Analysis: Costly gas and infrastructure are driving Virginia’s soaring power bills

Virginians are facing rising costs on multiple fronts, and electric bills are no exception. Virginia’s electric bills are increasing at a pace faster than general inflation and, according to the U.S. Energy Information Administration (EIA), bills have increased nearly 30% since 2021. It’s easy to understand the growing frustration, as some Virginians are forced to choose between paying for doctor’s visits and prescription drugs – or even food – over their electric bill.

Drawing on Dominion Energy’s and Appalachian Power’s own filings at the State Corporation Commission (the agency that oversees utility investments and regulates ratemaking in Virginia), a new analysis from EQ Research underscores that volatile fossil fuel prices and skyrocketing utility investment in power system infrastructure are the primary drivers behind surging electricity costs for Virginia households.

While not explicitly addressed in this report, we’d be remiss, as we consider cost drivers, not to highlight that data centers represent a significant element of the need for new power system infrastructure. As the Joint Legislative and Review Commission (JLARC) data center report pointed out, this booming industry brings economic benefits to the state, but comes with cost impacts to Virginia’s electric customers. Just recently, the SCC issued an order aimed at corralling transmission and distribution system costs brought on by data center energy demand. By requiring data centers and other large users to pay a minimum of 85% of contracted distribution and transmission demand, and 60% of generation demand, among other requirements, the SCC order seeks to protect Virginia ratepayers from those costs.

While the SCC’s order is notable, the consequences to customers in a more fossil-fuel focused future are clear: the more utilities seek to invest in gas power plants and associated infrastructure, the more Virginia households will remain financially tethered to a price-volatile and increasingly expensive energy system. Meanwhile renewable energy, particularly solar paired with battery storage, is the most affordable, most rapidly-scalable energy resource available to meet Virginia’s energy needs while keeping electricity prices in check.

What the Numbers Say

The data, taken from Dominion and ApCo’s own filings with the State Corporation Commission, paints a clear picture of what’s driving up Virginians’ electric bills.

Analysis of utility filings between January 1, 2019, and April 1, 2025, shows:

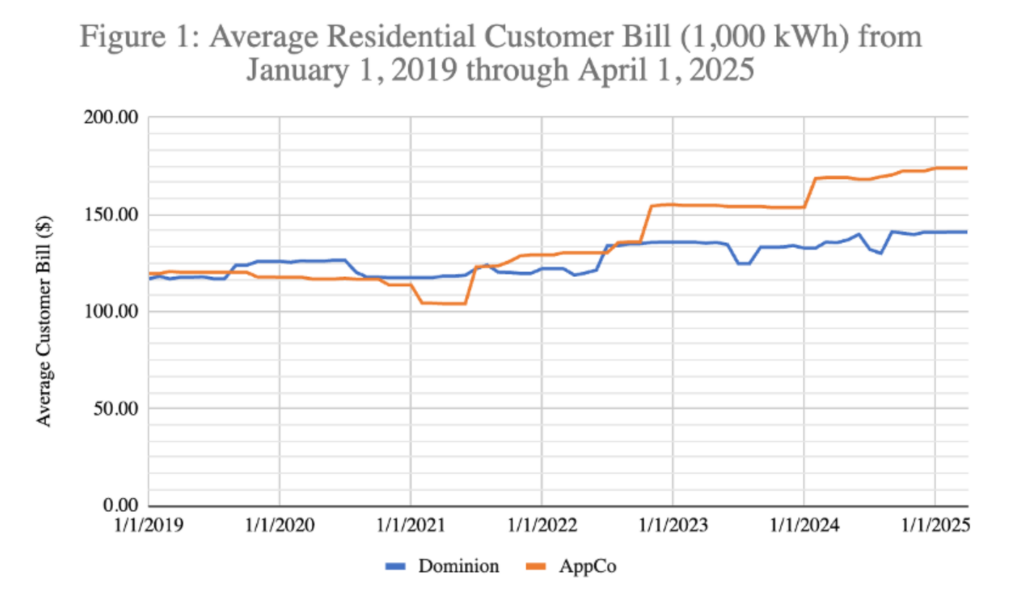

- Residential rates have increased significantly in both Dominion (20.5%) and ApCo’s (45.4%) service territories since January 2019. (See Figure 1)

- While base rates have remained relatively stable, rate riders to cover the costs of powerplant fuel and grid infrastructure spending have significantly increased residential customer costs in both Dominion and ApCo’s service territories.

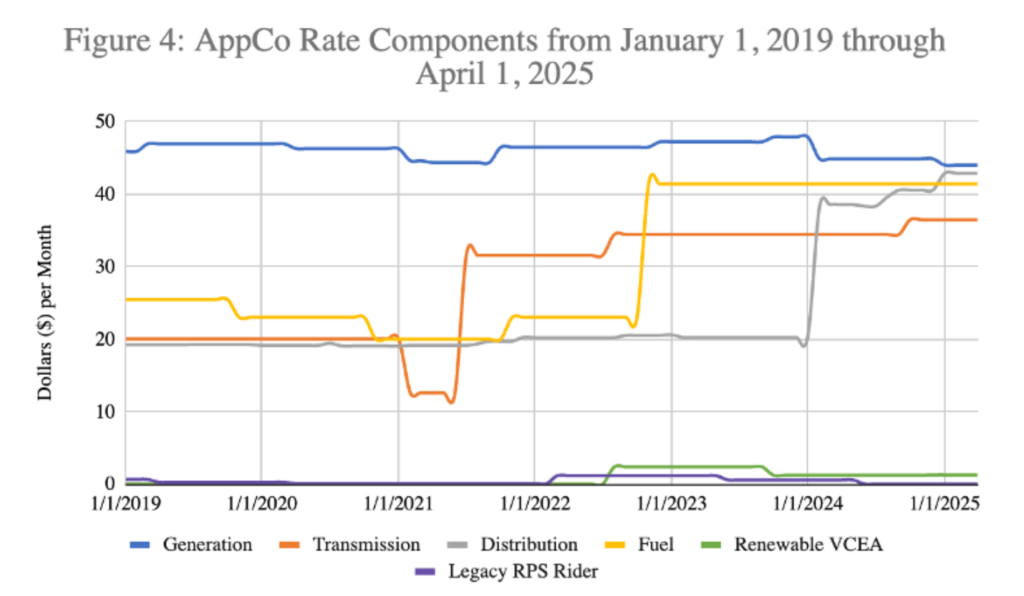

- Fuel costs – what the utility pays for natural gas – increased 62.5%, distribution costs increased 123.1%, and transmission costs increased 82.0% in ApCo’s service territory over the analysis period (See Figure 4)

- In Dominion’s service territory, non-renewable generation costs decreased 13.0% over the analysis period, but the trend in non-renewable generation costs over time shows a 73% spike in fuel costs beginning in 2022 and carrying into 2023. Distribution costs increased by 66.0% and transmission costs increased by 49.0% in Dominion’s service territory over the analysis period.

Reliance on Gas is Fueling a Rate Hike Rollercoaster

The utilities’ own SCC filings make it clear: the cost of fuel to run fossil power plants is a primary driver of price instability and rising cost for Virginia households. Nevertheless, Dominion continues to prioritize new fossil fuel investments. This piece of the energy equation is simple: When fuel prices spike, so do customers’ bills. When gas fuel prices jumped in 2022–23, Virginia households and businesses saw their bills spike. And with the U.S. Energy Information Administration forecasting gas prices to more than double in 2026, up from 2024 prices, that’s bad news for Virginians looking for energy affordability solutions – especially heading into cold winter months when rising demand for electricity to keep homes warm is already promising higher than usual electricity bills.

Energy Affordability and the Transition to Clean

One of the ways Virginia’s electric utilities generate a profit is through a guaranteed return on equity (ROE) for their investment in major infrastructure projects like power plants. While state policy might specify that electric power should be delivered to customers at the least cost, incentives in the electricity market encourage utilities to pursue the most expensive projects they can get the SCC to approve.

By requiring that utilities shift investment toward price-stable, affordable clean energy solutions, policies like the Virginia Clean Economy Act (VCEA) and programs like the Regional Greenhouse Gas Initiative (RGGI) help stabilize rates in the near term and keep downward pressure on energy costs for the long haul, with the added benefit of driving down climate and health-harming air pollution from the electric power sector. Analysis of ApCo’s and Dominion’s SCC filings shows that VCEA costs make up a relatively small fraction of the average customer’s monthly bill and are dwarfed by the significant cost increases customers are experiencing due to the utilities’ reliance on gas power plants and ballooning investment in grid infrastructure build out.

Moreover, ApCo itself announced in October that they were in a rare position to lower customer bills by a whopping 24% because of a ramp-up of renewable energy use. As ApCo explained in its press release, “incorporating more renewable sources of power into its energy mix resulted in the company requesting a reduction in its fuel factor rate.” While ApCo bills have trended higher over time, ApCo has connected important dots for its customers: reducing reliance on gas power plants while investing in new sources of clean energy delivers lower electric bills for Virginia households.

For Monopoly Utilities, Old Habits Die Hard

In most markets, companies compete to win your business by offering better prices or better products.

Electricity isn’t like that.

Most Virginians can’t comparison shop because, more than a century ago, policymakers granted utilities monopoly status — a model that made sense at the time when the goal was to expand electric power to rural communities around the state.

Now, monopoly utilities profit from a guaranteed return that encourages overspending on expensive infrastructure and outdated power plants that run on price volatile fuels. Customers — who have no alternatives — are stuck paying for it, including utilities’ profit margins, even as service lags and bills rise.

The result is a system misaligned with what Virginians want today: affordable, reliable and clean energy. Dominion’s and ApCo’s own filings show that relying on volatile fossil fuels leads to higher costs, price shocks and more pollution.

Policies like VCEA and RGGI help correct this by pushing utilities toward more stable, lower-cost clean energy solutions. It’s how policymakers today can ensure Virginia’s electricity system– created over a century ago to meet the needs of a bygone era –actually delivers for customers in the here and now.