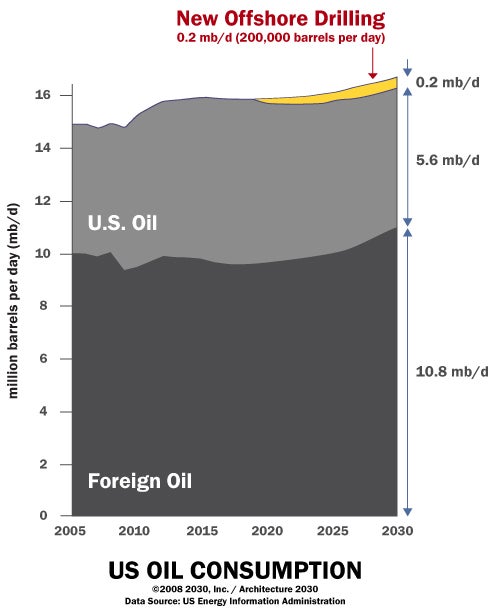

A picture is worth a thousand words:

Source: Architecture2030, based on data from the U.S. Energy Information Administration (EIA).

From Architecture2030:

According to the US Energy Information Administration, oil production from drilling offshore in the outer continental shelf wouldn’t begin until around the year 2017. Once begun, it wouldn’t reach peak production until about 2030 when it would produce only 200,000 barrels of oil per day (in yellow above). This would supply a meager 1.2% of total US annual oil consumption (just 0.6% of total US energy consumption). And, the offshore oil would be sold back to the US at the international rate, which today is $106 a barrel. So, the oil produced by offshore drilling would not only be a "drop in the bucket", it would be expensive, which translates to "no relief at the pump".

Gernot Wagner is an economist in the Climate and Air program at Environmental Defense Fund.

Gernot Wagner is an economist in the Climate and Air program at Environmental Defense Fund.

4 Comments

I asked Gernot why oil from the U.S. would be sold at world prices. He said:

True enough, but ALL oil sold, pretty much anywhere, goes into the global oil market. Increased supply reduces the cost. Thus benefiting consumers. Also, while supply is short, our oil companies want to produce as much as possible because the price is high and they make the most. Our companies making money benefits us rather than benefiting countries that, in many cases, hate us.

Not sure I agree with the mere 200,000 barrels a day. I think I have heard much higher figures than that. In any case 1.2% is better than 0%. Every “drop in the bucket” adds up. We also have A.N.W.R. to add to that as well as oil shale that “could” be accessed if congress would be willing to get off its collective rear ends. Not to mention “Pickens plan”, that could be a very reasonable near, and long term plan. Congress could help implement that too, but I am not holding my breath. Too much politics involved for any, real, practical, action.

I fail to see how increasing US oil production will directly affect the price at the pump for the long term. If we increase our supply, won’t OPEC decrease its supply to control the price? They shape this market and I have a hard time understanding how a measly 1.2% will change that fact.

International suppliers have their hands on the spicket and watch us very closely. They let the price go up to test the market and as soon as we lower our demand, they back off to find the sweet spot. Our dependence is rediculous!

The only way we will regain control will be to find alternatives and shape our own energy market!

May I add one thing.

Our dependence is not only rediculous, it’s primative. It is based on an out-dated value system. The new paradigm will increasingly seek to find true value in products. Oil, for instance, has other costs to take into account like: the cost for our environment, the cost for national security, the cost for biodiversity, the cost for the health of our grandchildren, and more. Add those costs to the price at the pump and see how much we are truely paying.