.

Across all scenarios, the lion’s share of the gains from global markets are due to international linking (when a carbon market in one country trades with another country’s carbon market). A much smaller share comes from increased use of domestic carbon markets across each cohort of nations.

This suggests that carbon pricing policies that encourage international cooperation—such as carbon markets—may be able to capture significantly more cost savings, and thus increased ambition, than carbon pricing policies that are less prone to linkage.

Carbon pricing policies that encourage international cooperation —such as carbon markets—may be able to capture significantly more cost savings, and thus increased ambition, than carbon pricing policies that are less prone to linkage

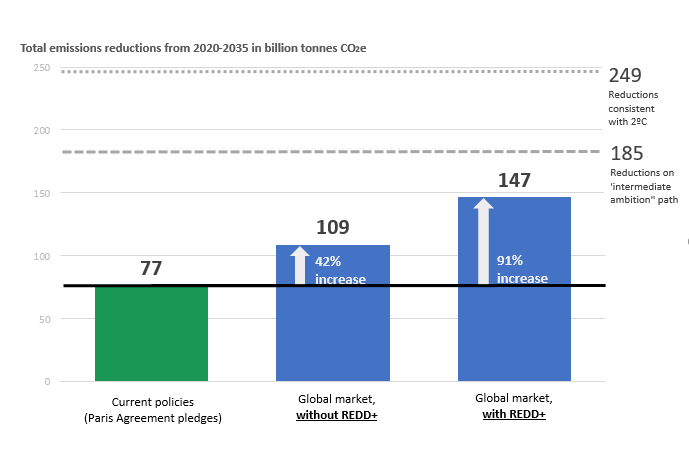

REDD+ increases ambition significantly

A large part of the gains outlined above come from the inclusion of credits from Reducing Emissions from Deforestation and Forest Degradation (REDD+) in markets (Figure 2). As an abundant source of relatively low-cost emissions reductions, including the forestry sector in trading scenarios lowered the overall cost of meeting NDCs substantially, thus increasing the potential ambition gains across all scenarios.

Under our global market scenario, the cost savings from REDD+ enable 38 billion tons (or 54%) of the total increase in ambition of 70 billion tons possible with full global trading. Including REDD+ credits in the global market not only lowers costs significantly, but also provides a large additional pool of low-cost reductions that can be “bought” with the resulting cost savings. This is in addition to achieving 27% of the reductions already included in the base case for meeting current levels of NDCs.

Rules and standards critical to reaching highest potential

Re-investing the cost savings from full international trading of emissions credits beyond NDC targets has the ability to roughly double ambition at the same cost. However, even those gains would still not be enough to keep the world under a 2 degrees Celsius temperature rise, so additional action, with additional costs, will be needed.

To ensure that such markets can reach their highest potential, it will be essential to implement rules and standards that prevent double-counting emissions reductions and ensure the environmental integrity of market transactions. In this way, well-designed carbon market policies can play a critical role in starting to enable the necessary increase in climate ambition.

Further reading: For an extension of this work into an analysis specifically related to international aviation and CORSIA, please see this analysis.